Money

Exports at all-time high of Rs200 billion last fiscal, but paltry compared to imports worth Rs1.92 trillion

Traders say export value of Nepali products rose due to global inflation, not because of growth in quantity shipped out.

Krishana Prasain

The value of Nepal's exports hit an all-time high of Rs200 billion in the last fiscal year, which has been largely attributed to a rising US dollar against the rupee and higher prices due to inflation.

Even though the export value surged by 41.74 percent over the previous year, shipments of listed goods remained subdued.

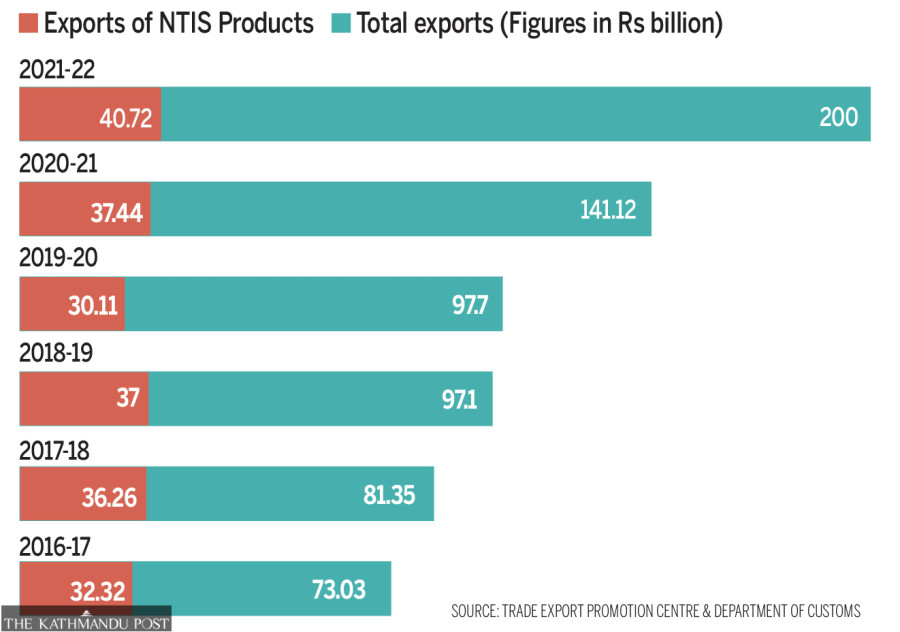

According to the statistics of the Department of Customs, listed products worth Rs40.72 billion were dispatched in the fiscal year 2021-22 ended mid-July, up 8.76 percent year-on-year.

Exports of products in the Nepal Trade Integration Strategy (NTIS) like medicinal and aromatic plants, fabrics, textiles, yarn and rope, leather, footwear, pashmina and carpets increased slightly. Exports of large cardamom and tea, however, declined.

Traders say the export value of Nepali products rose due to global inflation, and not because of any expansion in the quantity shipped out.

Shipments of processed palm, soybean and sunflower oils were worth Rs93.74 billion, which accounted for nearly a half of the country’s exports and largely drove up export values.

Export growth set a record, but it didn't make a dent in Nepal's foreign trade gap, which only yawned wider. While exports hit the Rs200 billion mark, imports soared to Rs1.92 trillion, resulting in a staggering trade deficit of Rs1.72 trillion.

The massive trade deficit caused a current account deficit, ringing an alarm that the country's imports have spiralled out of control.

Large cardamom shipments, Nepal’s niche product with increasing popularity among premium class consumers in the global market, decreased sharply by 31.45 percent to Rs4.81 billion in the last fiscal year.

Exports totalled Rs7 billion in the previous fiscal year.

Nirmal Bhattarai, president of the Large Cardamom Entrepreneurs Association of Nepal, said that the production of large cardamom declined 20 percent due to a winter drought.

"The price of large cardamom had increased in the initial months of the last fiscal year, but started to fall sharply from mid-April," said Bhattarai.

Large cardamom was traded at Rs1,200 per kg during the period mid-September to mid-November, which is the main harvest season.

"It then dropped to an all-time low of Rs800 per kg," he said. The price of large cardamom is influenced by demand in the international market.

Nepal is the world's largest producer of large cardamom with a 68 percent share of the global market, followed by India (22 percent) and Bhutan (9 percent).

Exports of pashmina, which were hit in the previous fiscal year due to Covid-19 restrictions, grew slightly in the last fiscal year. Pashmina shipments grew by 4.48 percent to Rs2.82 billion.

Durga Bikram Thapa, immediate past president of the Nepal Pashmina Industries Association, said that immediately after emerging from the impact of the Covid pandemic, Nepal’s trade suffered another wallop from the Russia-Ukraine war.

"Runaway inflation has hit the purchasing capacity of people worldwide, and as a result, demand for expensive products like pashmina has also dropped in the international market," Thapa said.

“The shipping charge that used to be around $5,000 per container before the pandemic has more than doubled to $12,000. This makes the product more expensive in the international market.”

The price of raw materials has also jumped by 40 percent, according to him. “As long as inflation bites consumers worldwide, it will be challenging for Nepali pashmina," he added.

Pashmina was exported mainly to the Netherlands, Switzerland, the United Kingdom, the United States, Italy, Japan and India.

Tea, Nepal’s lucrative cash crop, too did not perform well. According to official statistics, tea exports dropped 9.55 percent to Rs3.43 billion in the last fiscal year.

Deepak Khanal, director of the National Tea and Coffee Development Board, says that repeated hassles created by the Indian side regarding the quality of Nepali tea have been discouraging farmers from growing it.

Nepali tea needs to be tested at the Central Food Laboratory in Kolkata, India to obtain export certification.

"Around eight months ago, the Indian side blocked the export of 40,000 tonnes of tea for several weeks," Khanal said.

Nepal exports 90 percent of its tea to India. "The production of crush, tear, curl (CTC) tea has also been declining," Khanal said.

According to traders, one of the reasons behind reduced productivity is the government's inability to supply chemical fertilisers on time.

Tea farmers in the country's eastern region have been facing acute shortages of urea, one of the most important sources of nitrogen.

The tea sector has also been suffering from a lack of irrigation systems and erratic electricity supply. Traders say that the government has even stopped providing interest subsidies to the tea sector from this year.

Tea producers lament that they are still forced to sell tea at the price set by Indian traders.

Nepal exports its tea to India, Czech Republic, France, Germany, Japan, the US and Russia.

Exports of fabrics, textiles, yarns and ropes saw a rise of 19.42 percent to Rs16.33 billion in the last fiscal year. Yarn was exported to India, Turkey, Singapore and Jordan.

Carpet shipments jumped 32.26 percent to Rs9.58 billion in the last fiscal year.

Most of the carpets went to Australia, Austria, Belgium, Canada, China, France, Germany, Italy, Japan, the Netherlands, New Zealand, Russia, Spain, Sweden, Switzerland, the UK and the US.

Shipments of medicinal herbs increased to Rs1.7 billion in the last fiscal year from Rs1.69 billion in the previous year.

Trade economist Posh Raj Pandey said that last year’s export growth of Nepal’s potential products was not satisfactory. “Obviously, there were problems in the implementation of the Nepal Trade Integration Strategy,” he said.

"The government authorities think that export promotion and minimising the trade deficit is the responsibility of the Ministry of Industry, Commerce and Supplies," he said.

The government is reviewing the NTIS for the third time after it failed to boost exports amid a changing global trade landscape. The Ministry of Industry, Commerce and Supplies is planning to integrate new products with comparative advantage to boost exports in the upcoming NTIS.

The government rolled out the NTIS in 2016 intending to increase and promote exports to narrow down the trade deficit. But even after a decade, exports have been pathetic, experts say. The NTIS is normally reviewed every five years.

“There is a lack of intergovernmental coordination for the promotion of listed products,” said Pandey, who chairs the South Asia Watch on Trade, Economics and Environment. "There is no point in being proud of exports of Rs200 billion. Edible oil makes up 50 percent of the exports.”

11.12°C Kathmandu

11.12°C Kathmandu