Money

Nepse continues bull run; above 1,250

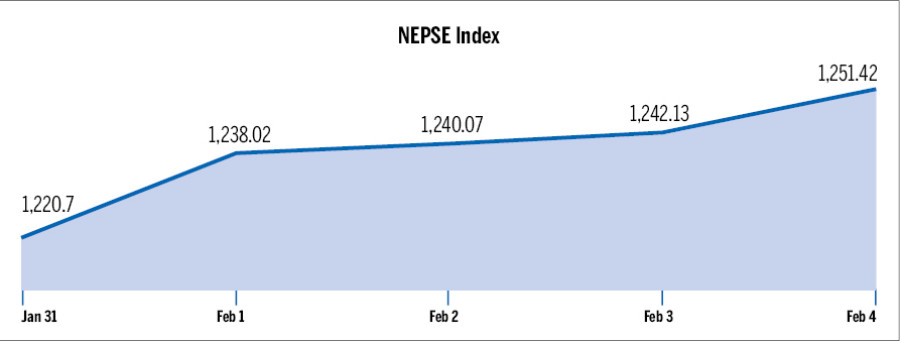

Nepal Stock Exchange (Nepse) last week jumped 30.72 points to close at its all-time high of 1,251.42.

epal Stock Exchange (Nepse) last week jumped 30.72 points to close at its all-time high of 1,251.42.

The market that opened at 1,220.7 points on Sunday posted gains throughout the week. The week’s largest gain came on Monday when the benchmark index surged 17.32 points.

The market has been on an upward trajectory for the last three weeks ever since the regulator enforced a full-fledged demat transaction system. Last week too, the index set a record of 1,219.62 points.

Stockbrokers attributed the rise to factors such as excess liquidity with banks, implementation of full-fledged demat system, positive political developments and better quarterly reports of banks and financial institutions.

Madhu Joshi, managing director

of Dynamic Money Managers Securities, said the investment volume too was increasing as more investors were getting attracted towards the stock market amid low interest rates on bank loans as well as deposits. “Besides, low price-to-earning ratio—meaning high earning capacity—of banks also boosted investors’ confidence,” said Joshi, adding the high rate of return of insurance companies also boosted the demand for shares.

Narendra Raj Sijapati, managing director of Kalika Securities, echoed Joshi. He said the good second-quarter profits posted by financial institutions also contributed to the market gains.

Except for trading, all other groups posted gains. Development banks (up 77 points) led the gainers’ side including manufacturing, insurance, commercial banks, hydropower, hotels, others and finance companies. The trading group was stable at 201.38 points throughout the weekdays.

Stockbrokers expressed the market would grow in the future. Sijapati said the market could hover between 1,250 and 1,300 points in the next week.

The sensitive index that measures the performance of ‘A’ class companies also surged 6.89 points to 269.52 points.

The overall market transaction for the week jumped 28.21 percent to Rs2.79 billion—daily average transaction of Rs560 million. The number of traded shares increased to 4,466,610 units from 3,444,117 units. Nepal Investment Bank topped in terms of transaction volume (Rs151.45 million). It was followed by Nepal Investment Bank (promoter’s shares), Nabil Bank (promoter’s shares), Sanima Bank and Global IME Bank. Nabil Balance Fund 1 took the pole in terms of the number of shares traded (328,000 units).

Meanwhile, Nepse listed 1 million primary shares of Saptakoshi Development Bank.

Nepal Investment Bank 151.45

Nepal Invest Bank (Pro) 145.93

Nabil Bank (Pro) 132

Sanima Bank 106.74

Global IME Bank 99.75

Development Banks 77

Manufacturing 54.43

Insurance Companies 46.9

Commercial Banks 26.08

Hydropower Companies 22.78

Hotels 20.7

Others 18.8

Finance Companies 8.1

5.12°C Kathmandu

5.12°C Kathmandu