Money

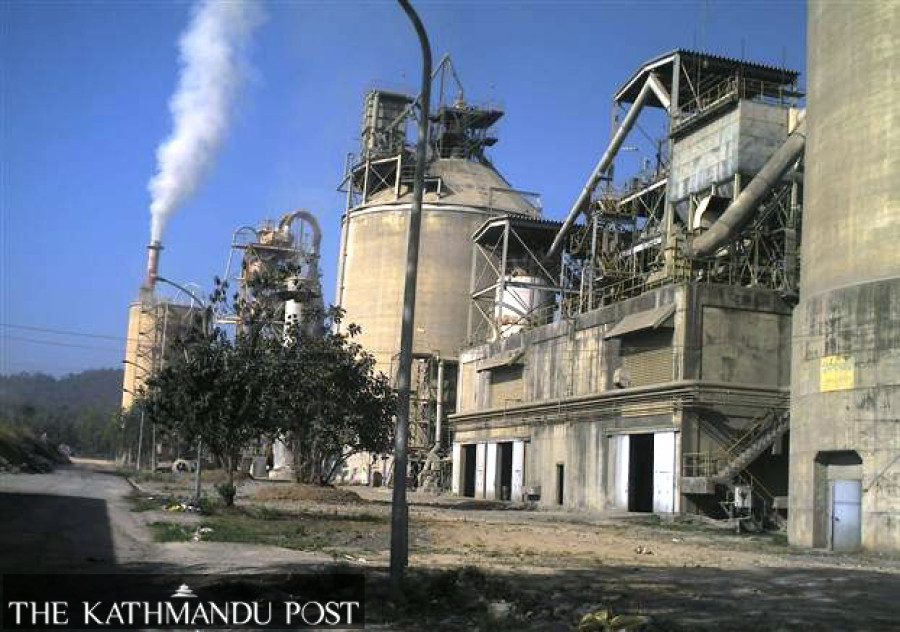

Udayapur Cement embarks on Rs500-million modernisation plan

Following the upgradation, the state-owned factory will churn out 1,100 tonnes of cement daily compared to the current 800 tonnes.

Dilliram Khatiwada

State-owned Udayapur Cement Industry has embarked on a Rs500 million modernisation plan in a bid to elbow into a market dominated by the private sector. The factory located in eastern Nepal plans to revamp itself to boost output, and be better placed to compete in the money-making sector where private manufacturers have an ever growing presence.

Udayapur Cement said it would replace all the old machinery and technology to keep up with the new entrants. The plant was installed 33 years ago, and most of the technology has become obsolete while private cement factories have been using the latest equipment.

Following the upgradation, the government factory will churn out 1,100 tonnes of cement daily compared to the current 800 tonnes.

“The work of installing modern machines has started,” said Gopi Krishna Neupane, general manager of Udayapur Cement. “We are still operating age-old machines. As a result, the cement production plant is not able to produce clinker as per demand.”

Neupane added, "Our clinker production capacity is declining. We are targeting to double production after installing the latest technology.” The company is spending Rs500 million on new machinery and technology.

Nepal launched a massive reconstruction scheme following the devastation left behind by the April 2015 earthquake, and demand for cement shot up. Several cement factories sprouted to cash in on the building boom, and some of those were set up with foreign direct investment.

"We don’t have any alternative. There is a need to upgrade to compete with other cement factories," said Neupane. “We have formulated a new plan.”

Udayapur Cement will replace the 20-metre shell of the rotary kiln mill by the end of February, for which it has already signed a Rs68 million contract.

The process of hiring specialists has been completed to increase the existing calibration from 30 percent to 90 percent for the installation of a reinforcement suspension preheater system.

Neupane said that the company's board of directors had passed a Rs500 million budget to complete these two new projects within the current fiscal year.

He said that out of the Rs500 million, Rs100 million would come from its internal resources and Rs400 million would be a loan from the government with a three-year repayment deadline.

The Ministry of Industry, Commerce and Supplies has written to the Ministry of Finance to release the loan.

The factory currently has a capacity to produce 800 tonnes of cement daily. As per the company, after installing new technology and machines, the existing plant will produce 1,100 tonnes of cement daily.

The daily production of 1,100 tonnes of cement will mean annual sales worth Rs1.10 billion.

“Since the machines are old, we face frequent problems,” said Laxman Pokharel, spokesperson for the company. “We have been spending millions of rupees annually to repair the system.”

Nepal is estimated to require 25.88 million tonnes of cement annually by 2024-25 due to an investment push in mega infrastructure projects, a study on the socio-economic impact of foreign direct investment in the country's cement industry published by Nepal Rastra Bank shows.

In 2019, the Ministry of Industry, Commerce and Supplies had projected that the installed capacity of Nepal's cement industry could increase to 20 million tonnes by the end of 2023-24, from 15 million tonnes currently.

According to the report, the actual annual production, before the Covid-19 pandemic, hovers around 7.5 million tonnes although the installed capacity is 15 million tonnes.

Domestic consumption amounts to 9.05 million tonnes, and the shortfall is covered by imports. In 2018-19, according to the report, 1.56 million tonnes of cement was imported from India.

The report said that most of the mega projects in Nepal use cements imported from India due to issues of certification, quality consistency and inability to provide bulk supply.

The survey was conducted in seven cement factories—three run by foreign investors, two state-owned and two private sector-run factories—out of the 55 plants currently in operation in the country.

Foreign direct investment in the cement industry in Nepal stands at Rs56.97 billion. Two new foreign-funded factories are under construction, according to the survey report. These three foreign investment cement factories account for 20.31 percent of the total installed capacity of the cement industry.

Nepali investors have injected Rs122.33 billion in the cement industry.

20.12°C Kathmandu

20.12°C Kathmandu