Money

Nepse dips 13.53 points as book closure nears

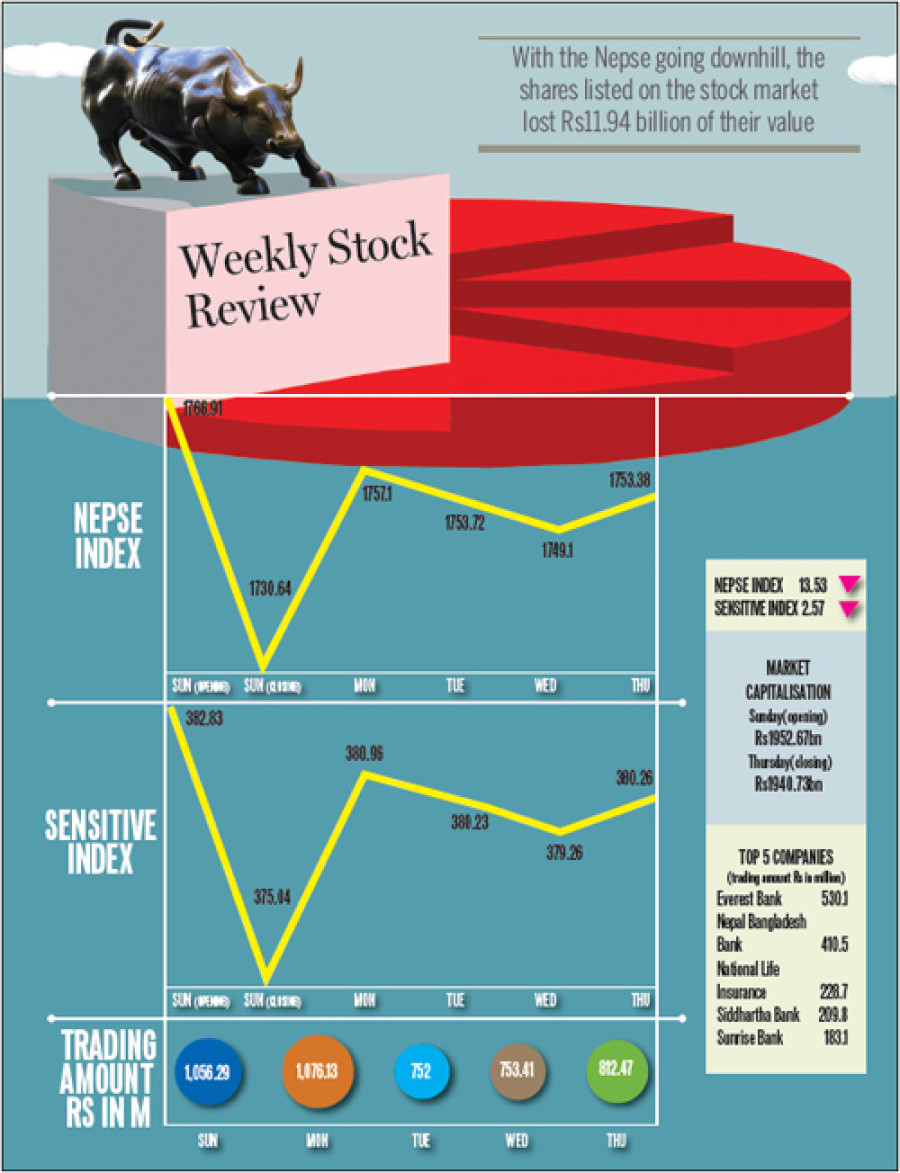

The Nepal Stock Exchange (Nepse) index dipped 13.53 points over the week on slowed demand due to the book closure declared by listed companies.

The Nepal Stock Exchange (Nepse) index dipped 13.53 points over the week on slowed demand due to the book closure declared by listed companies.

The secondary market opened at 1,766.91 points on Sunday and shed 36.27 points when trading closed. On Monday, the Nepse rose 26.46 points and closed at 1,757.1 points.

On Tuesday and Wednesday, the index dropped 3.38 points and 4.62 points respectively.

As the market closed for the week on Thursday, the Nepse inched up 4.28 points to close at 1,753.38 points.

“Except shares that investors expected to provide good returns in the long run, demand for most shares slowed, pulling down the overall index,” said Sharada Nepal, managing director of Sagarmatha Securities.

Along with the Nepse, the sensitive index that measures the performance of Group A companies also slipped 2.57 points to 380.26 points.

With the Nepse going downhill, the shares listed on the stock market lost Rs11.94 billion of their value and market capitalisation amounted to Rs1,940.73 billion.

Among the nine trading groups, the indices of seven declined last week. The insurance sub-index witnessed a fall of 281.9 points and closed at 8,701.47 points.

Likewise, the development bank sub-index went down 65.24 points to 1,804.11 points. Hydropower lost 41.98 points, manufacturing lost 38.63 points and the sub-indices of hotels, finance companies and others decreased 18.55 points, 10.87 points and 6.94 points respectively.

Nepal of Sagarmatha Securities described the fall in the insurance sub-group as market correction.

“Stocks of insurance companies are overpriced, and it is natural that the index should fall over time,” she added.

The banking group was the only gainer last week. The index of commercial banks swelled 11.47 points to close at 1,672.73 points. The trading sub-index was stable at 202.79 points.

Last week, Everest Bank observed the biggest turnover of Rs530.12 million. Recording share transactions worth Rs228.66 million, Nepal Bangladesh Bank came in the second position.

They were followed by National Life Insurance, Siddhartha Bank and Sunrise Bank in terms of turnover.

Stockbroker Nepal attributed the rise in the value of transactions of Everest Bank to the return that the bank is scheduled to make in a few days. “As the bank’s book closing time is approaching, investors have great expectations that it will offer a high return.”

In terms of the number of shares traded, Nabil Balance Fund 1 topped the list with 511,000 shares changing hands.

Last week, the shares of 158 listed companies were traded. Along with a fall in the Nepse, the turnover declined 21.27 percent to Rs4.45 billion. Similarly, the number of shares traded fell to 5,292,160 from 7,239,750 units.

14.12°C Kathmandu

14.12°C Kathmandu