National

Government dials down annual budget, once again, after failing to spend

Economists say an electoral spending boom this year and last year’s low base effect may help the economy grow to some extent but the 7 percent target still looks too ambitious.

Sangam Prasain

The government has trimmed down the annual budget by 5.3 percent after realising that it wouldn't be able to spend the amounts set aside for this fiscal year.

This translates to a reduction of Rs86.55 billion in the annual financial plan for 2021-22, ending mid-July 2022.

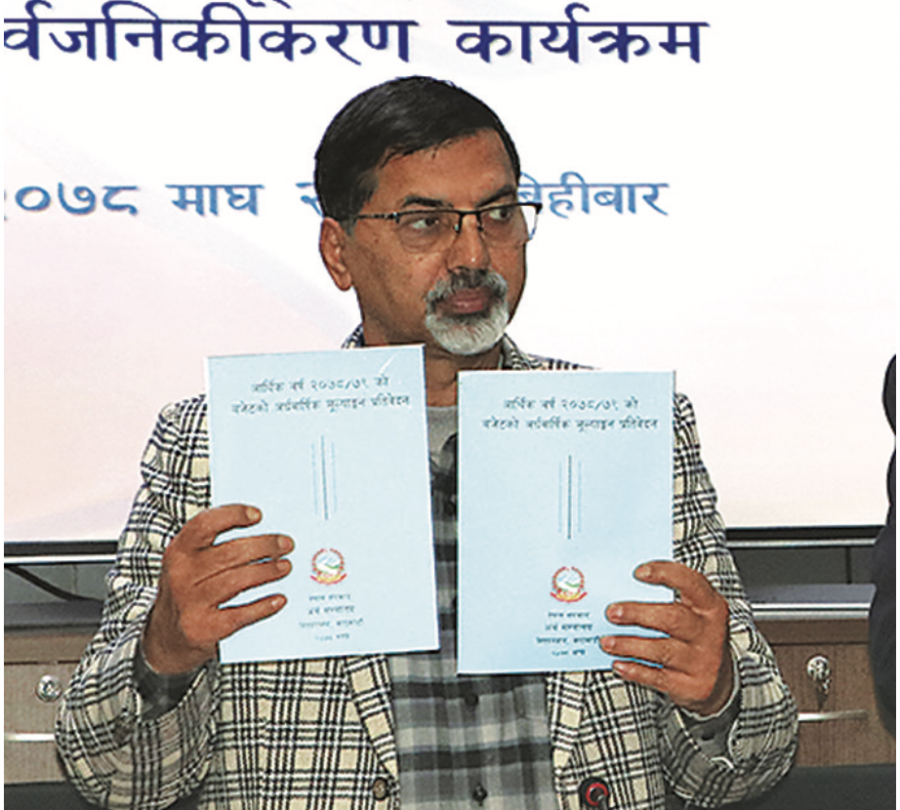

The revised budget is now Rs1.54 trillion, said Janardan Sharma, presenting a mid-term review of the annual budget on Thursday.

This is the third consecutive year that the country’s budget has been revised downward, which economists say is a result of the trend of trying to be populist in the beginning by bringing bloated budgets, and then revising down after failing to spend.

“Obviously, it’s a new trend. Politicians introduce an inflated budget without any basis. Later they revise it downwards,” said Dadhi Adhikari, an economist.

According to him, politicians are least bothered to consult experts and economists before bringing a budget.

“There is a never-ending trend of bringing populist budgets but in reality they don’t have the capacity to spend,” Adhikari told the Post.

According to Minister Sharma, through the mid-term review, the government has allocated Rs10 billion for the local elections, which have been announced for May 13.

“We have allocated Rs10 billion for the elections,” he said. “But there is demand for Rs50 billion,” he told a press meet held at the Finance Ministry.

Sharma said that the mid-term budget review has also adopted some austerity measures in order to reduce spendings on meetings and seminars and to buy vehicles for local elections.

The government has announced to conduct local level elections on May 13 in one phase as per the recommendation of the Election Commission.

The government has set aside some funds to buy chemical fertiliser following the hike in the global prices.

But officials at the Ministry of Agriculture say the fertiliser crisis is imminent this paddy growing season due to multiple factors like price hikes, global shortage, supply constraints, transportation problems and the poor state of the Agriculture Inputs Company, the Nepali supplier of farm inputs.

The supplier remains headless after the Commission for Investigation of Abuse of Authority had filed corruption cases against 12 of its officials on the charge of their involvement in the import of substandard fertilisers in January.

A week after dissolving the House of Representatives, the caretaker government of KP Sharma Oli presented the federal budget for 2021-22, through an ordinance, in the midst of the second wave of the Covid-19 pandemic.

On May 29, 2021, then finance minister Paudel presented a bloated budget of Rs1.64 trillion, which was 12 percent bigger than that of the last fiscal year, giving a semblance of government focus on the pandemic, but the funds earmarked to fight the virus barely scratch the surface.

Then the political situation deteriorated with Oli’s three-and-a-half-year-long tenure as prime minister ending.

Sher Bahadur Deuba came back as new prime minister on July 13, 2021.

After two months, on September 10, Finance Minister Sharma again presented Nepal’s annual financial plan of Rs1.63 trillion for the ongoing fiscal year 2021-22, nearly Rs15 billion less than the budget presented by the erstwhile KP Sharma Oli-led administration on May 29. Sharma had amended the existing budget through a replacement bill.

The coalition government led by the Nepali Congress has set an ambitious 7 percent economic growth target this fiscal year, even as the country’s economy has been hit by a third Covid-19 wave. The growth target is slightly higher, by 0.5 percentage points, compared to what was set by Sharma’s predecessor, Bishnu Poudel.

The finance minister hopes to achieve the targeted economic growth amid the government’s target of fully vaccinating all population by mid-April next year, which is expected to give a fillip to economic activities.

But the country’s economy started to show signs of recession.

Amid the Covid-19 pandemic, the year-on-year consumer price inflation jumped to a 64-month high of 7 percent in the first five months of the current fiscal year making people more vulnerable.

In the first half, inflation stood at 5.65 percent, way higher compared to 3.56 percent a year ago, according to Nepal Rastra Bank’s statistics.

Remittance inflow decreased 5.5 percent to Rs468.45 billion in the review period against an increase of 11.1 percent in the same period of the previous year.

The current account remained at a deficit of Rs354.07 billion in the review period compared to a deficit of Rs.51.68 billion in the same period of the previous year.

Balance of Payments showed a deficit of Rs241.23 billion in the review period against a surplus of Rs124.92 billion in the same period of the previous year.

Gross foreign exchange reserves decreased 16.7 percent to Rs1,165.8 billion in mid-January 2022 from Rs1399.03 billion in mid-July 2021.

The price of oil in the international market increased 57 percent to $87.17 per barrel in mid-January 2022 from $55.52 per barrel a year ago. The price of petroleum products hit a record high in the domestic market.

Nepal’s paddy harvest has been expected to shrink to a five-year low of 5.13 million tonnes this fiscal year caused by unseasonal October rainfall and experts say it may cause further upward pressure on inflation and downward pressure on the economy.

Paddy is Nepal’s biggest earning farm commodity, with tens of thousands of farmers relying on its income.

Imports increased 51.1 percent touching near Rs1 trillion mark in the first six months of the current fiscal year.

“All economic indicators are not performing well,” said Adhikari. “All indicators show that the country’s economy could grow by 4 percent this fiscal year.”

“And this is because of an anticipated spending boom triggered by the upcoming local elections and last fiscal year’s low base effect.”

The only achievement the government has made is the revenue collection. “We have achieved the revenue collection target,” said Sharma.

Sharma said that the low budget expenditure was due to weak institutional capacity.

Following the budget revision, Rs1.35 trillion has been set aside for recurrent expenditure, which usually goes into the salaries and pensions of government employees and social sector-related obligations.

Similarly, Rs340.32 billion has been set aside for capital expenditure, and Rs170.49 billion for financing provisions.

The budget for capital expenditure has been reduced by 10 percent.

The Finance Ministry has also revised its sources of funds. It will raise Rs50 billion through foreign grants, down from the original proposal of Rs59.92 billion. It plans to take foreign loans amounting to Rs206 billion, down from Rs283.9, and raise Rs1.18 trillion in revenues and domestic loans.

17.9°C Kathmandu

17.9°C Kathmandu