Money

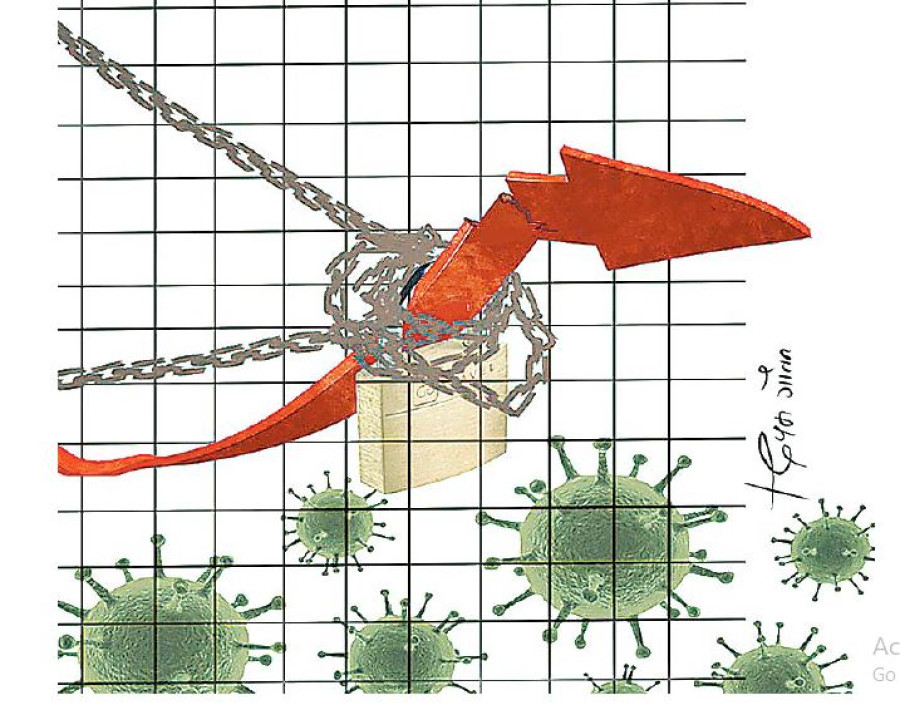

Pandemic has come as ready excuse for downturn in economy which was already sliding

The slowdown began in 2018-19 with the government’s low capital expenditure leading to a liquidity crunch, which in turn lowered the confidence of the country's private sector, experts say.

Prithvi Man Shrestha

The Covid-19 pandemic has come as a welcome excuse for the government’s continuing failure on the economic front.

With lockdown beginning in the third quarter of last fiscal to prevent the spread of coronavirus, growth slumped to 0.8 percent in the third quarter, according to the Central Bureau of Statistics.

In a survey titled The Effect of Covid-19 in Nepal’s Economy, Nepal Rastra Bank said only 35 percent of businesses operated partially while 4 percent operated fully during the lockdown period from March 24 to July 21.

It found 22.5 percent of employees were laid off by businesses in the formal sector—that includes manufacturing and service sectors. On average, industries and businesses trimmed 18.2 percent off their payroll, with hotels and restaurants leading, followed by transport entrepreneurs and educational institutions.

But a dig little deeper shows that the economy was taking a hit even before the country went into lockdown. With the economy not growing at the government target of double digit percentage, the slogan Prosperous Nepal Happy Nepalis rang hollow even before the pandemic.

According to the Central Bureau of Statistics, the first slodown began in the last quarter of fiscal 2018-19 when growth came down to 5.2 percent compared to 8 percent in the same quarter the previous fiscal.

The downward slide continued in the fiscal year 2019-20 with the economy growing by 5.4 percent in the first quarter against 8.5 percent in the corresponding quarter of the 2018-19. In the second quarter of 2019-20, the economy grew by 4.2 percent against 7 percent in the corresponding quarter of 2018-19.

The Economic Activities Study Report released by the central bank earlier this week supported the findings of the statistics bureau regarding the state of economy before the pandemic began.

According to the study, agriculture production (cereal, vegetables, fruits and spices) decreased by 0.3 percent during the first half of 2019-20, compared to a growth of 6.7 percent in the corresponding period of the previous fiscal.

Industrial capacity utilisation decreased to just 40 percent in the first half of the fiscal year 2019-20 from 60 percent during the same period in 2018-19.

But it is not just the agricultural and industrial sectors that have contributed to the slide.

Former vice-chairperson of National Planning Commission Shankar Sharma sees the government’s continued failure to spend capital budget adequately and to take the private sector into confidence as major reasons why growth was slowing down.

“Before the last fiscal year, economic growth was driven by post-earthquake reconstruction, sudden availability of electricity and increasing number of foreign tourists,” said Sharma.

“But in the last fiscal year, reconstruction activities slowed but the government’s expenditure remained poor, the size of the capital budget in comparison to recurrent one continued to decrease and the rapport between the government and the private sector worsened.”

The lethargic bureaucracy is mainly to blame for the lack of expenditure in infrastructure projects like roads, irrigation projects, airports and hydroelectricity plants.

“Ministers failed to take leadership in increasing capital expenditure,” said economist Govinda Nepal, who also served as a member of the National Planning Commission.

Higher government spending would mean more liquidity with the banks, which could be lent to the private sector to fuel growth.

Instead, the private sector has been complaining about the government’s alleged bullying.

According to Sharma, the private sector also appeared to be concerned about multiple taxation by the federal, provincial and local governments.

“The government’s priority remained on how to increase the revenue instead of facilitating businesses and creation of jobs,” said Shekhar Golchha, senior vice president of the Federation of Nepalese Chambers of Commerce and Industry.

There was the expectation of a high growth trajectory after the government announced in its policies and programmes for the fiscal year 2018-19 that growth would be close to double digits in the first year and double digits from the following years.

The hope was not unfounded because Nepal Communist Party leader KP Sharma Oli led a stable government with a near two-thirds majority in Kathmandu. His party led governments in six of the seven provinces and most of the local units. There has been uninterrupted electricity supply. Labour issues in the industries, which used to be the bane of Nepal’s economy, had been sorted out.

Economist Nepal pointed out the government’s focus from economic performance to managing the internal politics of the ruling Nepal Communist Party as another factor behind the downward slide in growth besides low capital expenditure and not very good relations with the private sector.

Factional politics took its ugly turn within the ruling party as early as the beginning of last fiscal year and it took a nasty turn in the middle of the pandemic as the party reached the verge of a split.

“The ruling party’s internal differences made headlines all year which may have disoriented the government,” Nepal said. “On the other hand, we repeatedly heard about the private sector’s unhappiness about the government. Possibly, the government's failure to hold good dialogue with the private sector may have affected investments from the private sector.”

In the first half of the fiscal year 2019-20, the private sector was facing the liquidity crunch and this led to the banks hiking interest rates. The government’s failure to spend its budget was one of the reasons that created a shortage of loanable funds in the banking system.

It was natural that economic activities slowed down when there was a liquidity crunch in the banking system and interest rates soared, said Golchha.

However, policy makers say that a little slowdown in economic growth in the first half of the last fiscal should not be taken as a surprise.

In a recent interview with the Post, Puspa Raj Kadel, vice-chairman of the National Planning Commission, said the downward spiral in growth rate was due to a higher base of the economy that had grown handsomely in the previous fiscal years.

But economists say that the question is whether the country is headed towards the direction of high growth trajectory as aimed.

“Despite relatively good growth rate in recent years, the pandemic will affect the economy for two years,” said Sharma. “After the pandemic is over, there can be high growth due to a low base.”

But, Kadel defended the slowing economic growth before the pandemic even though the planning commission's 15th plan (2019-20 to 2023-24) targeted an average growth of 10.1 percent in five years with over nine percent growth in the fiscal year 2019-20.

The pandemic has, however, shattered all the hopes of double digit growth during the 15th plan. The government has already started discussion on revising the growth targets which has started with the reduced growth target of seven percent in the current fiscal year.

Terming Nepal’s growth outlook in the 2020-21 fiscal uncertain, the World Bank said in its report ‘Nepal Development Update’ in July that “should cases in Nepal continue to rise and should a rebound in economic activity in the country’s major trading partners and remittance-sending countries be delayed, growth in this fiscal year 2020-21 risks turning negative, with a contraction of 2.8 percent possible”.

The government needs to implement development projects and employment centric programmes early to ensure that people have money in their hands, which would help revitalise the economy, according to economist Sharma.

Given the uncertain outlook with the pandemic continuing to rage, the private sector wants the government to provide a fiscal stimulus to enable companies to have money to run their businesses.

“Currently, only monetary stimulus has been announced but we want fiscal stimulus too to ward off the impact of the pandemic,” said Golchha.

8.79°C Kathmandu

8.79°C Kathmandu