Money

Nepal downsizes budget as revenue collection plunges

Banning imports had the disastrous effect of strangling a key revenue stream, economists said.

Sangam Prasain

A months-long import ban on several products described as luxury items caused revenues to plunge so sharply that the government has been forced to slash the budget for lack of cash, officials said.

The government lifted the embargo after eight months in early December following pressure from the private sector and the International Monetary Fund, but by then it had left lasting repercussions on the economy.

On Sunday, the government announced it was trimming the annual budget by a whopping 13.59 percent, the largest cut on record, after realising that it would not be able to raise the required funding.

This translates to a reduction by a staggering Rs243.83 billion in the 2022-23 budget.

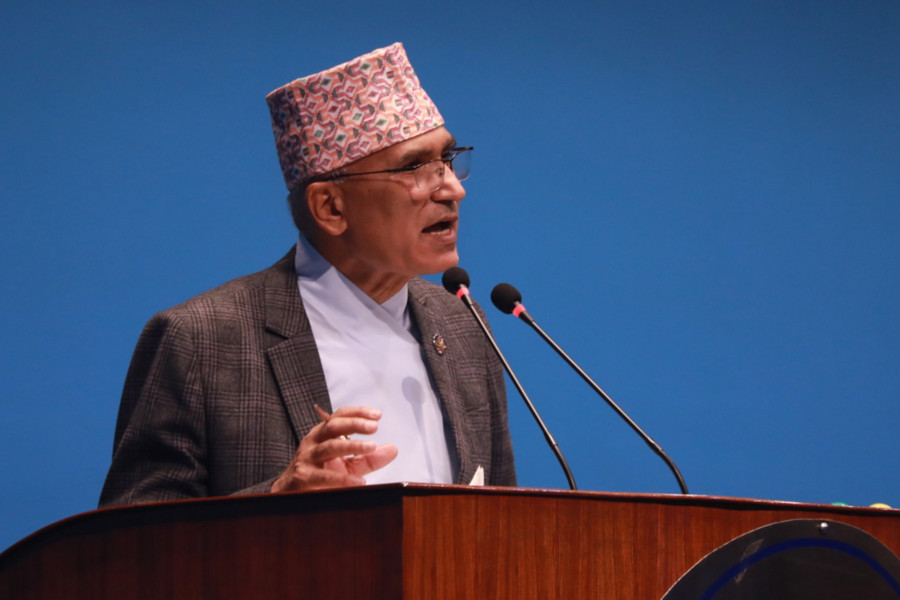

“For the first time since the fiscal year 1967-68, the country has witnessed a negative growth in revenue collection in the first six months of the fiscal year,” said Finance Minister Bishnu Paudel, presenting a mid-term review of the budget in Parliament on Sunday.

“The revised budget now amounts to Rs1,549.99 billion,” Paudel told lawmakers.

On May 29, the then finance minister Janardan Sharma had presented a budget of Rs1,793.83 billion, promising 8 percent growth.

Experts and economists said that the government should have imposed extra taxes on foreign goods if it had wanted to discourage them and conserve foreign exchange, but banning imports had the disastrous effect of strangling a key revenue stream.

“The import ban has hurt the economy,” said economist Jagadish Chandra Pokharel. “The government knew it wouldn't be able to achieve the revenue target, but it had no option.”

Insiders say that Sharma and Paudel always have a “rat and cat” story.

On May 29, 2021, the then finance minister Paudel presented a bloated budget of Rs1.64 trillion, which was 12 percent larger than the previous fiscal year, giving a semblance of government focus on the pandemic.

Then the political situation deteriorated with KP Sharma Oli’s tenure as prime minister cut short after three and a half years.

Sher Bahadur Deuba came back as the new prime minister on July 13, 2021.

Two months later on September 10, Finance Minister Sharma presented a new financial plan of Rs1.63 trillion for fiscal 2021-22, smaller than the previous budget presented by the Oli administration in May by nearly Rs15 billion.

Sharma had amended the existing budget through a replacement bill.

This is the fourth consecutive year that the country’s budget has been revised downward, and the first time that the budget has had to be slashed because of a fall in revenue, economists say.

“The government also knew that this year's budget implementation would be weak,” said Pokharel. The rate of budget expenditure has been low despite the general elections this fiscal year.

Trying to be populist by issuing a bloated budget and then revising it down after failing to spend has now become a habit, insiders say.

The Nepal government feared there would be a Sri Lankan-type syndrome, they say. Sri Lanka's economy started to disintegrate after its foreign exchange reserves were exhausted, so Nepal imposed an import ban to prevent a similar situation.

“Last year, there were concerns from some quarters that Nepal could become another Sri Lanka. But we don’t have such a situation now,” Prime Minister Pushpa Kamal Dahal said at a separate function in Kathmandu on Sunday. “There has been some improvement in the economy lately, but we are not sure whether that is sustainable.”

Last April, the government imposed import restrictions besides ordering importers to maintain a 100 percent margin amount to open a letter of credit.

The directive issued on April 26, 2021, embargoed 10 types of goods described as luxury items. They included, among other things, mobile sets worth over $600 and motorcycles of over 250cc capacity. Harsher restrictions followed, and mobile sets costing more than $300 and motorcycles with a capacity of more than 150cc were banned.

The mid-term review revealed that stopping imports to save foreign currency had led to low revenue collection, officials said.

Minister Paudel told lawmakers that taxes on the import of gasoline-powered vehicles were the key contributor to the nation’s treasury. Imports of petrol vehicles plunged by 91.7 percent, resulting in a drop in tax collection by 92.36 percent.

Imports of diesel vehicles fell by 33.65 percent, resulting in a drop in tax collection by 18.08 percent.

The import of MS billets, raw materials used in the manufacture of products like steel wire and rebar, went down by 71.8 percent, resulting in revenue loss to the government of 69 percent.

Similarly, restrictions on alcohol imports caused imports to plunge by 71.92 percent and revenue loss of 71.61 percent.

The finance minister said that the requirement to maintain a 100 percent margin amount to open a letter of credit also led to a decrease in the collection of import duty.

On the domestic front, government restrictions in the real estate business policy, basically enforced by banks, caused the government to suffer a revenue deficit of Rs5.29 billion.

The restriction on banks to issue loans to buy shares resulted in a loss of Rs6.90 billion in revenue to the government.

The review of the individual income tax rate resulted in revenue losses amounting to Rs9.36 billion.

Tax cuts announced to provide relief to Covid-hit businesses and drop in imports meant the government suffered revenue losses of Rs24 billion—Rs21.52 billion in income tax and Rs2.58 billion in value added tax.

The International Monetary Fund had questioned the wisdom of lengthening the import ban on certain products as it was hurting trade and the economy.

Economists too had warned that prolonging trade restrictions goes against the principles of a free market economy.

Deependra Bahadur Kshetry, former governor of Nepal Rastra Bank, said Nepal’s revenue was import-oriented, and any restriction on imports would directly hurt government revenue.

“The government’s poor capacity to implement projects on time is also the reason for downsizing the budget this year,” Kshetry said. “This year, the government changed, and with the change, government priorities too changed. This is another problem in a country like Nepal.”

The finance minister said the 8 percent economic growth target would not be achievable because the budget had been trimmed.

According to economists, the growth target was ambitious to begin with as the country was in the midst of a chemical fertiliser shortage, but the government said that election spending would boost the economy.

Campaign spending propels economic growth whenever elections are held, but strangely it did not happen in Nepal, they said.

A ban on the import of vehicles, alcohol, mobiles and other goods, a major source of revenue for the government, caused spending to shrink.

A big setback for the economy, according to industry insiders, was the slowdown in the real estate market which has traditionally boosted consumption.

Finance Minister Paudel said that farm output, mainly paddy, has seen growth while the tourism industry is in recovery.

“They are positive indicators of the economy, but the manufacturing sector has been operating below capacity resulting in slowed economic activity.”

In the first six months of the current fiscal year, the government raised revenue of Rs483.76 billion, which is 16 percent less compared to the same period of the last fiscal year, the Finance Ministry said.

In the current fiscal year, the government estimates that it will be able to spend Rs1,021.92 billion in the recurrent budget category, down from Rs1,183.23 billion, which is the spending on government salaries and state allowances.

The government’s recurrent expenditure stood at Rs455.12 billion in the first six months.

In the capital expenditure category, the government expects to spend Rs313.85 billion, down from Rs380.38 billion, based on the spending of the first six months of the current fiscal year, which is Rs53.45 billion.

In the financing category of the budget, the government plans to spend Rs214.21 billion, down from Rs230.21 billion, which is based on the spending of Rs67.76 billion in the first six months of the current fiscal year.

Minister Paudel said he had accorded priority to importing chemical fertilisers and funding national pride projects.

Answering questions raised by lawmakers, Paudel promised that even if the cost of fertilisers in the world market increases, there would be no shortage of funds to import the required quantity for Nepali farmers.

Nepal’s chemical fertiliser subsidy bill is likely to shoot up to a record Rs39 billion this fiscal year as import prices have swelled tremendously, officials said.

The government has earmarked Rs31 billion for the import of chemical fertilisers till February-end, Rs15 billion through the annual budget and Rs16 billion as source assurance.

The Ministry of Agriculture and Livestock Development has asked the Finance Ministry for another Rs7.73 billion to procure adequate stocks to prevent shortages during the paddy transplantation season in June.

Paudel said they had revised the revenue collection target for the current fiscal year to Rs1,244.75 billion, down from Rs1,403.14 billion.

Krishana Prasain and Pawan Pandey contributed reporting.

13.31°C Kathmandu

13.31°C Kathmandu