Money

Conflict threatens Nepal’s economy as remittance, inflation risks grow

As tensions in West Asia flare, experts warn of severe repercussions for Nepal’s remittance-driven economy.

Krishana Prasain

Nepal’s remittance-dependent and import-heavy economy may face a new series of shocks—particularly in the areas of labour market and inflation—due to escalating tensions in West Asia following Iran’s attack on Israel.

Reports say Israel came under heavy missile fire on Sunday, as Iran vowed to defend itself after what it described as unprecedented US airstrikes that, according to President Donald Trump, had “obliterated” key Iranian nuclear facilities.

Flight tracking service Flightradar24 showed that many airlines avoided large swathes of Middle Eastern airspace following the US strikes. Air traffic had already been rerouted in recent weeks due to rising military activity in the region.

Trump has warned Tehran of further devastating strikes if it fails to comply with calls for peace.

His decision to align more directly with Israel’s military efforts against Iran marks one of the most consequential foreign policy choices of his presidency, one fraught with global risks and uncertainty.

This surge in conflict has sparked concerns in Nepal, which relies heavily on remittance earnings to sustain household consumption and support its foreign exchange reserves.

According to the latest living standards survey, remittance income has helped raise average annual household spending by 66 percent over the past 12 years, from Rs75,902 in 2011 to Rs126,172 in 2023. Most rural households now depend on at least one family member working abroad.

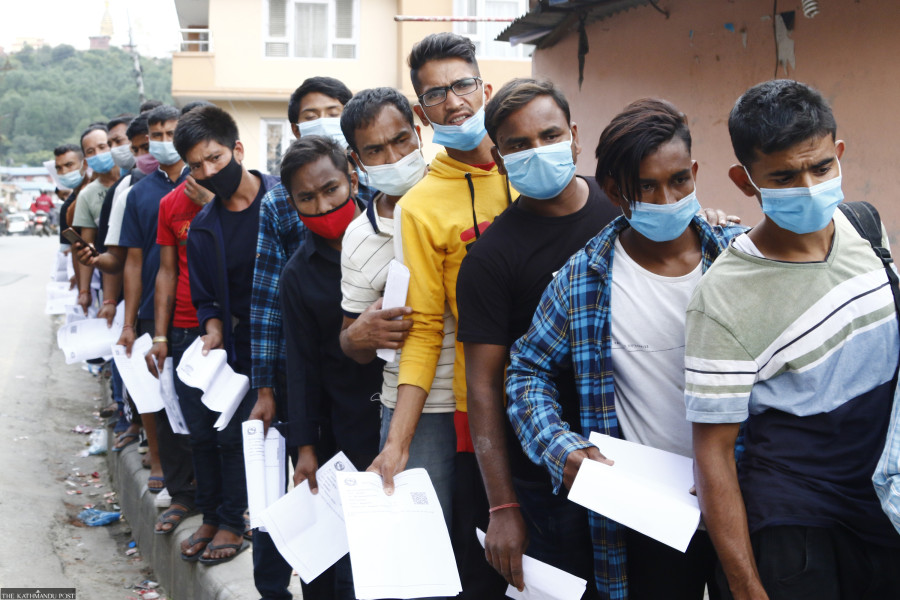

Data from the Nepal Rastra Bank shows remittance inflows reached a record $10.86 billion in the last fiscal year, pushing the country’s foreign currency reserves to historic highs. In the same year, 741,302 Nepalis left for foreign employment.

The United Arab Emirates remained the top destination, hosting 193,439 Nepali workers. It was followed by Saudi Arabia (141,502), Qatar (134,671), Kuwait (40,368), Bahrain (9,807), Oman (5,910) and Jordan (2,203). Israel employed 1,004 Nepali workers during the period.

Experts say a worsening conflict in West Asia—home to nearly half of all Nepali migrant workers—could have significant repercussions for Nepal and urge the government to prepare strategic responses to geopolitical shocks.

“Nepali workers in Israel contributed to our economy through remittances and helped lift household living standards by reducing poverty. All of this is now under threat,” said Ganesh Gurung, a migration expert.

“Israel is now at war not just with Palestine, but directly with Iran and indirectly with Lebanon,” Gurung said. “Migrant departures to Israel have been halted. If the war escalates, many Nepalis may be forced to return, losing their jobs. This would abruptly cut off remittance income, which was setting new records,” he warned.

Families that rely solely on remittances to survive could face extreme hardship, he added.

Gurung noted that Israel’s economy is already under severe stress due to its prolonged conflict with Palestine, and now Iran and Lebanon. “Its manufacturing sector is suffering, tax revenues are declining, and a large portion of the country’s income is redirected to military spending. That has directly affected job creation,” he said.

Economists also warn that conflict in oil-producing nations often leads to higher inflation worldwide, including in Nepal.

“The Israel-Iran war will have a multifaceted impact on Nepal’s economy,” said Chandramani Adhikari, an economist. “Global political alignments are shifting—China and Russia on one side, the Arab world on another, and the US-Israel bloc on the third. This deepens global uncertainty and threatens the stability of the global political economy.”

Adhikari said Nepal’s foreign direct investment, remittance flows, trade, and price stability could all be affected. “We are looking at a possible economic stagnation. Joblessness may rise, purchasing power may fall, and we may miss our economic growth targets.”

The government has already issued a travel advisory for Nepalis working in or returning from Israel.

Nepal’s consumer price inflation fell to 2.77 percent in mid-May 2025—the lowest in more than four years—thanks largely to moderating inflation in India.

But Adhikari warned that this downward trend may not last.

“Oil prices have already started rising. That will raise transport and production costs,” he said. “The US dollar is also strengthening, which means Nepal will pay more for imports.”

Adhikari recalled that during the 2008 global financial crisis, Nepal was relatively insulated due to its limited integration with global markets. “Today, we import 70 percent of what we consume. That makes us extremely vulnerable to global disruptions,” he said.

Foreign aid may also decline, as donor countries shift financial resources to manage war-related spending, he added.

9.61°C Kathmandu

9.61°C Kathmandu