Money

Nepal’s foreign debt liability swells as rupee plunges to an all-time low against dollar

Rupee’s fall due to steady depreciation of Indian rupee to which it is pegged, insiders say.

Krishana Prasain

Nepal’s foreign debt liability has swelled in local currency terms as the rupee plunged against the dollar, bloating by Rs19.37 billion during the third quarter of the current fiscal year 2021-22.

According to the Public Debt Management Office, the country suffered exchange rate losses due to currency fluctuations.

The Nepali currency slipped by Rs3.17 against the US dollar between mid-January and mid-April.

The rupee slid further in the fourth quarter, plunging to an all-time low of 125.16 against the dollar on Tuesday.

According to the Nepal Rastra Bank, the rupee fell by 32 paisa against the dollar in just one day.

The Nepali rupee’s fall is a result of the steady depreciation of the Indian rupee to which it is pegged, insiders say.

Narayan Prasad Pokhrel, deputy spokesperson for Nepal’s central bank, says the fortunes of the Nepali rupee are linked to the Indian rupee.

“Nepali currency becomes strong automatically when Indian currency is strong, and weakens when Indian currency weakens. It has nothing to do with Nepal’s economy.”

Indian currency rises when the southern neighbour’s economy performs well, so the domestic factor is not responsible for the determination of the exchange rate, he said.

According to a report titled Impact of Exchange Rate on Trade Deficit and Foreign Exchange Reserve in Nepal published by the central bank in 2019, Nepal has been following a pegged exchange rate system with the Indian rupee with periodic exchange rate corrections through revaluation or devaluation.

Nepal adopted a different kind of exchange rate system for convertible currencies.

In line with the economic liberalisation policy followed since the mid-1980s, Nepal introduced current account convertibility in 1993, effectively pegging the Nepali rupee to the Indian rupee at the rate of 1.60, the same exchange rate which was fixed in 1960 when the two currencies were pegged for the first time, the report said.

Since 1993, the exchange rate of the Nepali rupee with other convertible currencies has been market-determined in line with the exchange rate of the Indian rupee with convertible currencies.

According to economists, a strong US dollar has both advantages and disadvantages.

“One thing is obvious. The depreciation of Nepali currency will increase our debt liability as we make interest payments and repayment of instalments in dollars,” Pokhrel said.

A depreciation of the domestic currency could exert pressure on the balance of payments, especially at a time when the country is struggling to maintain it.

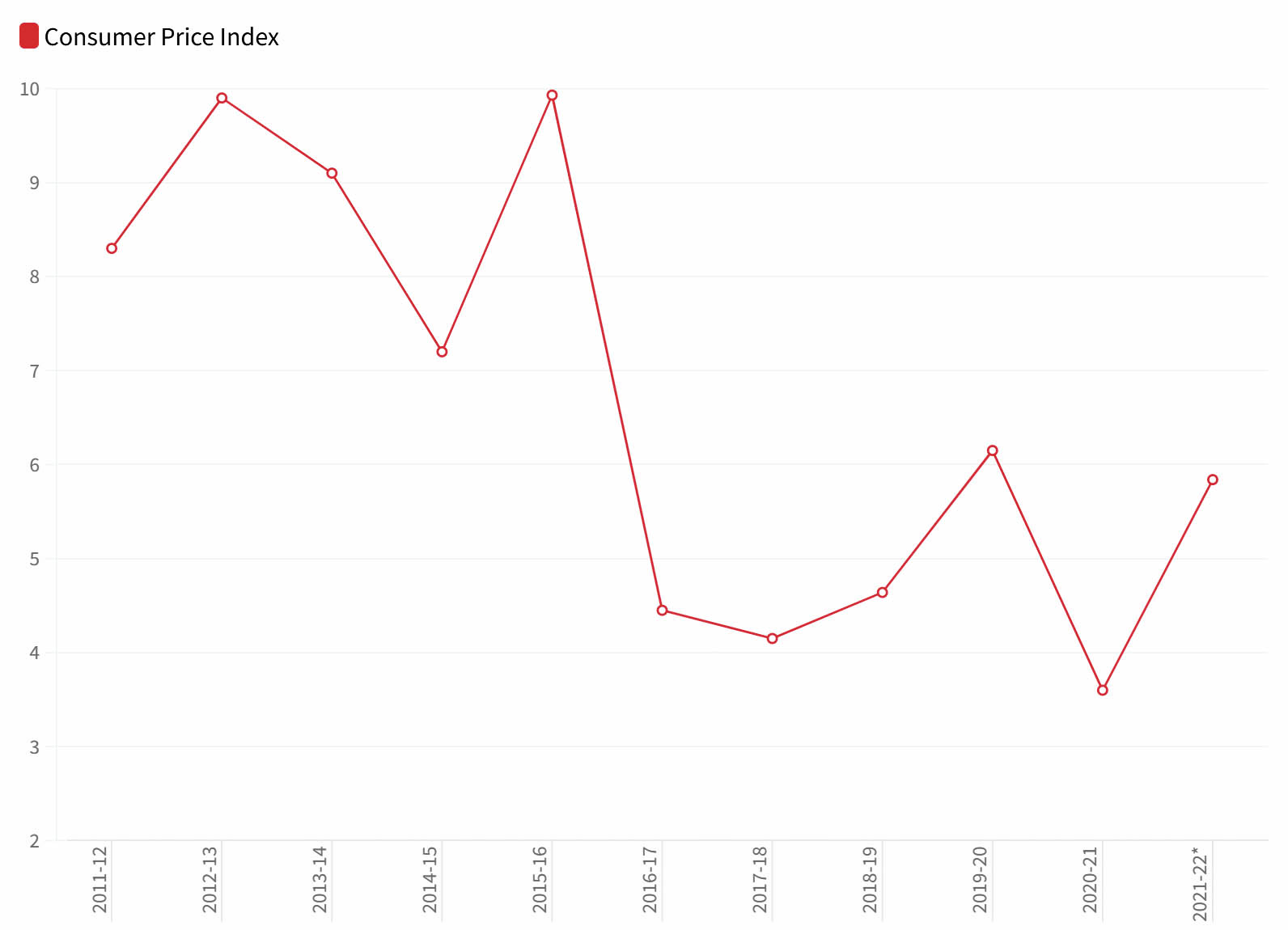

Depreciation is likely to push the inflation rate up, as the country is highly dependent on imported goods and has a very low level of domestic production.

“At a time when economic indicators like the balance of payments are not in a good position with rising imports, the sharp rise of the dollar is definitely not good news,” said economist Govinda Nepal.

"As payment for imports from India is made by exchanging US dollars for Indian rupees, a strong greenback means higher cost of goods for Nepal which will contribute to a rise in inflation," Nepal said.

According to the Nepal Rastra Bank, the country’s export earnings amounted to Rs173.35 billion while the import bill came to a staggering Rs1.60 trillion in the first 10 months of the current fiscal year ended mid-May.

The greatest impact will be on the purchase of petroleum products on which Nepal is fully dependent. It will also impact the cost of chemical fertilisers which is shooting through the roof.

Prakash Kumar Shrestha, executive director of the Nepal Rastra Bank, said a depreciation of the Nepali rupee will have a good impact from an economic perspective.

"Despite a rising import bill, the depreciation of Nepali currency increases the value of remittance," he said. "It can benefit Nepal if its exports are strong."

The central bank report also showed that a 1 percentage point depreciation of the Nepali rupee results in an increase in the reserve by 0.82 percentage point and a decline in trade deficit by 0.75 percentage point.

The appreciation of the US dollar, on the other hand, can benefit the remittance earners.

As a result of the appreciation of the US dollar, remittance earnings, which had suffered a drop until the last nine months of the fiscal year compared to the same period last year, saw a growth in terms of Nepali currency.

Remittance inflows increased 0.2 percent to Rs811.79 billion in the review period compared to 19.2 percent in the same period of the previous year, according to the central bank’s statistics.

But in US dollar terms, remittance inflows dropped 1.6 percent to 6.76 billion in the review period against an increase of 16.1 percent in the same period of the previous year.

Another beneficiary of a strong US dollar is the tourism industry because tourists can buy more for their dollar.

"Foreign visitors will find the price of goods and services in Nepal cheaper with a stronger dollar, and that encourages them to choose Nepal for their trip," said Shrestha.

The rupee fell by 3.71 percent against the dollar during the period mid-July 2021 to mid-May 2022, according to the Nepal Rastra Bank.

16.12°C Kathmandu

16.12°C Kathmandu