Money

China’s dominance in Nepal EV market leaves India trailing

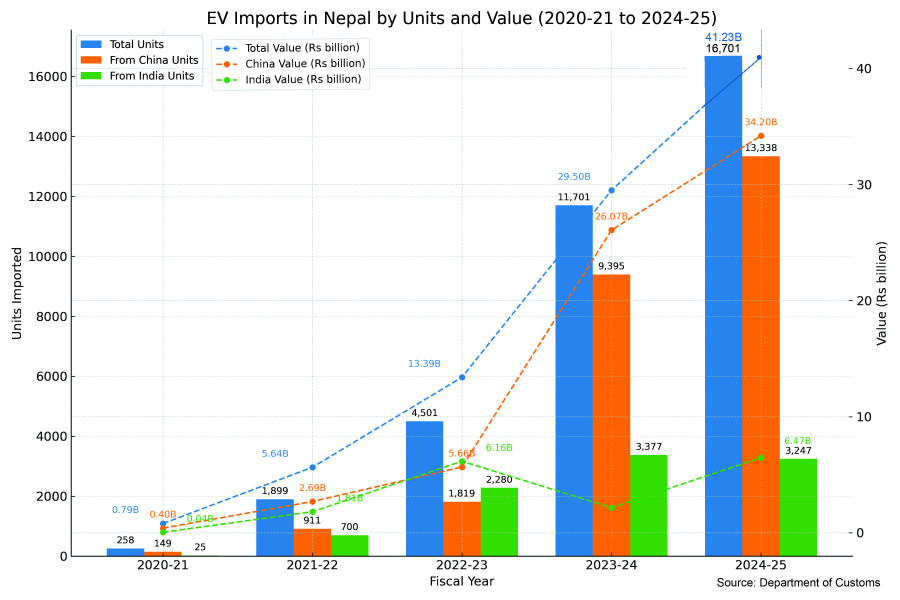

Among the 16,701 vehicles sold in Nepal in the fiscal year 2024-25, the number of Chinese vehicles was 13,338.

Krishana Prasain

The summer heat hung heavy over Bhrikutimandap Exhibition Hall in Kathmandu on Saturday, but that did not stop Ishwar Rauniyar from weaving through the crowded alleys of the Nepal Automobile Importers and Manufacturers Association (NAIMA) Auto Show. Rows of gleaming, high-tech electric vehicles stretched before him, their metallic surfaces catching the overhead lights.

“EV cars here are more than I expected,” said the 52-year-old from Balaju, pausing to admire a sleek SUV. “The look and features are amazing, even in vehicles priced below Rs3 million.”

This year’s auto show has become the battleground for Chinese and Indian electric vehicle (EV) makers. Almost every stall offers tempting deals — cash prizes up to Rs700,000, generous discounts, and new models boasting advanced technology.

After comparing the models, Rauniyar had a clear verdict. “Chinese EV manufacturers are slightly ahead in fit and finish. Their technology is better,” he said, strolling alongside his cousin.

The five-day event, which began last Wednesday, has been extended until Monday due to surging interest. Organisers say the competition on display reflects the fight for Nepal’s EV market dominance, with Chinese brands clearly taking the lead this year.

One of the busiest stalls belonged to Chinese brand BYD, now one of Nepal’s best-selling EV names. Directly opposite Mahindra’s stand, BYD unveiled the Atto 1, starting at Rs2.89 million, attracting a steady stream of visitors.

Electric vehicles now account for a staggering 73 percent of all four-wheeled passenger vehicle imports to Nepal—one of the highest shares globally.

Imports of four-wheelers, including passenger buses, microbuses, and private vehicles, rose 27.04 percent year-on-year in the last fiscal year that ended mid-July. EV imports alone climbed 23.33 percent. Of 22,907 four-wheelers worth Rs50.88 billion brought into the country, 16,701 were EVs valued at Rs41.23 billion.

Just five years ago, the market looked very different. In fiscal 2019-20, Nepal imported only 236 EVs—mainly from China—worth Rs674 million. That year, petrol- and diesel-powered vehicle imports totalled 10,310 units worth Rs9.24 billion.

Until 2022, Tata Nexon EVs were preferred by Nepali customers for their affordability. From April 2021 to March 2022, just after Covid restrictions eased, Nepalis started buying EVs in earnest. Sipradi Trading, the authorised distributor of Tata vehicles in Nepal, said they sold more than 2,000 EV units that year, with the Nexon accounting for 90 percent of sales.

Nexon EVs cost between Rs3.89 million and Rs4.39 million. India was then Nepal’s largest EV supplier, followed by China.

Then BYD entered the market and quickly dominated, offering a new smart cockpit experience.

Indian media report that India has recently sent a few hundred EV units to Nepal, but shipments have been hampered by slow domestic manufacturing and tough competition from Chinese brands.

“This year, the response has been better than expected, and bookings are excellent,” said Prerna Maharjan, BYD’s marketing executive.

She noted a surprising trend: women entrepreneurs are becoming a significant part of the customer base, with female buyers making up about 40 percent of BYD’s Atto 3 and Dolphin models.

Representing India, Mahindra launched its all-electric BE 6 and XEV 9e SUVs. Company officials say the interest has been overwhelming — between 700 and 800 visitors stop by their stall daily.

Sachin Arolkar, head of international operations at Mahindra Automotive, who was in Kathmandu for the BE 6 launch recently, said Chinese competition has helped expand the market. “It has pushed EV infrastructure development and raised customer expectations,” he told the Post. “But we’re confident Mahindra can stand out with trusted after-sales service, brand heritage, and product quality.”

“Eighteen- and nineteen-year-olds are influencing their parents’ buying decisions,” said Santoshi Nepal, senior marketing manager at Agni Incorporated, Mahindra’s authorised distributor in Nepal. “Ground clearance and range are what attract most buyers.”

Mahindra expects to cross three-digit bookings for its new EVs before the show ends. Prices range from Rs5.7 million to Rs6.8 million for the BE 6, and Rs6.9 million to Rs9.5 million for the XEV 9e. Even Mahindra’s internal combustion model, the 3XO, priced from Rs4.4 million, is drawing attention despite the EV rush.

Crowds have been equally impressive.

According to NAIMA’s media and marketing consultant Pratik Aryal, more than 15,000 people attended on the first day, 13,500 on the second, and nearly 19,500 on the third. Organisers hope the total will reach 100,000 by Monday.

More than 50 automobile brands are participating this year—21 four-wheeler makers, 17 two-wheeler brands, seven commercial vehicle brands, and one three-wheeler manufacturer. Thirty-five new models, from internal combustion to hybrid and electric, have been launched.

NAIMA has not disclosed total bookings, but conversations with exhibitors suggest most visitors are drawn to EVs, from budget hatchbacks to luxury SUVs.

One premium contender is Zeekar X, a Chinese luxury EV built on the Volvo platform and launched in Nepal last year. It sold over 50 units in its first year. “We’ve taken more than 10 bookings in just the first three days,” said Kishor Maharjan, head of sales at Pioneer Moto Corp. Prices start at Rs8.5 million.

Leapmotor, another Chinese brand, entered the Nepali market in November 2024 and has already sold 260 units. Its lineup includes the entry-level T03 hatchback at Rs2.79 million, the B10 sedan at Rs4.99 million, and the C10 SUV, offered at a discounted Rs6.5 million during the show. The B10, priced under Rs6 million, boasts a 460km range on a single charge.

Two-wheeler EVs are also attracting strong interest.

Indian brand Ather launched the Rizta S family scooter, capable of carrying four people, with a 125km range, live location sharing, and an eight-year battery warranty. Prices start at Rs383,500. “We booked over 80 scooters in three days,” said Nisaj Maharjan from Vaidya Energy, Ather’s official dealer.

Chinese brand NIU also made a splash, unveiling the RQi electric bike at Rs1 million and the FQi 300 scooter at Rs385,000. “Within an hour of the RQi launch, we had 18 bookings,” said Manoj Thapa Magar of Eco Infinity.

By the end of the day, Rauniyar had visited nearly every stall. He was impressed but not yet ready to commit. “Most EVs have similar technology, even their batteries, just with different features,” he said. “I haven’t made up my mind yet.”

13.12°C Kathmandu

13.12°C Kathmandu