Money

Nepal’s record Rs1.96 trillion budget makes bold promises amid a bleak outlook

Budget aims for 6 percent growth and supports private investment. Doubts over implementation in a climate of political instability and poor spending.

Sangam Prasain

Following a last-minute agreement with opposition parties, which decided not to disrupt the budget announcement, Finance Minister Bishnu Paudel presented a significantly expanded annual financial plan in Parliament on Thursday, aiming to revive sluggish economic growth.

Minister Paudel unveiled a Rs1.96 trillion annual financial plan, with a focus on completing long-delayed infrastructure projects. This budget is 5.6 percent larger than the current fiscal year’s and comes amid persistent political instability, a growing number of scandals, and widespread corruption—factors economists and analysts have flagged as major risks to its implementation.

In a notable policy shift, the government also announced that Nepalis would now be allowed to invest abroad.

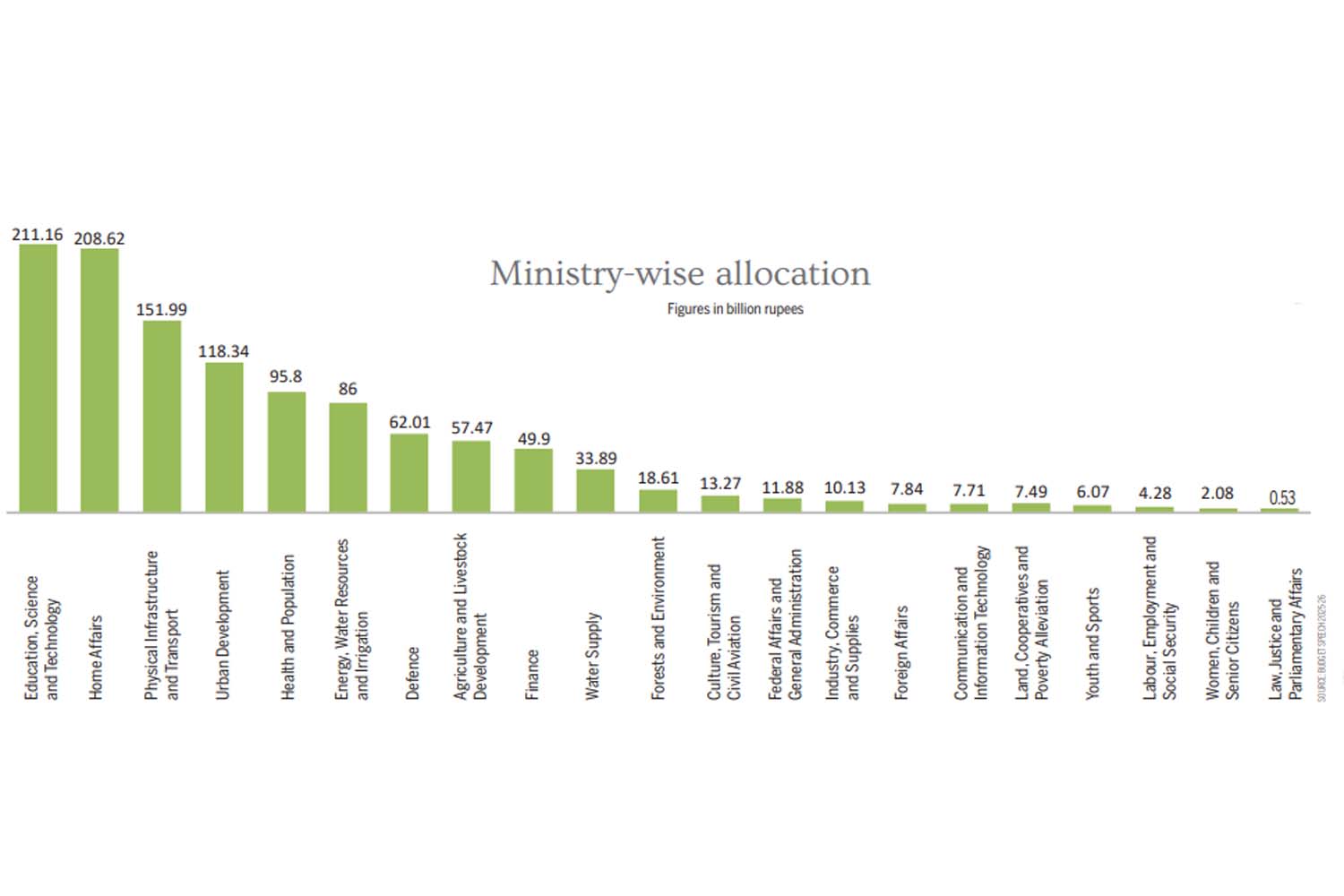

Minister Paudel doubled the budget for sports—making the allocation highest on record—acknowledging the rising popularity of cricket and football. Fans have repeatedly called for better stadium facilities in order to host international matches.

With this expenditure, the government aims to grow the economy by 6 percent and cap inflation at 5.5 percent.

Economists, however, warn that despite a strong post-Covid rebound, Nepal’s economy remains burdened by political instability and impulsive policy decisions driven by short-term political goals. Government and private sector spending continues to be sluggish. Experts argue that double-digit growth will remain unattainable unless the government creates a conducive environment for private sector investment.

With an average growth rate of just 4 percent over the past decade, Nepal is set to graduate from the list of least developed countries by the middle of the next fiscal year. To stimulate private investment and jumpstart growth, the government hopes to mobilise Rs1.1 trillion from the private sector.

Private sector representatives have largely welcomed the budget. “Most of the suggestions provided by the private sector have been addressed,” said Hem Raj Dhakal, vice president of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), the apex private sector body.

He praised measures such as the reduction in rental fees in special economic zones, support for Nepali investment abroad, fee waivers on land leased to factories relocating outside the Kathmandu Valley to reduce pollution, the removal of bank guarantees for obtaining import-export codes, and a reduction in excise duties on select goods.

According to the budget, by fiscal year 2025–26, the government aims to engage the private sector in projects worth Rs700 billion. Additionally, it plans to sign new projects worth Rs400 billion with the private sector for implementation in the upcoming fiscal year.

Unlike widely expected, the government did not increase taxes on electric vehicles or raise civil servant salaries. Instead, a revised monthly dearness allowance of Rs5,000—up from Rs2,000—has been approved for government employees.

Considering the report of the High-Level Economic Reform Recommendation Commission, the budget has arranged for citizens who have completed 70 years of age by the upcoming fiscal year to receive the elderly citizen allowance.

However, the existing age requirement for receiving the allowance for senior citizens, including those who are disabled and those from marginalised and endangered communities, has been maintained.

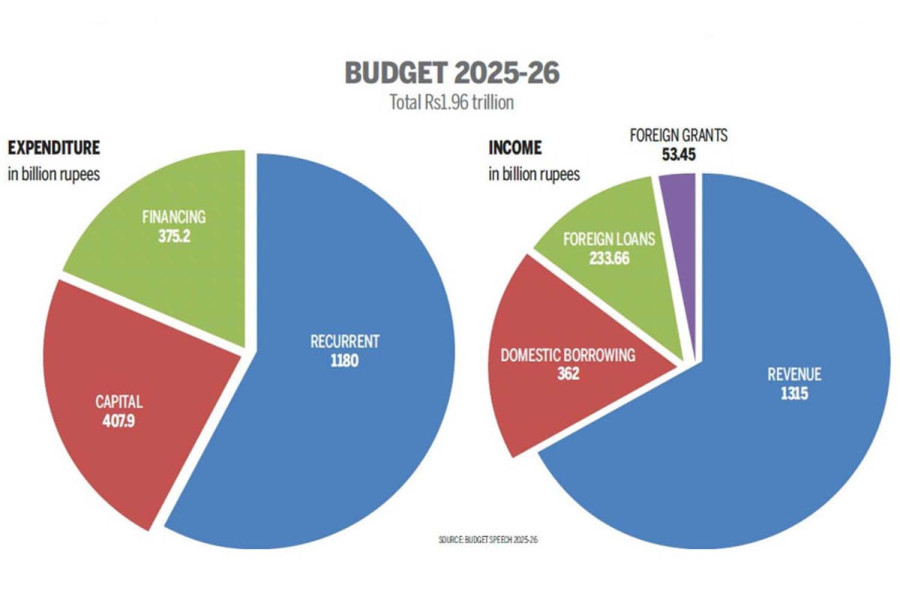

The government has allocated Rs1.18 trillion, or 60.1 percent of the total budget, for recurrent spending, which covers regular expenses such as staff salaries and allowances. Capital spending, which funds development projects and infrastructure, is Rs407.89 billion or 20.8 percent of the budget. Rs375.2 billion, or 19.1 percent, has been earmarked for financing needs.

According to the budget statement, the government plans to raise Rs1.31 trillion in revenue and receive Rs53.45 billion in foreign grants. The Rs595.66 billion deficit will be financed through foreign loans of Rs233.66 billion and domestic borrowing of Rs362 billion.

Economist Pushkar Bajracharya criticised the plan, calling it “utterly ambitious.” “It is ordinary and not encouraging, as the government has failed to bring focused and prioritised programmes for economic recovery. This is concerning,” he said.

Bajracharya noted that a revenue target of Rs1.31 trillion is unrealistic in the current economic climate, where growth has nearly stalled. “Achieving 6 percent growth is also difficult, given the fragile global economic environment,” he added.

He further pointed out that donor funding is shrinking and the geopolitical situation remains tense. In such a scenario, obtaining grants and loans will be increasingly difficult for a country heavily reliant on remittances from migrant workers.

Nonetheless, Bajracharya acknowledged the government’s effort to simplify the tax regime by reducing overlapping provisions, calling it a commendable move.

Minister Paudel said the decision to allow overseas investment aims to globalise domestic enterprises. Under the new rules, Nepali companies can establish overseas sales branches and processing units for semi-processed goods.

However, only 25 percent of the annual income from exports will be allowed for reinvestment abroad, and 50 percent of profits from such ventures must be repatriated to Nepal, subject to approval by the Investment Board Nepal.

The budget also provides for Nepali citizens to receive sweat equity from foreign firms in exchange for offering technological expertise, specialised knowledge, or unique services.

“Sweat equity will legally recognise the value of Nepali professionals and innovators working with foreign firms in non-monetary forms,” said Paudel. “This is a step towards harnessing global opportunities for Nepali talent.”

To support startups, the government has allocated Rs730 million in subsidised loans for the next fiscal year. These loans will carry a concessional interest rate of just 3 percent, aiming to foster innovation and entrepreneurship, especially among Gen Z.

Paudel said startups based on innovation and emerging technologies will be prioritised. “This initiative is designed to foster a dynamic entrepreneurial ecosystem and help new businesses scale up with easier access to finance,” he noted.

A Rs4.15 billion allocation has been made to transform Tribhuvan International Airport into a boutique airport, a project initially proposed in 2019 by then-president Bidya Devi Bhandari to reflect Nepal’s cultural and architectural identity.

In higher education, the government announced a new policy to attract foreign students by offering free visas and undertaking structural reforms. Foreign students will get visas valid throughout their academic programmes, while their guardians will be eligible for multiple-entry visas.

The government also plans to reorganise university departments and faculties, reduce the outflow of students going abroad, and establish a robust higher education regulatory body by restructuring the existing university commission.

“Universities will receive grants based on educational quality, student enrolment, and infrastructure,” Paudel stated. “An academic calendar will be mandatory and must be published before each academic session. Failure to comply will result in grant suspension.”

To ease the real estate sector’s liquidity crunch, a new policy allows the sale of housing and apartment units developed on land exceeding legal ceiling limits—provided they had prior approval. This also applies to land registered under companies or factories to avoid acquisition.

Real estate developers will be allowed to build and sell units on institutional land within government-prescribed limits.

The government also announced plans to blend bioethanol with petrol beginning fiscal year 2025–26, promoting cleaner fuel alternatives and reducing dependence on fossil fuel imports. Expansion of petroleum infrastructure, including the Amlekhgunj–Lothar and Siliguri–Chaarali pipelines and additional storage facilities, is also on the agenda.

In a bid to address the cooperative crisis, Minister Paudel said the assets of those who had embezzled cooperative funds would be auctioned and distributed to victims. Passports and assets of implicated cooperative officials will be frozen. A revolving fund and seed capital have also been earmarked for relief.

An international-level exhibition hall will be built on 214 ropani (10.89 hectares) of land at the Capital’s Bhrikuti Mandap exhibition ground.

The budget also includes support for the jewellery sector. Export-oriented gold and silver industries that earn at least 50 percent of export value in foreign currency will be eligible for bonded warehouse facilities and can import metals accordingly.

New industries in special economic zones (SEZs) and industrial areas will get rental discounts for their first three years. SEZ rent has been slashed from Rs20 to Rs5 per square meter. Industries that export more than 30 percent of their products will also receive infrastructure support.

Hotels and resorts will enjoy tax and customs duty exemptions similar to those of productive industries. A new law will guarantee service-charge-based benefits for tourism workers in hotels, motels, restaurants, and jungle safari operations.

To tackle plastic pollution, the government will impose a ban, effective from November 17, on the production, import, and use of plastic bags thinner than 40 microns.

The midday meal programme budget for students up to grade five has been increased to Rs10.19 billion, covering 2.8 million children. The sanitary pad distribution initiative will continue with a Rs1.29 billion budget, which is expected to benefit 1.3 million girls.

An allocation of Rs10.16 billion has been made to raise the remuneration of early childhood development facilitators and community school staff. Another Rs10 billion has been set aside for the Health Insurance Programme.

A new international-standard multipurpose sports stadium will be constructed in Damak, Jhapa—Prime Minister KP Sharma Oli's constituency. To promote sports development and tourism, high-altitude stadiums will also be built in Solukhumbu, Mustang, and Jumla.

By the end of fiscal year 2025–26, newly operational hydropower projects will add 942 megawatts to the national grid, raising total installed capacity to 4,858 megawatts. Additionally, 732 kilometres of double-circuit national transmission lines will be constructed.

The Kathmandu–Terai/Madhesh Expressway is scheduled for completion by fiscal year 2026–27. In the coming year, 37 kilometres of road, 4 kilometres of tunnels, and 60 bridges will be completed. Rs24.49 billion has been allocated for this purpose.

The budget has also announced selling 30 percent of Nepal Telecom’s shares to the general public and overhauling the national flag carrier Nepal Airlines.

Reacting to the new budget, Chandra Prasad Dhakal, president of the Federation of Nepalese Chambers of Commerce and Industry, said it has addressed some of the current economic challenges.

This year’s budget has touched upon traditional sectors like agriculture, tourism, and industry, as well as newer areas with comparative advantages such as information technology, alternative energy, and finance.

The plan to grant benefits to resort and hotel businesses similar to those of special industries could increase tourism infrastructure investment.

Likewise, promoting fruit farming in hilly regions and along highways, along with provisions for storage and transportation in partnership with the private sector, is expected to benefit agriculture.

“Some notable positive measures include the removal of the Rs300,000 bank guarantee previously required to obtain an EXIM code, and the replacement of manual customs valuation booklets with an automated valuation system,” according to Dhakal.

“Establishing an Asset Management Company to deal with rising non-banking assets, and the provision allowing Know Your Customer (KYC) details updated at one bank to be valid across others are also welcome steps.”

However, he said, one crucial demand was not met: removing the 13 percent value-added tax on air tickets.

“Keeping this tax in place will continue to make Nepal an expensive tourist destination, potentially discouraging tourism growth.”

“While Nepal has already signed a deal to export 10,000 megawatts of electricity to India and there are prospects with Bangladesh, the request to extend the tax exemption period for electricity export was not addressed. This requires further clarification.”

He said another unaddressed issue is the 2.5 percent TDS (Tax Deducted at Source) on cargo, which has long discouraged exports. “Keeping it unchanged will have a continued negative effect on export competitiveness,” said President Dhakal.

21.88°C Kathmandu

21.88°C Kathmandu