Money

Digital payment will enable Indians to spend more in Nepal

Fonepay Payment Service partnered with India’s NPCI International Payments to launch the cross-border payment service using quick response (QR) codes. Indian visitors can now scan the Fonepay QR code using India’s digital payment app–PhonePe.

Krishana Prasain

Starting March 1, Indians have been allowed to make payments through their mobile phone marking a milestone in cross-border digital payment between Nepal and India. Fonepay Payment Service partnered with India’s NPCI International Payments to launch the cross-border payment service using quick response (QR) codes. Indian visitors can now scan the Fonepay QR code using India’s digital payment app–PhonePe. The Post’s Krishana Prasain sat with Ritesh Pai, CEO of International Payments, PhonePe, during his brief visit to Kathmandu, to talk about PhonePe's entry into Nepal, its plan and strategies. Excerpts:

Tell us about PhonePe.

PhonePe is an Indian digital payments and financial services company headquartered in Bengaluru, India. The PhonePe app, based on the Unified Payments Interface (UPI), started its service in 2016. Today, we are seeing billions of transactions happening in India. It was one of the Indian government's initiatives to take UPI to an international level. The NPCI, the domestic network in India, is creating an enabler by adding new geography to promote the UPI. While the network will do what it is supposed to play the role of enabler or facilitator, entities like us with large app user bases can drive consumption. So, it is the thought process that started from the government for making India’s homegrown financial instrument to be accepted internationally. With the blessing from the regulator and the network, we entered the Nepali market. PhonePe does a transaction of IRs250 million daily. We do more than a million transactions hourly and this is growing.

Why did PhonePe choose the Nepali market?

As I said, this was part of the overall thought process where UPI had to go global. So, there are multiple geographies that NPCI is going and enabling. As of now, we are in the UAE, Singapore and Nepal. The decision regarding which markets to enable, among others, will be something that NPCI decides. We just tailgate them immediately, so that once that particular geography is enabled as in the merchants, they are ready to accept the UPI apps from a payment perspective and we immediately come and start the operation. This is because there is not much technical development that we have to do as our existing app, once activated for international transactions, can start working. It is just the on-ground awareness that we need to create like branding and marketing. So, when an Indian app user comes to Nepal, they can relate and know that the UPI apps are being accepted here. The merchant is also aware that this is a new financial instrument that can be accepted while purchasing goods and services.

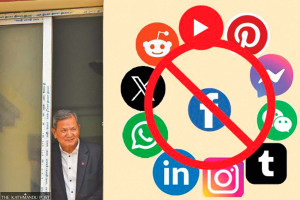

Do you have any marketing plans in Nepal and India?

In India, we have already started to make the consumer aware. As PhonePe has a 530 million user base, the in-app notification itself can help to reach the users in one go. Apart from that, we started a major outdoor activity on Thursday where we are doing a lot of branding exercises in very high convergence areas like airports and some other strategic locations. We are doing a lot of promotion on the digital media. Social media is something that we are leveraging very well. In Nepal, we will do both. In terms of outdoor, a lot of decals will happen at the merchant locations which will consist of social, digital and brand strategies to create awareness. This will be a continuous exercise. We may have to come up with different strategies for different locations as what works in a city like Kathmandu may not be true in the other border areas. So border areas may require a slightly more grounded kind of communication or a slightly different approach, which will be more human-to-human than social or digital media. We are exploring and just figuring out how to do it.

How do you observe Nepal's digital payment ecosystem?

The very fact that we are sitting and discussing means Nepal has achieved something. I think the initial building blocks are there. Of course, there is more to do. Even at PhonePe, we feel there is more to do. We are in discussion with various stakeholders in Nepal as there are a lot of things which are built today that are slightly proprietary, or owned privately. Maybe going the interoperable way or coming up with a very good public digital infrastructure can help many players come and leverage that ecosystem.

Otherwise, today, each one trying and creating his network at some point will start bleeding as it becomes too much when it comes to managing, growing and investing in these infrastructures. But if a common platform is created where everyone can come and take part, then its use becomes slightly easier as compared to building everything from the ground. So, maybe, that is a shift I see.

Tell us about PhonePe's partnership with the Fonepay network. What are the benefits for the customers?

As far as the partnership with Fonepay is concerned, I think it all emanated from the fact that NPCI came and enabled that geography for us. If I have to drive consumption, then I have to engage all the stakeholders that matter. From an Indian customer perspective, I think some of the pain points are very well known such as the limitation to the quantity of cash and the denomination of cash that an Indian traveller can carry. Similarly, there are issues like non-acceptance of some of the debit and credit cards by Indian banks as they can't be used for paying in Nepali currency. There is no better situation than UPI to come in as when someone carries cash, they are always under that mental block when it comes to spending. But when it comes to digital with access to the entire balance that one has in their bank account, you tend to spend more because you are at peace, you are not even logistically worried about where to keep cash or the fear of it being stolen.

In India, people are so well-versed with digital that I think we end up using cash for really very few things. I don't even remember the last time I used cash. Maybe I used it the other day to pay for the taxi fare here in Nepal. But otherwise like paying my maids, drivers, and even the milkman–everything is happening digitally. So a lot of non-face-to-face transactions do happen. So, I think Indians will benefit definitely because Nepal is an absolutely beautiful use case where there are already a lot of frictions that exist which I think UPI can eliminate. I think merchants will also see value because a certain segment of customers who otherwise would never have come to him from a transactions perspective can now come because he is accepting a UPI digital payment ecosystem.

In the longer run, a lot of these merchants will benefit from digital transaction acceptance as it helps leave a digital footprint as far as their financial activities are concerned. This graduates them to consume a lot many more financial services, which can help them grow their business. Tomorrow if there is an electronic trail of all his financial transactions, his creditworthiness also improves. Tomorrow if financial institutions want to give him some lending purely by looking at the digital trail of his financial transactions, they can take a more judicious call around his creditworthiness and lending.

Please share your success story.

It has been a long journey. I think we started with baby steps. We want to build solutions which are very interoperable rather than proprietary because many other startups in India who started almost at a similar time got into their proprietary wallets, and built their merchant ecosystem, among others. We firmly believe interoperable network is the way to go. There are multiple benefits to be derived from that and this. We started with peer-to-peer (P2P) and graduated to other payments like bill payments, top-ups, and recharge, among others. In the management part, we started doing the investments and insurance. We are now in the growth phase where we are doing lending and stock markets. Today, we have almost eight licenses across six regulators which means we are regulated as well. We know the importance of complying with the regulations. At the same time, we are diversifying into various other businesses.

23.12°C Kathmandu

23.12°C Kathmandu