National

Governor suspended when economy is in crisis and finance minister in question

Government forms a committee to look into Governor Adhikari’s activities, leading to his automatic suspension.

Anil Giri & Prithvi Man Shrestha

The government has suspended the central bank governor in a rare move.

Maha Prasad Adhikari, the Nepal Rastra Bank governor, faced an automatic suspension on Friday following the government’s move of forming a panel to look into what it called charges of leaking sensitive information about its decisions and not fulfilling his responsibilities effectively.

Sources said the government has formed a three-member investigation committee headed by former Supreme Court judge Purushottam Bhandari. The committee has been given a month to submit its report.

Govinda Pariyar, Prime Minister Sher Bahadur Deuba’s press chief, confirmed to the Post that a three-member probe committee had been formed, leading to Adhikari’s suspension.

Section 22 and its sub-section 5 of the Nepal Rastra Bank Act-2002 have detailed the conditions that allow removal of the governor, deputy governor and directors of the central bank. They can be removed if they fail to do the due diligence, lack efficiency, harm the country's banking and financial system, or if they are found to have acted dishonestly or with mala fide intention in any transaction related to the business of the bank among other things, according to the Act.

This is the second time a sitting governor has been suspended.

Adhikari told the Post that he had “been informed about the formation” of the probe committee.

“I have no further information on the committee, or on the reasons for forming the committee, for that matter,” said Adhikari.

With Adhikari suspended, Nilam Dhungana Timilsina, the deputy governor, has been given the responsibility of acting governor.

Adhikari was appointed as Nepal’s 17th governor on April 6, 2020, after Chiranjivi Nepal completed his five-year tenure on March 17.

Before that, Adhikari was serving as chief executive officer of the Investment Board Nepal.

Adhikari’s suspension comes all of a sudden—just like an impeachment motion against Chief Justice Cholendra Shumsher Rana on March 13, raising questions if the move is guided by political vendetta.

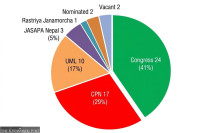

Adhikari is considered close to the main opposition CPN-UML. It was during UML chair KP Sharma Oli’s tenure as prime minister that he was brought to lead the central bank from the Investment Board Nepal.

After Deuba’s appointment as prime minister, Janardan Sharma, a leader of the CPN (Maoist Centre), a key coalition partner in the government, was appointed finance minister.

Sources in the parties and insiders in Singha Durbar say Sharma and Adhikari were not on the best of terms.

According to insiders, Adhikari was high on the agenda during Thursday’s Cabinet meeting which took a slew of decisions including the recommendation of 20 individuals as ambassadors for various missions.

Ahead of the Cabinet meeting, Prime Minister Deuba had held a discussion with Maoist Centre chair Pushpa Kamal Dahal and CPN (Unified Socialist) chair Madhav Kumar Nepal, who are key coalition partners.

“Both Dahal and Nepal had expressed serious concerns over the state of the country’s economy, including governor Adhikari’s performance and asked the prime minister to take concrete steps before the economy turned worse,” said the minister from the Nepali Congress.

According to the minister, the prime minister actually was not in favour of suspending Adhikari because he was basically not happy with the performance of Finance Minister Sharma.

“The prime minister was planning to consult with some senior economists to seek inputs on how to revive the economy,” said the minister. “But under pressure from Dahal and Nepal, the prime minister instructed some Nepali Congress and Maoist Centre ministers to take an appropriate decision on Adhikari.”

The minister said the country’s economy was seriously discussed at the Cabinet meeting as well as during informal meetings of the ministers.

Another minister said that some ministers sat for an informal meeting ahead of the Cabinet meeting where Sharma explained how Adhikari was systematically destroying the economy.

Sharma also briefed that investors were not happy with the central bank’s current approach to addressing the liquidity crisis, according to the minister.

But Sharma himself has come into question in recent months for his failure to take steps to fix the economy.

Multiple experts the Post has spoken to in the past months have said despite all economic indicators being down, Sharma as the finance minister had been completely out of the loop and oblivious to the looming crisis.

Adhikari’s suspension also follows a recent controversy surrounding Sharma. According to Kantipur, the Post’s sister paper, Sharma was facilitating the release of “some suspicious money” belonging to one Prithvi Bahadur Shah.

Chiranjivi Nepal, Adhikari’s predecessor at the central bank, said the government move “is not good.”

“Such a decision by the government will not boost the morale of the financial institutions at a time when the country’s economic indicators are not performing well,” Nepal told the Post.

In Nepal, a governor’s term is fixed for five years.

Earlier in August 2000, the then finance minister Mahesh Acharya had sacked then governor Tilak Rawal without giving any reason, and appointed Dipendra Purush Dhakal. Later, after the Supreme Court reversed the decision, reinstating Rawal, Acharya had resigned as minister. Tussle between Acharya and Rawal had resulted in an ugly episode.

In June 2007, governor Bijay Nath Bhattarai was suspended after the Commission for the Investigation of Abuse of Authority filed a case at the Special Court accusing him of hiring KPMG Sri Lanka, a consulting firm, to help improve the bank’s management practices.

The anti-graft body had accused Bhattarai of causing losses worth Rs24.5 million to state coffers by not claiming compensation even after KPMG unilaterally terminated the consultancy agreement.

Though the single bench of the immediate Supreme Court Justice Tahir Ali Ansari convicted Bhattarai of corruption, a division bench of immediate Justices Khil Raj Regmi and Prem Sharma of the Supreme Court in 2009 acquitted Bhattarai along with immediate central bank executive director Surendra Man Pradhan of the corruption charges, paving the way for Bhattarai’s reinstatement as governor in July 2009.

During Thursday’s Cabinet meeting, some ministers had questioned the working style of Adhikari and accused him of leaking sensitive information to the media, a senior government official said. The decision to form the probe committee came afterwards.

The relation between Finance Minister Janardan Sharma and governor Adhikari had been souring for a long time.

In August last year, Finance Minister Sharma had expressed dissatisfaction over the leak of information related to the monetary policy 2021-22 before its official announcement.

Again in January, Adhikari dismissed the government’s claim that achieving a 7 percent economic growth rate this fiscal year will be a challenging task. This came as a counter to Sharma who despite no signs of recovery had been claiming a growth rate of 7 percent.

The suspension of the governor has come at a time when the country’s economy is facing severe stress and ahead of the three tiers of election that may put the country’s financial system into the doldrums, according to experts.

“Whether the move to remove the governor was justified depends on what the charges against him are and whether those charges are based on valid grounds,” said former governor Dipendra Bahadur Kshetry. “Based on what has so far been reported in the media, I have not found any valid ground for the governor’s sacking.”

The Nepal Rastra Bank Act-2002 has ensured autonomy to the central bank and strengthened the position of the governor. Section 22 (5) of the law has specified five bases for removal of the governor, deputy governors and board directors of the central banks. Section 22 (6) of the law bars removal of the governor under no other grounds.

“This law was introduced to ensure more autonomy to the central bank by making it difficult to remove the governor after the incident of removal of Rawal in 2000,” said Kshetry.

International agencies like the World Bank and the International Monetary Fund also insist on autonomy of the central bank.

“Their recommendation was also taken into account while preparing the current law,” said Kshetry. “They will also observe how the action against the governor was taken.”

Chiranjivi Nepal, Adhikari’s predecessor, said that the government’s decision is unfortunate and that it is aimed at snatching the autonomy of the central bank.

“In the recent past too efforts were made to undermine the autonomy of the central bank,” he said. “The previous KP Sharma Oli-led government had also tabled a bill to amend the Nepal Rastra Bank Act by making a provision that eases the government to remove the governor.”

As per the bill, the government could remove the governor, deputy governor or board director of the central bank. The government could remove them if they delayed the work of the central bank unnecessarily and delayed taking decisions. The bill has been pending at Parliament though. During discussions on the bill, a number of lawmakers had called for ensuring autonomy to the central bank.

Tussles between the government and the central bank are not new in the world when the economic situation of a country worsens.

In Turkey, inflation was over 25 percent in 2018, but President Recep Tayyip Erdogan was openly telling the Central Bank of the Republic of Turkey not to raise rates. Governor Murat Çetinkaya stood his ground. In July 2019, Erdogan by presidential decree gave himself the authority to appoint the central bank governor. Çetinkaya was sacked the same month.

Former Reserve Bank of India Governor Raghuram Rajan’s tenure was not extended as he took a stand against the Narendra Modi government’s monetary policy. Having insisted he would lower rates only when he was confident that inflation was under control, Rajan was not offered a second three-year term. There have been several rate cuts under his successor Urjit Patel.

A senior official of the central bank told the Post that economic stability has been affected badly in the countries where the governor has been sacked on unreasonable grounds.

21.56°C Kathmandu

21.56°C Kathmandu