Money

A Rs1.79 trillion budget with programmes aimed at polls and no clarity on resources

Economists say too big a budget which could fuel inflation that’s already biting people hard, just as the country stares at an economic crisis.

Prithvi Man Shrestha & Krishana Prasain

The Sher Bahadur Deuba-led coalition government on Sunday presented a budget of Rs1.79 trillion in Parliament for the fiscal year 2022-23, mostly looking at the election year, with populist schemes galore.

Finance Minister Janardan Sharma read out the budget on behalf of the government.

Despite warnings from economists that the oversupply of money in the market could fuel inflation, the government presented a nearly 10 percent bigger budget compared to that for the ongoing fiscal year.

Nepal's inflation hit 7.28 percent last month, the highest in nearly six years, due to the surge in petroleum prices following Russia's invasion of Ukraine. Inflation was already high amid strong demand and stubborn pandemic-related supply shortages.

The government has targeted to limit inflation below 7 percent in the next fiscal year.

For three consecutive years, the country’s budget has been revised downward, which economists say is a result of the trend of trying to be populist in the beginning by bringing bloated budgets, and then revising down after failing to spend.

Economists say it is a new trend. Politicians introduce an inflated budget without any basis. Later they revise it downwards.

In September last year, Sharma had presented a Rs1.63 trillion budget for this ongoing fiscal year 2021-22, which ends in mid-July.

In February, Sharma revised the budget downward to Rs1.54 trillion after realising that the government wouldn't be able to spend the amounts set aside for this fiscal year. On Sunday, again, the budget size was reduced to Rs1.44 trillion for the ongoing fiscal year.

Now, the government seems to have put its focus on populist schemes given the fact that this is the election year—federal and provincial elections are due later this year after local elections were held on May 13.

The resources claimed by the finance minister, however, are unrealistic when it comes to financing such a big budget amid shrinking incomes.

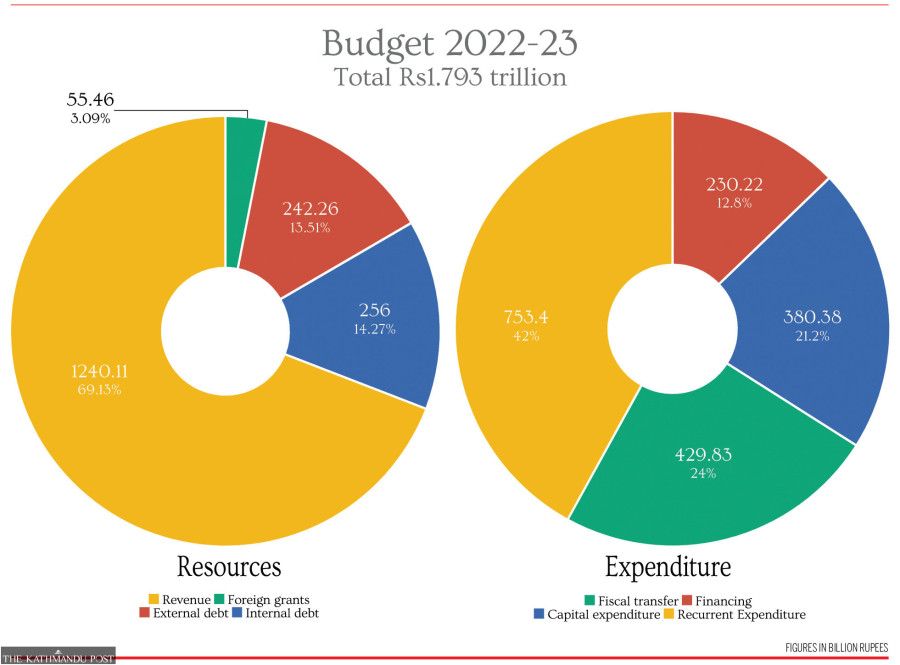

According to Sharma, the source of financing will be Rs1.24 trillion from revenues and Rs55.46 billion from foreign grants. The deficit of Rs498.26 billion will be raised through domestic and foreign loans.

The finance minister said Rs242.26 billion will be raised from external loans, and Rs256 billion from internal loans. As it will be difficult for the government to raise revenue to finance the belated expenditure plans, it has been forced to rely on loans and grants.

“If the government raises more internal loans, it will create scarcity of loanable funds for the private sector and affect their investments,” said Govinda Nepal, an economist. “The government has also failed to receive grants and loans as planned in the last 4–5 years.”

The government has allocated Rs380.38 billion (21.2 percent) for capital expenditure, Rs753.40 billion (42 percent) for recurrent expenditure and Rs230.22 billion (12.8 percent) for fiscal management. The remaining 24 percent of the budget (Rs429.83 billion) will be mobilised for local and provincial governments.

“The size of the budget is huge and the government institutions do not have the capacity to spend this bloated budget, which always has been the case,” said Keshav Acharya, also an economist.

Amid this, the government has to finance some of the populist programmes that it has announced, including lowering the age limit for the elderly allowance, increment in salary for government employees, exempting loans taken by farmers and delivery allowance for new mothers in 25 districts, treatment allowance for kidney patients, patients of cancer and spinal paralysis, free-of-charge screening of non-communicable diseases for people aged 40 years and above.

The government has announced providing one electric stove to each family nationwide in grants through local governments so as to reduce the burden the state has to bear for liquified petroleum gas (cooking gas). However, it is not clear how it can be achieved, given Nepalis’ reluctance to switch to electric cooking because of outages and power tripping.

Experts say the government will face a tough time managing the resources for so many populist programmes it has announced targeted at the elections.

Pushpa Raj Kadel, a former vice-chairperson of the National Planning Commission, said that the populist programmes show that this government’s main target is to influence elections instead of resolving the problems faced by the economy.

One example is lowering the age for the elderly allowance. Sharma through the budget said that all those who have attained the age of 68 years would get the senior citizen allowance, bringing down the earlier limit of 70 years. This, experts say, will put an extra burden on the state’s chest.

“Lowering the age limit will increase the long-term financial burden on the government coffers,” said Kadel, who headed the planning body under former prime minister KP Sharma Oli, also the chair of the main opposition CPN-UML.

The life expectancy for Nepal in 2021 reached 71 years, up from 69 years in 2014, according to World Bank data.

As per the budgetary provision, the government has allocated Rs134 billion for social security allowances. The government’s budgetary allocation on social security allowances has nearly doubled in the last two years.

After the Oli administration increased the social security allowances by 33 percent for all types of beneficiaries for the current fiscal year, the budget allocation went above Rs100 billion from Rs68.65 billion in the fiscal year 2020-21.

The social security allowance or cash transfer programme covers just 41 percent of the government spending on social protection, according to the World Bank.

In its report titled “Social Protection: Review of Public Expenditure and Assessment of Social Assistance Programmes, the multilateral agency said overall spending on social protection rose to Rs189 billion in the fiscal year 2019-20 from Rs26 billion in fiscal year 2010-11.

The government has also hiked the salary of government employees by 15 percent to be effective from the beginning of the next fiscal, which too will add an extra burden to the state coffers. This will also mean it has to increase pensions for the retired employees.

The government has also increased its liability substantially at a time when it is struggling to meet the revenue targets. It has made a downward revision of revenue collection target to Rs1.15 trillion from Rs1.18 trillion as the collection was affected by import restrictions.

For the next fiscal year, the government has targeted to generate Rs1.24 trillion in revenue, just 7.6 percent more than the estimated revenue collection in the current fiscal year.

This appears to be a realisation that revenue collection would not be great in the next fiscal year as the government aims to cut down on imports in the next fiscal year as well.

Finance Minister Sharma announced that the imports of paddy, maize, wheat, vegetables and fruits would be reduced by at least 30 percent in the next fiscal year. Exports will be doubled while overall imports will be reduced by at least 20 percent in the next fiscal year, he said. Trade balance will be maintained in the next five years, according to the budget.

The government has also decided to cut tax on petroleum products, which are one of the largest sources of government revenue.

“Revenue generation from import of goods is very high in the country,” said Govinda Nepal, the economist. “So it will be challenging for the government to meet the revenue collection target by cutting on imports.”

The government feels compelled to take measures to control rising imports, which have led to the current account deficit, ballooning of balance of payment deficit and depletion of foreign exchange reserves.

Such a situation has given rise to concerns if the country is heading in the direction of Sri Lanka, which is facing the worst economic crisis since its independence.

Despite the ambitious import reduction target, addressing the economic crisis is easier said than done.

Experts say the government’s move to curtail imports was unrealistic as the base of domestic production is insignificant while prices of goods have increased globally, which will increase the country’s import bills.

A World Bank report titled Commodity Market Outlook released on April 26 states the energy prices are expected to rise more than 50 percent in 2022 before easing in 2023 and 2024. Non-energy prices, including those of agriculture and metals, are projected to increase almost 20 percent in 2022 and will also moderate in the following years.

Hemanta Dawadi, a former director general of the Federation of Nepalese Chambers of Commerce and Industry, said that maintaining trade balance in five years is “next to impossible” as it takes at least two-three years for domestic manufacturing firms to start production after they are established to replace imported products.

“The policy of import control itself is wrong because it does not allow the economy to grow,” said Dawadi. “The right policy will be to boost exports to balance the import growth.”

The country needs to import capital goods (machineries) and intermediate goods (raw materials and other goods which are used to produce finished products) which help boost the economy.

As per the budget, the government has targeted to achieve eight percent economic growth in the next fiscal year, almost double of what the World Bank projected.

According to the Nepal Development Update released by the World Bank in April, Nepal’s economy is expected to grow by 4.1 percent in the next fiscal year.

“At a time when prices of petroleum products and other goods and services are rising, the economic growth target of eight percent is too ambitious as inflation will increase the cost of production and reduce value addition,” said Acharya, the economist.

The import control measures will also squeeze economic activities in the country.

“The policy of import control will not help the government to achieve the targeted growth,” said Dawadi. “The government has recognised the problem but the remedy it has chosen is not right.”

In a bid to boost exports, Finance Minister Sharma has announced cash incentives of up to 8 percent for products like clinker, cement, steel, footwear, processed water and information technology-related services as well as services related to business process outsourcing. The country is more or less self-reliant on cement and clinker.

Pashupati Murarka, director of Arghakhanchi Cement Limited, said export of cement to India is possible if there is support from the government.

Former commerce secretary Purushottam Ojha said products which would get cash incentives should be broadened.

“Products like carpet and ready-made garments should also receive such incentives but the finance minister did not say anything about that,” said Ojha.

Even though the government in the past announced cash incentives for exports, those inducements failed to yield desired results as the country’s reliance on imports continued to grow.

“There is a huge challenge to meet the target. I don’t think it is possible to neutralise the trade deficit in five years,” said Ojha. “It requires a lot of hard work to balance the trade in five years as import dependency is high and the export-import ratio is too wide.”

16.12°C Kathmandu

16.12°C Kathmandu