Money

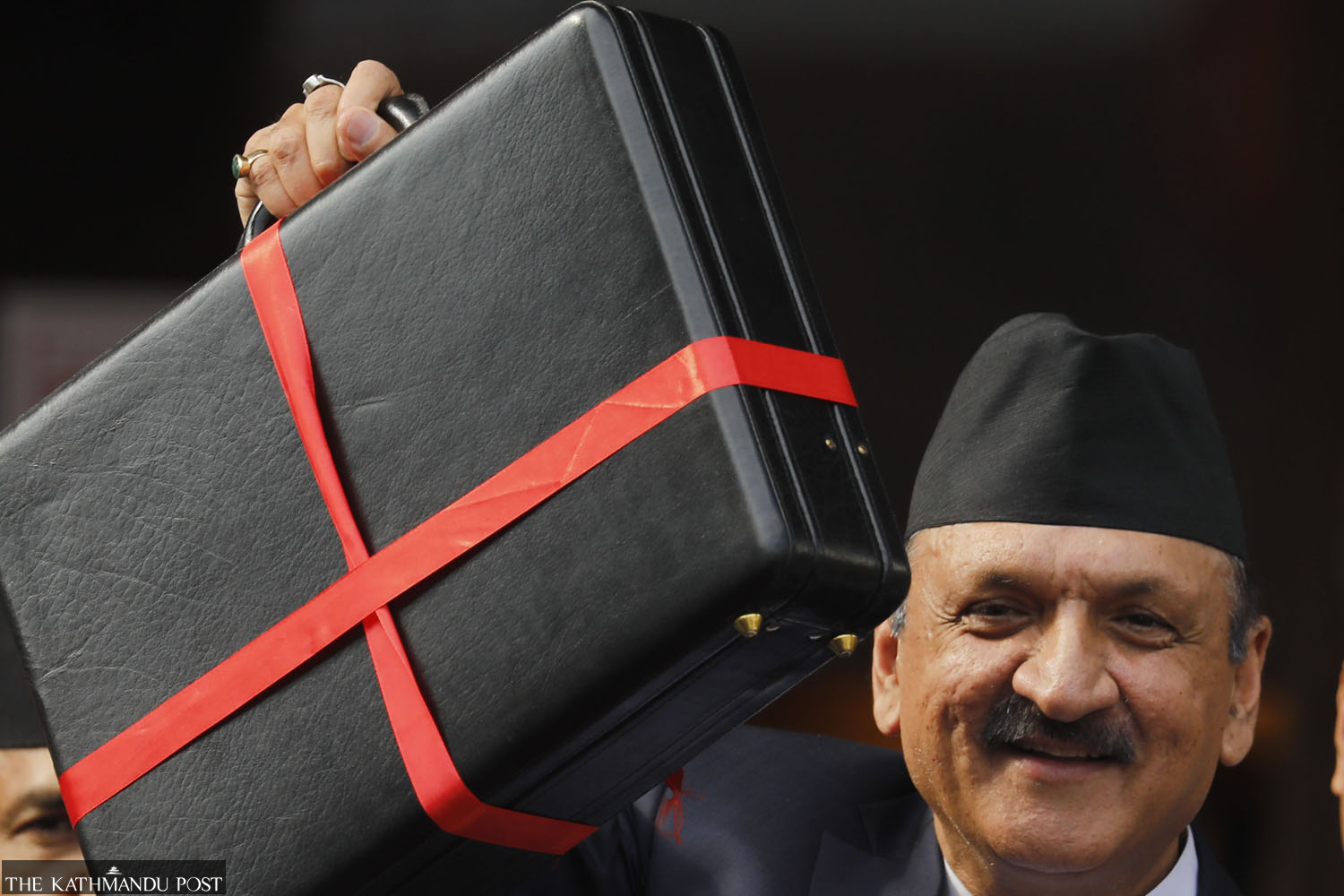

Nepal unveils Rs1.75 trillion financial plan for fiscal 2023-24

The government has targeted a growth rate of 6 percent and aims to keep inflation within 6.5 percent.

Sangam Prasain & Prithvi Man Shrestha

Nepal's economy has run into money problems for the first time in nearly six decades, and the coalition government is struggling to fix them.

The country was officially in a recession until the second quarter of the current fiscal year, with the annual economic growth rate projected to slow down to 1.86 percent as a result.

This adds to the existing pressure on the government that needs to make tough decisions to boost private sector confidence and consumer spending.

Amid the ongoing slowdown, the government on Monday presented its annual financial plan worth Rs1.75 trillion for the next fiscal year 2023-24 beginning mid-July.

The budget size for the next fiscal year is 2.37 percent smaller than the unrevised budget of the current fiscal year.

The government has allocated Rs1.14 trillion or 65.2 percent of the total budget for recurrent spending, which consists of regular expenses of salaries and allowances.

It has set aside Rs302 billion or 17.25 percent of the budget for capital spending, to build projects and critical infrastructures.

Similarly, the government has earmarked Rs307 billion, or 17.55 percent of the total budget, for financing.

According to Finance Minister Dr Prakash Sharan Mahat, the government will raise Rs1.24 trillion in revenues, Rs49.94 billion in foreign grants, Rs212 billion in external loans and Rs240 billion in internal loans.

The government has targeted a growth rate of 6 percent for the next fiscal year. It also aims to keep inflation within 6.5 percent in the next fiscal year.

Economists say the budget has many positive sides, but it does not address the core problem—the economic slowdown. The collapse in tax revenues is one of the major challenges that policymakers confronted this fiscal year.

“The government has not acknowledged that the country is in crisis and failed to address pressing problems,” said economist Pushkar Bajracharya. “If the ongoing crisis is not dealt with on time, it could push the country to the brink.”

Thousands of youths are forced to leave the country in search of jobs with departures estimated to reach 800,000 by the end of this fiscal year. Students too are leaving the country in droves for higher studies.

Insiders say that entrepreneurs have shuttered their shops and are seeking overseas jobs. The private sector—including the media industry, manufacturing, construction, wholesale and retail—is expected to see a contraction in the current fiscal year.

A series of events ranging from political paralysis and exploding inflation to growing corruption is pushing Nepal into a full-blown crisis.

The country's economy has long been characterised by an abysmally corrupt set of policies designed to provide subsidies to the elite while neglecting the vast majority of the population. This trend has continued, insiders say.

“Budget funds have been scattered on frivolous programmes. This will be counter-productive,” said Bajracharya.

He says the budget is expansionary and keeping inflation at 6.5 percent is a lofty dream. Inflation is the common enemy of the ordinary people. “As in past years, the budget will be revised during the mid-term review as the government has no capacity to spend.”

But he praised some programmes in agriculture and infrastructure as being good.

“The budget has addressed the difficulties of the private sector to some extent, but it won’t boost its morale as Nepal is always beset with political uncertainty.”

The finance minister, who has long been talking about boosting the morale of the private sector amid the economic downturn, has announced a number of measures to promote domestic production and employment.

The government will launch the National Production and Employment Promotion Programme at the local level with a focus on the commercialisation of agriculture, promotion of small and micro enterprises and development of information technology and tourism.

The Prime Minister Nepali Production and Consumption Growth Programme has also been announced to promote micro to medium-scale enterprises in agriculture, garment, footwear and pharmaceuticals.

Satish Kumar More, immediate past president of the Confederation of Nepalese Industries, says the budget's endorsement of its concept of ‘Make in Nepal’ is welcome as it is essential for the country’s industrialisation.

“If the scheme is implemented as per its spirit, the country’s economy could see some vibrancy,” he said.

Chandra Prasad Dhakal, president of the Federation of Nepalese Chambers of Commerce and Industry, Nepal’s apex private sector body, said the budget talks about boosting the confidence of the private sector several times, which is encouraging.

Manufacturing, trading and construction are some major sectors that were expected to see a contraction this fiscal year leading to a slump in economic production.

“The budget talks about only implementing projects which are ready to go, and the announcement that it would promote local manufacturing is welcome,” he said. “But the question is how the announcements are translated into action.”

As factories are not relocating to the Special Economic Zones in expected numbers, the government has lowered the export quota requirement to attract firms to the only SEZ that is currently operational.

The government has vowed to simplify the registration process for new enterprises. A company can now be set up even with an authorised capital of Rs100.

But industrialists say that more than the capital requirement, the complex paperwork and the need to run around from one office to another is the main problem as the one-stop service centre has not been much effective.

They say that more than opening a company, shutting it down is the more difficult part, and this has been a big hurdle that discourages investments in Nepal.

The budget statement has announced removing the threshold for foreign investment in the information technology sector, and said foreign investors would not be required to obtain approval to reinvest their earnings in Nepal.

FNCCI President Dhakal said these were among the recommendations made by the private sector to the government.

The budget has heavily prioritised the agriculture sector. As much as Rs30 billion has been set aside to subsidise chemical fertilisers.

Even though the government announced a number of austerity measures, the long-term liability created by the previous government will continue to drain state resources, experts said.

The finance minister announced that 20 unnecessary government agencies would be shut down to cut costs.

According to the budget statement, there will be no procurement of new vehicles by the government, no construction of new buildings except the most essential ones, no foreign trips except the essential ones, and cash instead of fuel will be provided to public officials who are entitled to receive fuel allowances.

Even though the government had announced cutting recurrent expenditure by 20 percent through austerity measures for the current fiscal year, there is no clarity on how much spending was reduced due to these measures.

The previous government’s decision to hike the salaries of government employees by 15 percent, which also led to a rise in pension payments, and lower the age limit for elderly allowances contributed to a massive rise in recurrent expenditure.

According to the Department of National ID and Civil Registration, the number of beneficiaries receiving elderly allowances had increased by 295,281 as of mid-April this fiscal year after the age limit was lowered. This has led to a rise in payments by over Rs14 billion, and they will rise further by the end of the current fiscal year, experts said.

To ensure air safety, the finance minister said that the Civil Aviation Authority of Nepal would be split into two entities—regulator and service provider. This announcement has been made in the last two budget statements too, but it has never been implemented.

Experts say that the failure to implement the announcements made in the budget statement is an example of bad governance.

The government will expand the social security coverage by implementing what the Nepali Congress election manifesto called Kokh Dekhi Sok Samma (From womb to death) scheme. The budget for social security programmes has been increased to Rs157 billion.

Talking points

39 percent tax on those with annual incomes above Rs 5 million

Construction of Nijgadh international airport after determining its investment modality

Creating an environment for sustainable extraction and export of stones and aggregates

Carrying out a feasibility study on cannabis farming for medicinal purposes

Upgradation of eight airports

Revival of the controversial Constituency Development Fund

Ensuring the entry of NRNs into Nepal’s capital markets

Addition of 900MW electricity to national grid

Salaries of civil servants, old-age pensions not increased

Ban on the use of plastic as packaging material for tobacco products

16.12°C Kathmandu

16.12°C Kathmandu