Money

Central bank cuts interest rates to boost credit, investment

Policy rate slashed to 4.5 percent as bank targets 13 percent money supply growth and 12 percent credit expansion.

Sangam Prasain & Krishana Prasain

Nepal’s central bank on Friday slashed its benchmark interest rate from 5 percent to 4.5 percent in a bid to boost credit growth and investment as the country’s foreign exchange reserves hit a record high.

The rate cut makes it cheaper for commercial banks to borrow from the central bank, potentially prompting them to reduce lending rates for businesses and consumers. This, in turn, will support investment and spending.

Economists and analysts call it a “liberal monetary policy,” a strategy the central bank employs to stimulate economic activities by increasing the money supply and lowering interest rates.

Nepal’s foreign exchange reserves reached an all-time high of Rs2.56 trillion in mid-June. Nepal Rastra Bank (NRB) held Rs2.27 trillion, while the rest was with other banks and financial institutions.

Unveiling the monetary policy for the fiscal year 2025-26, NRB Governor Biswo Nath Poudel said the central bank would steer liquidity and foreign exchange management to meet the targeted 6 percent economic growth.

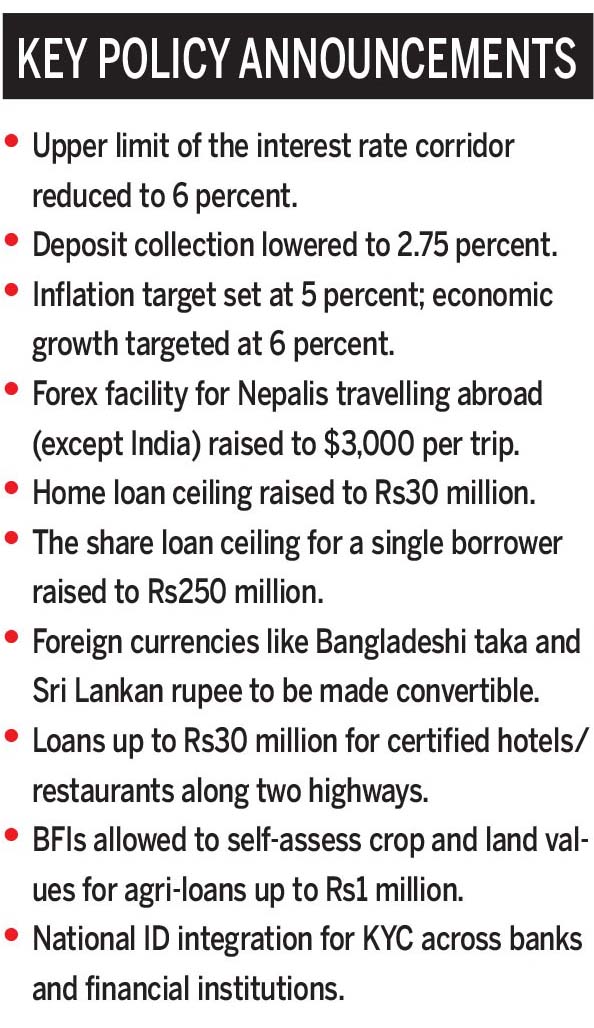

The monetary policy also aims to keep inflation around 5 percent. As part of this, the upper boundary of the interest rate corridor—the bank rate—has been reduced from 6.5 percent to 6 percent, while the deposit collection rate, the lower boundary, has been lowered from 3 percent to 2.75 percent.

Credit to the private sector is projected to rise by 12 percent, and broad money supply is expected to expand by 13 percent in the new fiscal year.

Although the economy is showing signs of recovery, banks are under pressure due to rising non-performing loans (NPLs) and the accumulation of non-banking assets. The number of blacklisted borrowers is also growing.

“Increasing lending capacity, improving credit management, and strengthening capital adequacy are now critical,” said Governor Poudel. “We will prioritise the establishment of asset management companies to tackle the problem of rising NPL.”

He added that the current excess liquidity and lower interest rates present a timely opportunity to mobilise funds for growth.

Santosh Koirala, president of the Nepal Bankers’ Association and CEO of Machhapuchchhre Bank, welcomed the new policy. “It’s positive and flexible, and includes nearly all the suggestions from the banking sector. It will help keep the economic momentum intact.”

He noted that the policy eases lending in sectors like land, housing, and equity markets while introducing new directives for agriculture lending. “Its impact will be clearer once the implementation guidelines are out. Promotion of digital and neo-banking is another progressive step.”

The new policy raises the housing loan ceiling from Rs20 million to Rs30 million. For first-time buyers or home builders, the loan-to-value ratio may increase to 80 percent; for others, the cap remains at 70 percent.

Banks and financial institutions (BFIs) can now self-assess the value of crops, arable land, and agricultural structures to issue loans of up to Rs1 million. These loans—aimed at boosting rural credit access—will require minimal provisioning during the grace period.

Additionally, loans extended for agriculture-related activities like crop farming, livestock, poultry, and aquaculture must be aligned with the production cycle and will have improved monitoring mechanisms.

According to the policy, loans disbursed for producing crop varieties recommended by the Nepal Agricultural Research Council will also get regulatory facilitation.

In hospitality, the policy offers up to Rs30 million credit for hotels and restaurants that have earned food hygiene certification from the Department of Food Technology and Quality Control.

These loans, targeting establishments along postal and mid-hill highways, will qualify as SME (small and medium enterprises) loans and fall under priority sector lending. They can carry a maximum premium of 2 percentage points above the base rate.

In earthquake-hit districts like Jajarkot and Rukum, BFIs may restructure or reschedule loans if borrowers apply and have paid at least 10 percent of the outstanding interest.

The single-borrower cap has been raised for margin-type share loans from Rs150 million to Rs250 million.

The policy introduces leniency in blacklisting practices, especially in cases of cheque dishonour, to help financially distressed borrowers.

Microfinance institutions’ ability to distribute more than 15 percent annual dividends (cash or bonus) will be reviewed to ensure better capital retention.

Loans of up to Rs300,000—whether collateralised or not—given to youths going abroad for employment will now be classified as deprived sector lending. For women, this threshold is set at Rs500,000.

To ease travel expenses, the foreign exchange facility for Nepali citizens travelling abroad, excluding India, has been raised from $2,500 to $3,000 per trip.

Nepal will gradually include more currencies—such as the Bangladeshi taka and Sri Lankan rupee—on its list of convertible currencies, in response to growing transaction volumes with those countries.

To enhance financial governance, the NRB plans to align regulatory practices with international norms and adopt a risk-based supervision approach. Banks will be held more accountable for loan decisions, and additional regulations will be gradually relaxed.

The government is also set to approve and implement the Second Financial Sector Strategy, which outlines long-term reforms for the financial system’s sustainable development.

The policy allows BFIs and financial service providers to use National ID cards for Know Your Customer (KYC) verification in what is a major digital initiative. Once customers update their information in one bank, the data will be accessible to other authorised institutions through a shared digital infrastructure.

This is expected to reduce paperwork, speed up banking processes, and improve service delivery.

Experts say the monetary policy takes a balanced and forward-looking approach to stimulate credit while preserving financial stability.

“The monetary policy seems liberal,” said Nara Bahadur Thapa, former Nepal Rastra Bank executive director. “It has prioritised lending for smallholders by making banks responsible,” said Thapa.

“However, this type of programme is ineffective without institutional management. Whether these provisions lead to the intended credit expansion and economic growth depends mainly on timely implementation and continued coordination between fiscal and monetary authorities.”

16.12°C Kathmandu

16.12°C Kathmandu