Money

We’ve been in Nepal for 35 years—EVs are the next

In a candid conversation, Mahindra’s international operations head Sachin Arolkar discusses the company’s EV launch in Nepal, its strategy to challenge Chinese dominance, and why the brand sees a long-term future in the Himalayan market.

Post Report

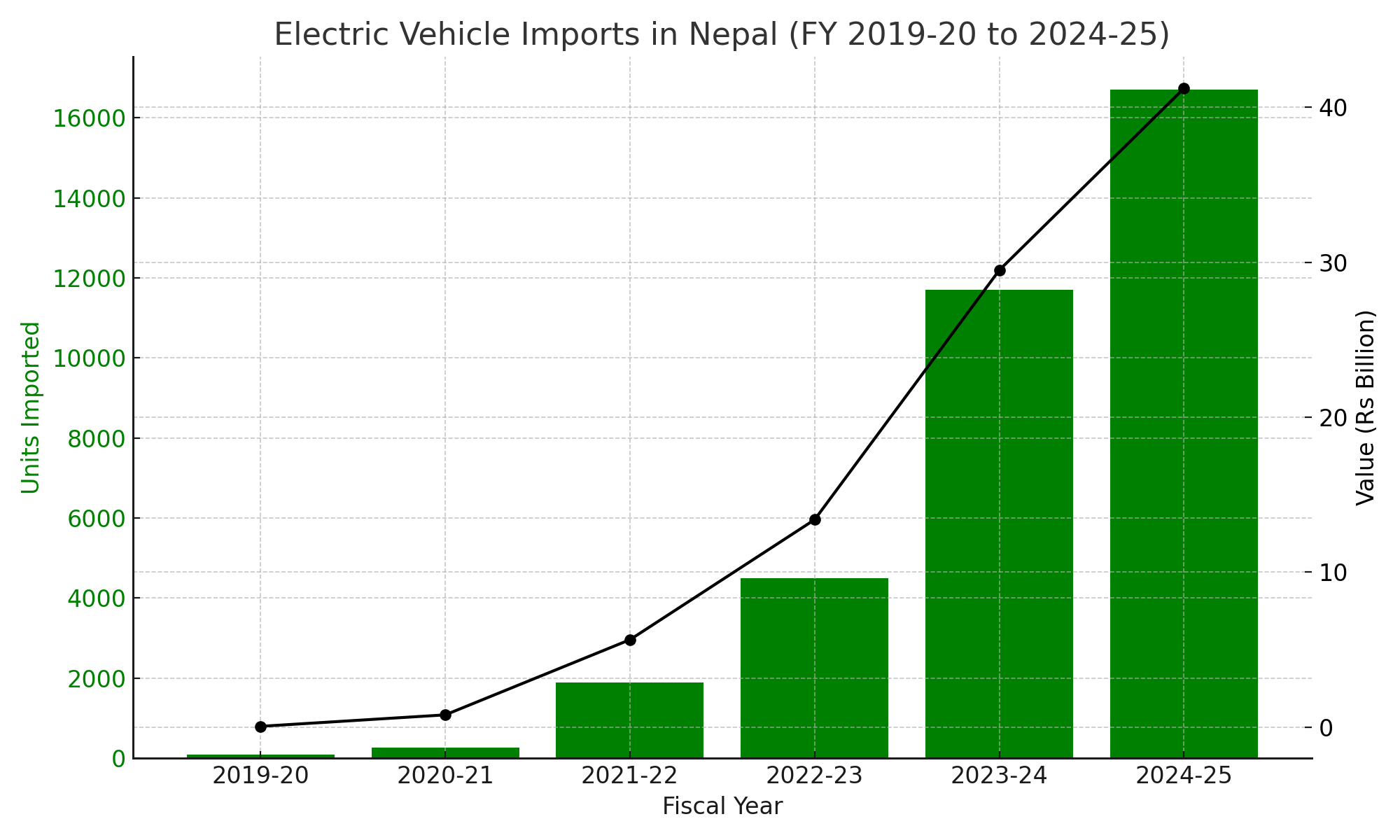

Electric vehicle (EV) imports have surged in Nepal, accounting for 73 percent of all four-wheeler passenger vehicle imports in the last fiscal year ending July 16. This growth rate is one of the highest globally. Tapping into this momentum, Indian auto manufacturer Mahindra is preparing to launch its new line of EVs and compact SUVs during the Nepal Mobility Show 2025, organised by the Nepal Automobiles Importers and Manufacturers Association (NAIMA) from Wednesday in Kathmandu. Nepal’s rapid shift towards electric mobility is not just an environmental or economic development—it’s also becoming a stage for geopolitical influence. As the country increasingly pivots to clean energy vehicles, India and China are vying for dominance in this growing sector.

In recent years, Chinese EV brands such as BYD, MG, and Neta have surged ahead in the Nepali market, offering a mix of affordability, high-tech features, and swift deployment. Their growing footprint reflects China’s broader economic engagement in Nepal, from infrastructure to manufacturing, often supported by favourable financing.

India, on the other hand, has longstanding historical, cultural, and economic ties with Nepal. While Indian automakers were once dominant in Nepal's internal combustion engine (ICE) market, they’ve lagged in the EV transition. Mahindra’s entry into Nepal’s EV market signals a more assertive posture to reclaim influence in a strategically vital neighbour.

The Post caught up with Sachin Arolkar, head of international operations at Mahindra Automotive, who is in Kathmandu for the launch. He discussed Nepal’s growing EV appetite, Mahindra’s strategy to stay competitive, and how the brand works with its longtime partner Agni Group to deliver long-term value to Nepali customers. Excerpts:

Nepal saw a dramatic surge in EV imports last fiscal year, accounting for 73 percent of all four-wheeled passenger vehicle imports. How does this trend align with Mahindra’s EV strategy in the country?

The pace of EV adoption in Nepal is truly impressive, and we think this is the right moment for Mahindra to make a comprehensive entry into the EV space. The Nepali market is already mature in terms of EV awareness, and we believe our product offerings are an excellent fit for these consumers' expectations.

Chinese EV brands currently dominate Nepal’s electric car market. How does Mahindra plan to position its EVs, especially the XUV line, to compete?

Our foundation is the Mahindra brand itself. Through our partnership with Agni Group, we've been present in Nepal for over 35 years. People here already know our pickups and SUVs, and that familiarity builds trust. We believe that purchasing a vehicle is just the beginning—the real value lies in the ownership experience. Over the years, we’ve fine-tuned our support infrastructure to deliver that. Whether it’s our compact SUV or the EVs we’re introducing, they all carry the Mahindra DNA. The competition, particularly from Chinese brands, has helped develop the market by pushing for EV infrastructure and raising customer expectations. But we’re confident that Mahindra can stand out through our combination of trusted after-sales service, brand heritage, and product quality.

What specific efforts is Mahindra making to enhance customer experience in Nepal?

It starts with design and build. Our vehicles are styled to stand out and feature top-tier specs. Once customers get behind the wheel, they’ll experience the smooth drive, premium features, and strong performance. On the ownership side, our longstanding partnership with Agni ensures extensive after-sales service, parts availability, and customer support. We’re also here for the long run. With over three decades in Nepal already, customers can rest assured that we’ll be around to handle any future concerns—whether it’s about batteries, resale value, or maintenance.

Which Mahindra model is the most popular in Nepal, and why?

The Mahindra Scorpio SUV is undoubtedly our flagship product here. It’s rugged, has high ground clearance, and is built for the terrain in Nepal. It represents what Mahindra stands for—durability, performance, and utility. We’ve now infused that same DNA into our electric SUVs. Our EVs match that performance while adding modern styling and technology. Our upcoming EVs—the BE6 and the XUV—will cater to different segments. The BE6 targets younger, self-driven customers looking for standout design, while the XUV offers comfort and premium features.

What market share does Mahindra currently hold in Nepal? What are your targets for the coming years?

We command over 70 percent of the market in the commercial vehicle segment. In the fossil-fuel SUV category, particularly the Scorpio segment, we hold over 30 percent. We haven’t yet entered the compact SUV segment here, but that changes with the launch of our XUV 3XO. The 3XO has been very successful in India and South Africa. We just launched it in Australia this July, and now it's time for Nepal. This product will help us capture the compact SUV segment. In the EV space, our goal is to be among the top three brands in Nepal, and we’re working hard to make that a reality.

What specific preferences have you observed among Nepali consumers, and how are your new products tailored to meet them?

Nepali customers typically look for high ground clearance due to the country’s terrain, and all our vehicles—including EVs—are designed with that in mind. In terms of driving range, the infrastructure is now robust enough that people prefer convenience over very-long-range EVs. We’ll be offering a competitive range and top-tier battery warranties to address customer concerns. We’ve also spent time extensively testing our vehicles here in Nepal. For the past two months, our test units have been driven nationwide to gather insights and fine-tune the product to local conditions. We believe no other brand launching EVs here has done this level of local validation.

Mahindra’s partnership with Agni Group spans 35 years. How critical is this relationship in your Nepal strategy?

This partnership is central to our success. Much of what Mahindra is in Nepal today is because of Agni's work—whether it’s understanding customer needs, building infrastructure, or ensuring parts and service availability. Agni’s vision and operational excellence have played a major role in shaping Mahindra’s footprint here. We consider this a long-term, strategic partnership.

Are there any logistical or regulatory hurdles Mahindra faces in transporting EVs from India to Nepal?

The challenges are more about the nature of EVs themselves—battery handling, certification, and logistics—than Nepal-specific hurdles. We’ve already gained experience transporting EVs within India, and we’re applying those lessons to cross-border operations. Regarding certification and customs requirements in Nepal, we’ve done our homework. We understand the processes and don’t foresee any major obstacles in complying with local regulations.

12.12°C Kathmandu

12.12°C Kathmandu