Money

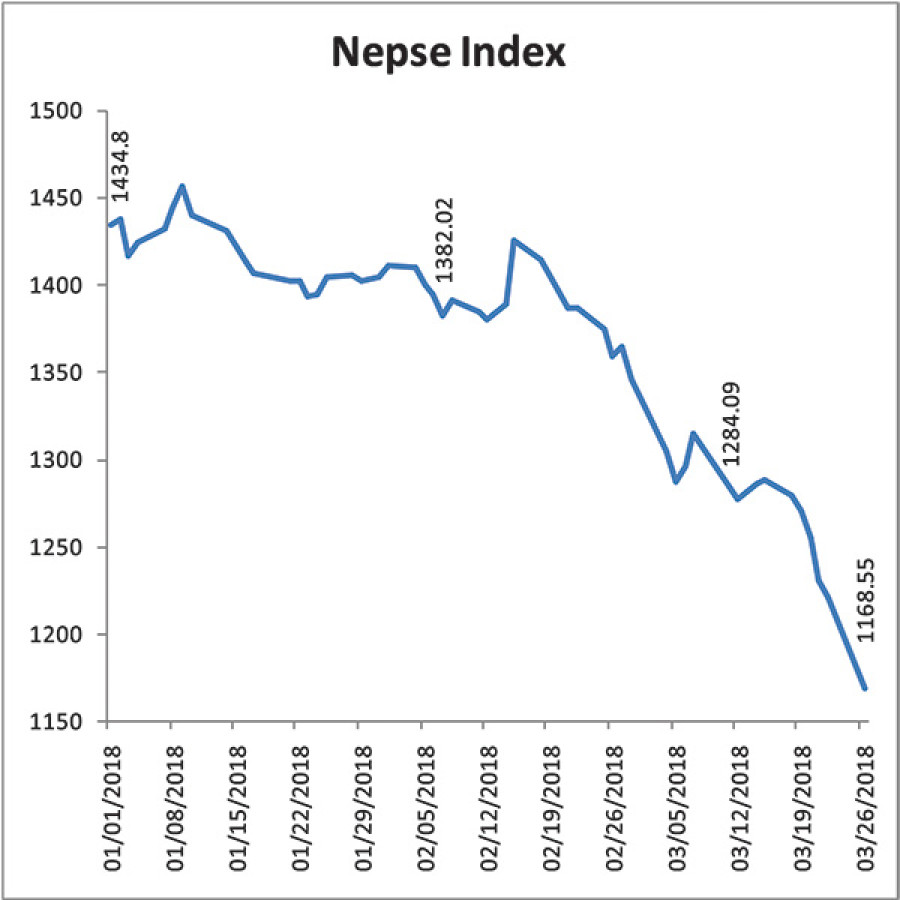

Nepse drops below 1200 pts

Nepal Stock Exchange (Nepse) index took a heavy beating on Monday, losing a whopping 51.89 points to slip below 1200-point mark, as selling spree gripped the market.

Nepal Stock Exchange (Nepse) index took a heavy beating on Monday, losing a whopping 51.89 points to slip below 1200-point mark, as selling spree gripped the market.

The market opened at 1220.41 points on Monday and shed 3 percent within 40 minutes of commencement of trading. If the market falls by 3 percent in the first trading hour of the day, Nepse must halt trading for 15 minutes. After the trading resumed, the index made some recovery and rose to as high as 1195.01 points before taking a downward spiral. The market finally closed at 26-month low of 1168.55 points. The last time Nepse had fallen to this level was on January 10, 2016, when the index had hit 1167.18 points. Nepse has been trapped in bearish trend for quite some time, shedding 279 points in the last three months alone. This trend started right after the government of the left alliance took office. Uncertainty in the new government’s policies, shortage of loanable funds in the banking sector and soaring lending rate are some of the reasons for the stock market’s continuous fall. Stockbrokers said the market has also seen excessive supply of stocks because of launch of initial and further public offerings, and issuance of rights and bonus shares. One of the reasons for jump in supply of stocks is recent introduction of a platform called the Centralised Application Supported by Blocked Amount (C-ASBA), which wraps up share allotment process in as low as 37 hours of submission of share applications.

The stock market has seen addition of over 1.12 billion units of new shares in the last one year, according to Nepse. “However, the market has failed to attract new buyers,” the stockbroker said.

According to stockbrokers, apathy of large investors and failure of banks to issue fresh loan against shares have also affected the market adversely. Also, banks that provided margin loans have started calling on investors to top-up their balances as share prices are on a freefall.

During Monday’s trading, investors lost Rs60.8 billion, with market capitalisation hitting Rs1,368.9 billion at the end of the day. Rastriya Beema Company was the biggest loser on Monday, shedding 900 points, while Progressive Finance ended up as the biggest gainer, adding 14 points to its stock.

9.7°C Kathmandu

9.7°C Kathmandu