Money

Upper Karnali Hydropower Project bogged down in price negotiations

Indian developer GMR has signed a pact to export power to Bangladesh but they are still haggling over the rate

Prahlad Rijal

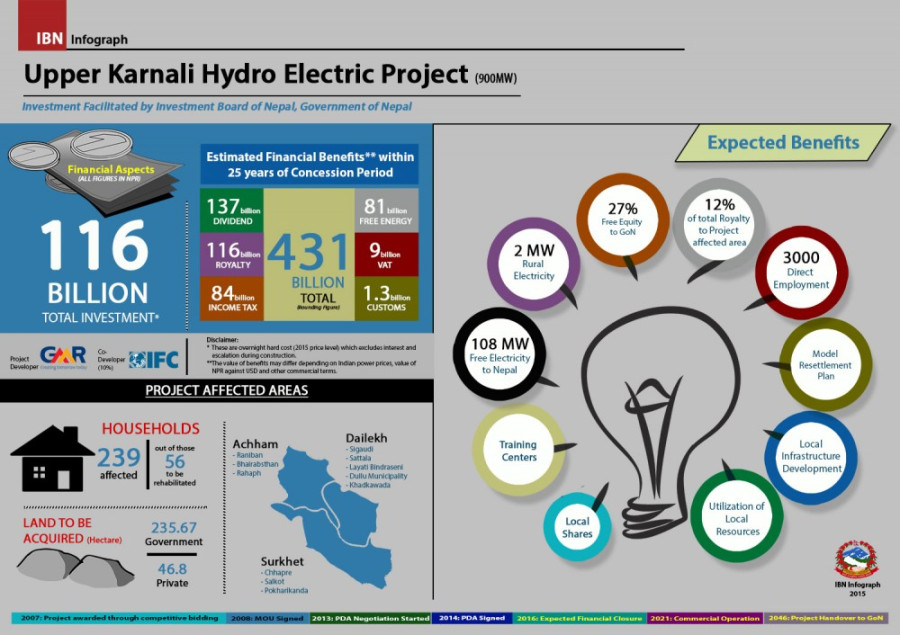

A year after the Post’s revelation that Indian company Grandhi Mallikarjuna Rao (GMR), the developer of the 900 MW Upper Karnali hydropower project, offered to sell electricity produced by the plant to Bangladesh at 10 cents per unit, negotiations are still stuck over the power purchase and sales agreement.

A government official who was present at a recent meeting between Bangladeshi and Nepali energy authorities in Cox’s Bazar said that the Nepali side unsuccessfully asked for a three-month timeframe to reach an agreement.

“We asked for a deadline to make a deal, but Bangladeshi authorities rejected the idea and said an agreement would be forged soon,” said the official who asked not to be named. “Our counterparts updated us that multiple negotiations over the tariff had failed to produce results. But they were positive about fixing the rates soon.”

The uncertainty means that the market for the electricity generated by the project is yet to be secured by the developer allowing it to arrange funding for the construction of the plant in western Nepal.

Also, the Nepal Electricity Authority, one of the stakeholders, will have to wait for the 108 MW that it is slated to receive free of cost from the project.

Bangladesh had signed a memorandum of understanding with India’s NTPC Vidyut Vyapar Nigam to import electricity from the Upper Karnali scheme via India during Bangladeshi Prime Minister Sheikh Hasina’s visit to India in April 2017. But the parties have not been able to strike an agreement that will allow the developer to perform financial closure.

Investment Board Nepal, which has already extended the financial closure deadline for the Indian developer twice, has balked at extending it further despite company’s request.

“The company has asked for an extension, but without any significant progress and a favorable environment for the project to move ahead, we are not in a position to extend the deadline,” said Maha Prasad Adhikari, the board’s chief executive officer. “Once the purchase agreement with Bangladesh is fixed, it will be easy for us to extend the financial closure deadline.”

A principal agreement on the commercial terms of the power purchase agreement excluding tariff rates was reached between the Bangladesh Power Development Board and GMR last year, paving the way for GMR to export 500 MW to power-hungry Bangladesh. “But the two parties are yet to finalise and sign a power purchase agreement, probably because of the ‘high rate’ proposed by the developer,” said the official.

The export-oriented Upper Karnali project has a high price tag due to surcharges placed on the use of Nepali and Indian transmission grids. As the developer is required to relay energy using Nepali and Indian infrastructure, it will have to pay wheeling charges to both Nepal and India. Apart from the charges, the loss of electricity in long distance transmission is also usually high.

Without the Indian developer finding a potential lender to finance the construction of the project, the cross-border trade of electricity from western Nepal to Bangladesh via India is likely to happen later than expected.

9.7°C Kathmandu

9.7°C Kathmandu