Money

Plan to boost market activity sends NEPSE soaring over 20 points

Securities Board of Nepal to introduce reform measures this fiscal year..jpg&w=900&height=601)

Rajesh Khanal

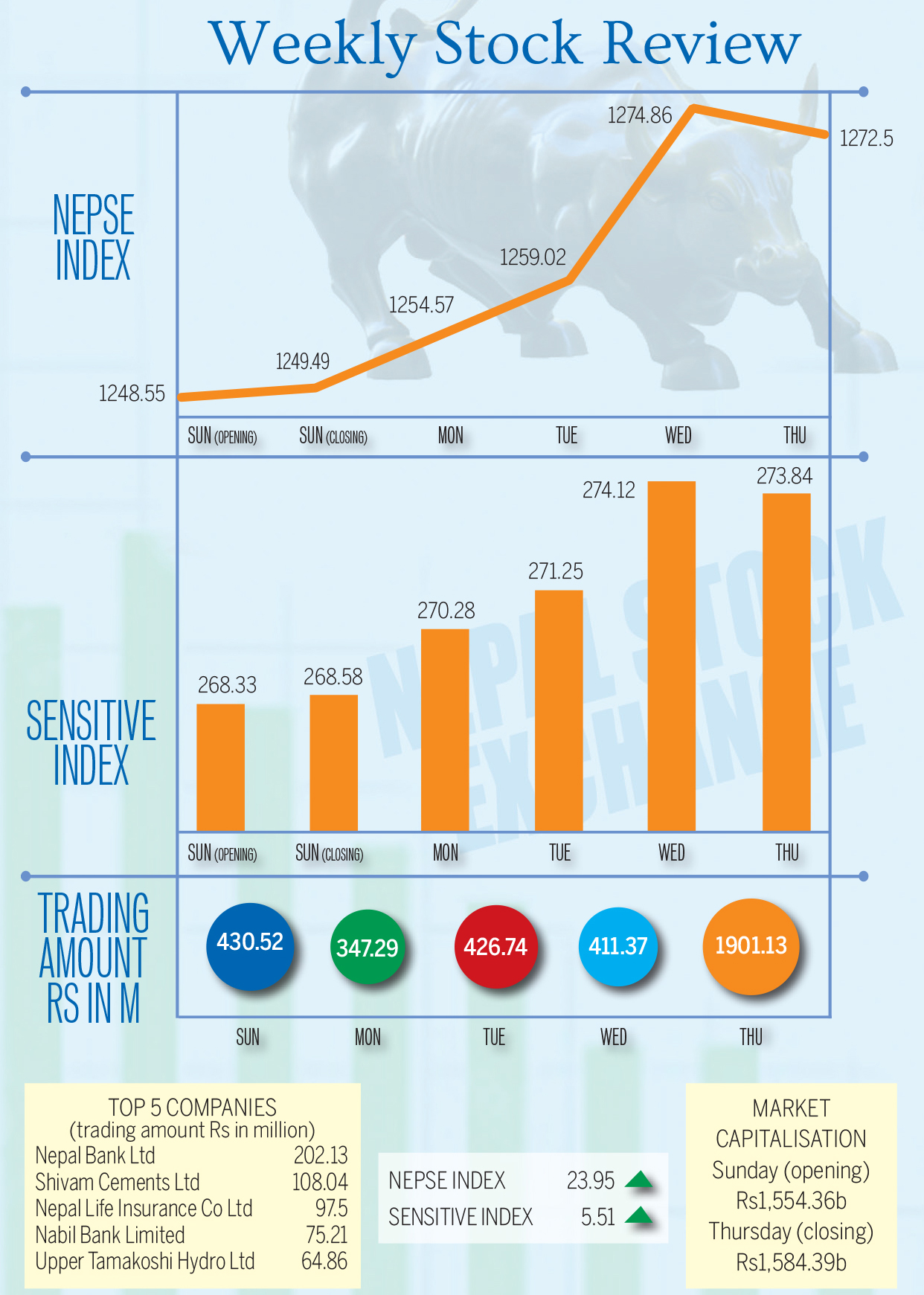

Nepal Stock Exchange (NEPSE) last week escalated 23.95 points to close at 1,272.5 points, after the Securities Board of Nepal expressed its commitment to enforce a number of reform measures this fiscal year.

Despite the upswing in the market index, the average daily turnover slumped to Rs380.23 million last week from Rs526.66 million in the previous week.

The market which opened at Rs1,248.55 points on Sunday, rose marginally by 0.94 points to close at Rs1,249.49 points. The market continued to gain traction during week, gaining 5.08 points, 4.45 points and 15.84 points on Monday, Tuesday and Wednesday respectively. However, the market ran out of steam on Thursday, losing 2.36 points.

Stock analysts said the investors were buoyed by the regulator unveiling its policies and programmes to boost activity in the country’s only secondary bourse. “The board has expressed its commitment to enforce book building which will allow listed companies to fix premium prices for their initial public offerings and reducing the transaction settlement period, among others,” said a stockbroker on condition maintaining anonymity.

The sensitive index that measures the performance of Group A companies also went up 5.51 points to close at 273.84 points with a notable rise in stock prices of commercial banks.

An increase in share prices also saw investors gaining Rs30.03 billion in the book value of their investment portfolio.

Most of the sub-indices posted gains except for trading which remained stable at 259.85 points during the review period.

Manufacturing recorded the highest gains, adding 81.9 points to close at 2,717.5 points. Non-life insurance, life insurance, development bank, hotels, microfinance, hydropower and commercial banks picked up double-digit gains.

‘Others’ and finance companies gained 9.93 points and 7.89 points respectively.

In terms of individual companies, Nepal Bank Limited saw Rs202.13 million worth of shares exchanging hands, the largest in the segment. It was followed by Shivam Cements, Nepal Life Insurance, Nabil Bank and Upper Tamakoshi Hydropower Limited.

Last week, stocks worth Rs1.9 billion were traded, which was 27.8 percent less than the amount in the previous week. The total number of traded shares also plummeted to 8,599,020 units from 11,387,516 units.

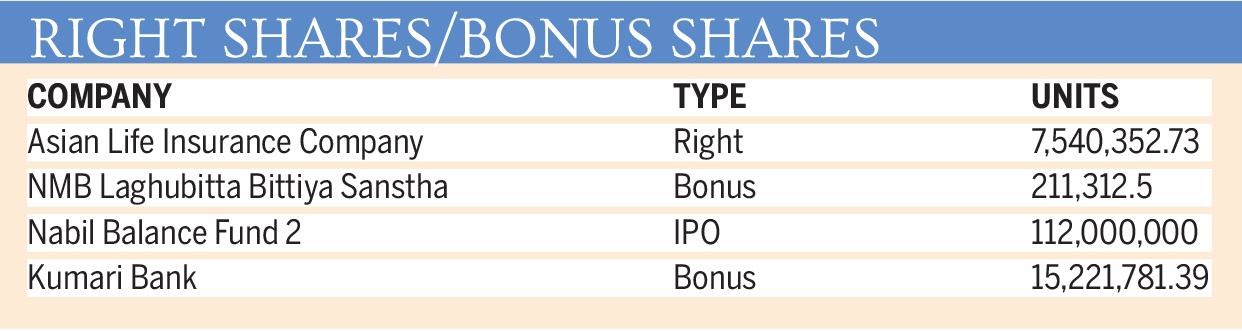

NEPSE listed 134,973,466.6 units of new shares from four companies during the review period.

What do you think?

Dear reader, we’d like to hear from you. We regularly publish letters to the editor on contemporary issues or direct responses to something the Post has recently published. Please send your letters to [email protected] with "Letter to the Editor" in the subject line. Please include your name, location, and a contact address so one of our editors can reach out to you.

9.6°C Kathmandu

9.6°C Kathmandu