Money

NEA, CTGI seal deal on 750mw West Seti Hydropower Project

Nepal’s energy sector, which is still feeling the pangs of this week’s cancellation of biggest hydropower development agreement, has received a much-needed shot in the arm with the signing of a major deal with a leading Chinese firm that would almost double the country’s electricity generating capacity.

Rupak D. Sharma

Nepal’s energy sector, which is still feeling the pangs of this week’s cancellation of biggest hydropower development agreement, has received a much-needed shot in the arm with the signing of a major deal with a leading Chinese firm that would almost double the country’s electricity generating capacity.

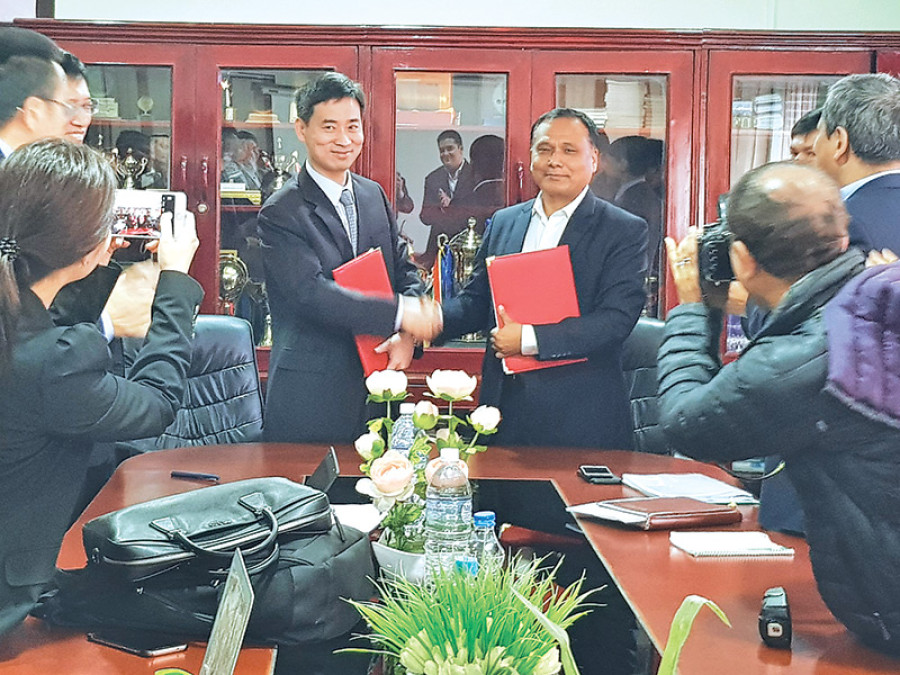

Nepal Electricity Authority (NEA), the state-owned power utility, on Thursday signed the final agreement with China Three Gorges International (CTGI) Corporation, a subsidiary of China Three Gorges Corporation, to set up a joint venture to develop 750-megawatt West Seti Hydropower Project.

The pact was signed between NEA Managing Director Kul Man Ghising and CTGI Director of Investment Department Yao Fiexiong. The agreement with the Chinese company was signed three days after the government scrapped a pact signed with China Gezhouba Group Corporation, which was hired to build 1,200MW BudhiGandaki Hydropower Project.

With the signing of the pact, West Seti Hydropower Project, which was formally handed over to the Chinese company on August 29, 2012, has achieved a major milestone.

“We are very happy with the latest development, as the project would help Nepal to drastically increase per capita electricity consumption, increase electricity’s access to 100 percent of the population from existing 65 percent, and make the country self-reliant in electricity generation,” NEA Spokesperson Prabal Adhikari said.

West Seti Hydropower Project, a reservoir project that will spread over Baitadi, Bajhang, Dadeldhura and Doti districts in far-western Nepal, is expected to generate 2.8 billion units of electricity per year. The project, which will have a 207-metre tall dam, is expected to generate electricity within 6 years and 7 months of commencement of construction works.

The project will cost $1.8 billion including interest charges incurred during construction period ($1.4 billion excluding interest charges), according to NEA. The investment in the project will be made through West Seti Hydropower Project Development Limited, a joint venture company, which will soon be established by CTGI and NEA. The signing of Thursday’s agreement has paved the way for setting up of the joint venture.

The company will be 75-percent owned by CTGI; NEA will have 25 percent stake in the joint venture. This means Chinese company will bear 75 percent of the cost required to build the project and the remaining will be borne by NEA.

CTGI has agreed to arrange soft loan for NEA via China Export-Import (Exim) Bank or other financial institutions to invest in the project. CTGI has also agreed to offload up to 10 percentage points of its stake to enable people affected by the project to purchase stocks in the joint venture. CTGI may also sell another 14 percentage points of the joint venture’s stake to local Nepali investors. The Chinese company has not named domestic companies which it intends to rope in, but sources told the Post that shares may be sold to ICTC, a consulting firm.

With all these divestments, the Chinese company will still have 51 percent stake in the joint venture, making it the majority shareholder in the project. “The stake of the Chinese company in the joint venture, as per the agreement signed on Thursday, should not drop below 51-percent mark till five years of project’s commencement,” Adhikari said.

Nepal, which currently has installed capacity of less than 1,000 MW, had long waited for the construction of the project to start. However, delays made the Chinese company in signing the final joint venture agreement had put the project in limbo. Now that the agreement has been signed, the Investment Board Nepal must expedite the process of approving the pact and permit the Chinese company to bring in money from abroad. Also, the central bank here should allow the Chinese company to factor in pre-construction expenses made by the company so far in Nepal as paid-up capital. If delays are made in taking these actions, the project’s construction would be further delayed.

“This project is very important for us as it is a reservoir project and would generate quite a big quantum of electricity even during the dry season,” said Adhikari.

Almost all of hydroelectricity projects currently operational in Nepal are run-of-the-river. These types of projects generate electricity based on availability of water in river basins. So, when winter arrives, output of these projects plunges because of drop in the level of water in river basins.

The West Seti project is expected to generate 65 percent of the total electricity during wet (rainy) season and the remaining during dry (winter) season.

Since the quantum of energy generated by the project is quite huge and is meant for domestic consumption, the government must start framing policies to encourage households and industries to cut-back on use of fossil fuel, such as petrol, diesel and liquefied petroleum gas, so that West Seti’s electricity does not go to waste, according to Adhikari.

22.92°C Kathmandu

22.92°C Kathmandu