Money

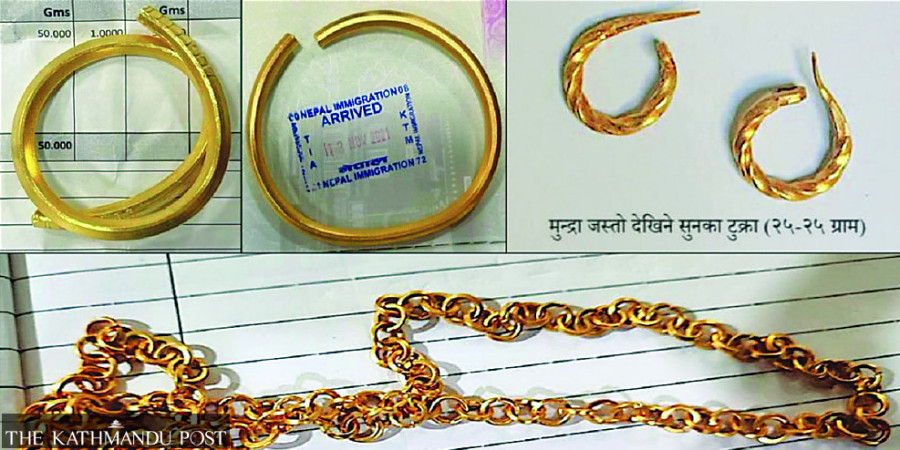

Over two quintals of gold jewellery seized at TIA customs in the last two months

Government may tighten imports of the yellow metal further to stem forex reserve depletion.

Prithvi Man Shrestha

The customs office at the Tribhuvan International Airport (TIA) has seized more than two quintals of gold jewellery brought by Nepalis from abroad in excess of the allowed limit, over the last two months. This shows the yellow metal has been entering the country in considerable quantities through individuals besides official import of gold by commercial banks and may provide some answers to the depletion in Nepal’s foreign exchange reserves.

The customs office started seizing gold beyond allowed limits from November 29 last year.

As per the customs department’s notice issued on November 28 last year, people returning from abroad can bring with them up to 50 grams of gold in the form of jewellery and they don’t have to pay any tax for the amount. Anyone carrying more jewellery—up to 200 grams—needs to pay tax for the gold in excess of 50 grams, according to the department. But gold jewellery weighing more than 200 grams is confiscated, the department said.

Likewise, people are allowed to bring up to 100 grams of gold in bullion by paying taxes.

“In the 67 days since November 29, we seized 205kg of gold brought in the form of jewellery and allowed the owners to repossess the gold after they paid the import taxes,” said Mahesh Bhattarai, chief customs officer at the airport.

The 205 kg of seized gold does not include the gold bullions seized over the period and gold jewellery brought within the permissible limit.

“If both the gold jewellery brought within the allowed limit and the gold bullions seized are taken into account, then the total gold that entered the country is significantly higher,” said Bhattarai.

The government has set the daily gold import limit at 20kg and only commercial banks can do so. Based on this quota, the banks are supposed to have imported 1,340 kg gold in the last 67 days. This means the gold jewellery seized by the customs office is equivalent to 15.29 percent of the gold formally imported over the period.

Importing gold in the form of jewellery has been on the rise recently, a trend that government officials say is a major cause for concern as it is believed to be contributing to the decline in remittance inflows.

The government’s worry has grown lately amid rising imports and depleting foreign exchange reserves. Decline in remittances could put further pressure on the economy, officials say.

“At the time when we started increasing vigilance on individuals to check excess imports, the daily import was around 20 kg a day, which is equivalent to the daily import quota fixed for commercial banks,” said Bhattarai. “Nowadays, such imports have come down to around 2-3 kg.”

According to the Department of Customs, the country's import bill hit nearly one trillion rupees during the first half of the current fiscal year, indicating a sharp rise in imports in recent years. The country's imports had first hit the one trillion rupee mark in the fiscal year 2017-18.

During the first half of the current fiscal year 2021-22, import bill reached a staggering Rs999.34 billion, a rise of 51.13 percent year-on-year. On the other hand, remittance inflows dipped by 7.3 percent to $3.26 billion on a year-on-year basis, while foreign exchange reserves dropped 14.7 percent to $10.03 billion in mid-December 2021 from $11.75 billion in mid-July 2021.

Considering the risk posed to the national economy by the worsening external sector situation, the government and the central bank have been introducing a slew of measures to discourage imports of non-essential goods including gold, silver and luxury items.

Increased vigilance against illegal gold imports resulted in significant seizures of jewellery and the customs office collected around Rs200 million in customs duty, according to Bhattarai.

Customs officials said migrant workers are being used as gold carriers by gold dealers to avoid paying taxes. These carriers bring gold in permissible limits, and are paid a certain amount for the job. After collecting the gold from these carriers, the dealers sell it at higher prices, especially in India, according to officials. When migrant workers spend their income on gold abroad, this hits remittance inflow, according to officials.

“Our recent measures are aimed at improving the inflow of remittances,” said Prakash Kumar Shrestha, chief of economic research department at the central bank.

When it comes to formal imports of gold, Nepal imported the yellow metal worth Rs22 billion during the first half of the current fiscal year, according to the customs department.

Formal import of gold over the last six months, has, however, remained stable with monthly import averaging worth around Rs3.6 billion, the customs data suggests.

“Considering the decreasing remittances and depletion of foreign exchange, we had informally proposed to the finance ministry to reduce the daily gold import quota for commercial banks to 10kg,” said Shrestha, the chief of the research department at the central bank.

He said that a number of measures taken by the government and the central bank has contributed to a decline in monthly imports in the sixth month compared to the five months of the current fiscal year.

“But still there has not been significant improvement in the remittance income and foreign exchange reserves,” he added.

20.26°C Kathmandu

20.26°C Kathmandu