Money

For first time, Nepse above 1,400

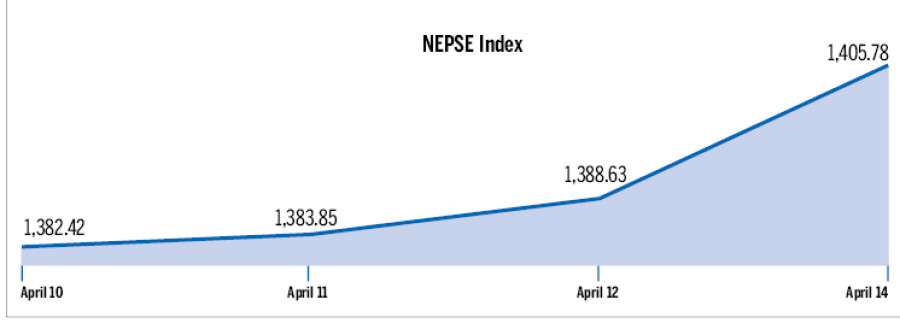

Nepal Stock Exchange (Nepse) last week rose above 1,400 points mark for the first time in its history.

Nepal Stock Exchange (Nepse) last week rose above 1,400 points mark for the first time in its history.

Investors are buying shares even as the prices have skyrocketed despite repeated warnings by Securities Board of Nepal (Sebon) about a potential bust.

Last week, the benchmark index gained 23.36 points to close at 1,405.78 points. The market that opened at 1,382.42 points on Sunday posted gains throughout the week. The week’s biggest gain came on Thursday, when the market jumped 17.15 points.

Stockbrokers attributed the rise to investors’ growing attraction towards shares of banks and financial institutions (BFIs). Satish Kumar Shrestha, managing director of Siprabi Securities, said investors are hoping good third-quarter results from BFIs.

“Besides, the banking sub-index has not grown at the same rate as other sectors have grown. So investors are hoping the banking sector will grow further in the coming days,” said Shrestha, adding the high liquidity with banks, resulting in easy availability of cheaper margin loans, also contributed to the growth. Sharada Nepal, managing director of Sagarmatha Securities, echoed Shrestha, stating the investors are also expecting right’s and bonus share issuance from BFIs to meet the paid-up capital requirements, which the central bank has hiked by four times.

Of nine trading groups, indices of seven posted gains. Hotels (up 59.55 points) was the top gainer, followed by insurance, manufacturing, commercial banks, development banks, finance companies and others. Hydropower (down 3.65 points) was the sole loser. The trading group was stable at 201.38 points. The sensitive index that measures the performance of A class companies gained 5.08 points to 303.72 points.

The market transaction increased 8.64 percent to Rs2.26 billion, while the number of traded shares increased to 4,472,840 units from 3,406,630. Nepal Bank Limited posted the highest individual transaction of Rs168.05 million. It was followed by Nepal Bangladesh Bank, Nepal Investment Bank, Nabil Bank (promoter’s shares) and Citizens Bank International. NIBL Sambriddha Fund 1 topped in terms of the number of shares traded (606,000 units).

Meanwhile, Nepse listed bonus shares of Manaslu Bikas Bank, Bagmati Development Bank, NIC Asia Bank, Himalayan Bank, Prime Commercial Bank, Everest Bank, Swarojgar Laghubitta Bikas Bank, Guheswori Merchant Banking and Finance, Goodwill Finance, Nepal Express Finance and Manjushree Finance during the review period. It also registered 5.3 million right shares of Century Commercial Bank.

8.12°C Kathmandu

8.12°C Kathmandu