Money

Manufacturing slack, low FDI inflow likely to crimp Nepal’s economic growth

Foreign investment is key, but the country needs to increase exports and focus on agriculture, tourism and IT to sustain growth, analysts say..jpg&w=900&height=601)

Prithvi Man Shrestha

Last week, Nigeria's Dangote Cement said it was planning to exit Nepal, as it failed to get a suitable mine from the government six years after it got the foreign direct investment approval from Investment Board Nepal.

Dangote, which was among the first of the companies to apply for foreign direct investment in 2013, stands at a crossroads today.

At a time when the global economy is showing clear signs of slowing down, Nepal would be struggling to meet its gross domestic product growth rate target in the current fiscal year and thereon if the government cannot retain the investors, experts say.

"Nepal, in fact, has failed to build confidence among the investors," said Chandan Sapkota, an economist.

Buoyed by three successive years of high GDP growth, the government has set an ambitious economic growth target of 8.5 percent for the current fiscal year. In addition, it has targeted an average growth rate of 9.6 percent for the next five years.

To achieve an average economic growth of 9.6 percent over the period, Nepal’s gross fixed capital formation (investment) should be Rs9.22 trillion, according to the Approach Paper of 15th Periodic Plan (2019/20-2023/24). But the national account, produced by the Central Bureau of Statistics in April this year, says such investment in the economy in the current fiscal year stood at just Rs1.27 trillion, leaving a huge gap of resources to be filled in the next five years.

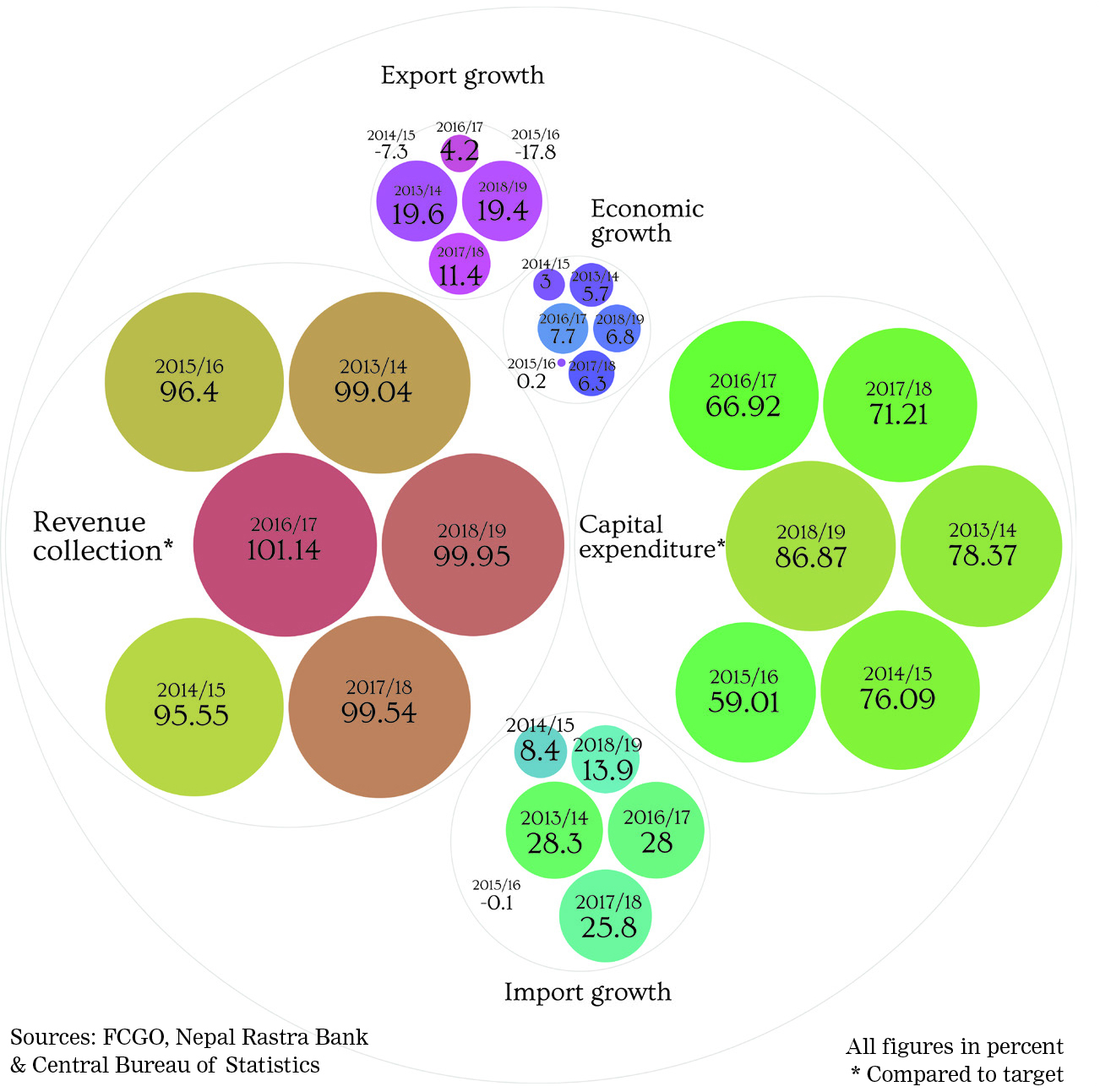

Nepal's economy grew by 6.8 percent in 2018/19, which the government dubbed the base year for economic transformation. According to the Nepal Rastra Bank, the country’s economy grew 6.3 percent in 2017/18 and 7.7 percent in 2016/17.

“The growth in the last fiscal year was an outcome of post-earthquake reconstruction, electricity supply, an uptick in the tourism sector and good weather conditions that helped agriculture,” Shankar Sharma, former vice-chairman of the National Planning Commission, told the Post.

Though the country’s current economic status is not in the doldrums, “sustainability of high growth is questionable because year-round irrigation system has reached just 25 percent of farmland, industrialisation is weak and there is no sector which can drive the economy”, according to Sharma.

Despite robust growth in the previous years, other key sectors of the economy, however, are staring down the barrel.

According to analysts, while foreign investment is key, the country needs to boost the manufacturing sector and industries, increase exports and focus on areas like agriculture, tourism and information technology to sustain high economic growth.

What is concerning is, said Sharma, the manufacturing sector has slowed down and the capital expenditure has not been up to the mark.

Despite an increased growth in the overall economy, the growth in the manufacturing sector slowed to 5.78 percent last fiscal year from 9.17 percent the previous year, latest figures show. The decreased growth rate in the manufacturing sector comes in the backdrop of the declining number of new industry registrations and a decrease in domestic and foreign investment commitments in industries.

According to the Department of Industry, industry registrations fell to 436 last fiscal year from 498, total committed investment dropped to Rs 282 billion from Rs350 billion the previous year and foreign direct investment pledges also nosevided to Rs24 billion from Rs56 billion during the same period.

The actual inflow of foreign direct investments into Nepal also decreased to Rs13 billion from Rs17.5 billion year-on-year in the financial year that ended in July, according to data from the Nepal Rastra Bank.

“Cost of doing business in Nepal is relatively high. So far, we have not been able to improve on this situation,” said Shekhar Golchha, senior vice-president of the Federation of Nepalese Chambers of Commerce and Industry, the apex private sector body.

Reduced foreign direct investments along with widening trade deficit resulted in a negative balance of payment of Rs67 billion last fiscal for the first time in 10 years, according to Nepal Rastra Bank. Likewise, the foreign exchange reserves had decreased by Rs64 billion and the trade deficit had widened by 13 percent to Rs1.32 trillion.

“Decrease in foreign exchange reserve and negative balance of payment means the economy has weakened overall,” said Hari Bhakta Sharma, former president of the Confederation of Nepalese Industries.

The central bank says the huge trade deficit is essentially responsible for both the deficit in the balance of payments as well as lower foreign exchange reserves. The current foreign exchange reserve is only sufficient to sustain imports of goods and services for 7.8 months.

Experts say what the country should immediately focus on is the manufacturing sector.

“Our manufacturing sector faces competition from manufacturing powerhouses like China and India,” said Sharma, the former vice-chair at the planning commission. “In order to make our manufacturing viable, we have to link our manufacturing industry to the value chain of India.”

Even though the government announced in its budget for this fiscal that seven industrial estates will be developed in the seven provinces, there has been no progress so far.

Industrialist Binod Chaudhary, who is also a lawmaker, hit out at the government last week for failing to operationalise even one industrial estate. Speaking in Parliament, Chaudhary also criticised the government for failing to offer adequate incentives to enterprises to move to the Special Economic Zone in Bhairahawa and the Garment Processing Zone in Simara.

Analysts say unless the government adopts a holistic approach—from introducing policy reforms to reducing the red tape, promoting the private sector and improving ease of doing business—the country will struggle to achieve the growth target.

After all, everything boils down to governance, said Rameshore Khanal, a former finance secretary.

“Large investors exiting the country could give a negative message about Nepal’s investment climate, as such disappointed investors share their experiences in the international forums,” Khanal told the Post. “It is also vital for Nepal to at least ensure that Chinese and Indian firms don’t run away from Nepal as they have been the largest investors in the country.”

***

What do you think?

Dear reader, we’d like to hear from you. We regularly publish letters to the editor on contemporary issues or direct responses to something the Post has recently published. Please send your letters to [email protected] with "Letter to the Editor" in the subject line. Please include your name, location, and a contact address so one of our editors can reach out to you.

20.12°C Kathmandu

20.12°C Kathmandu