Money

Nepse index dips 65.04 pts

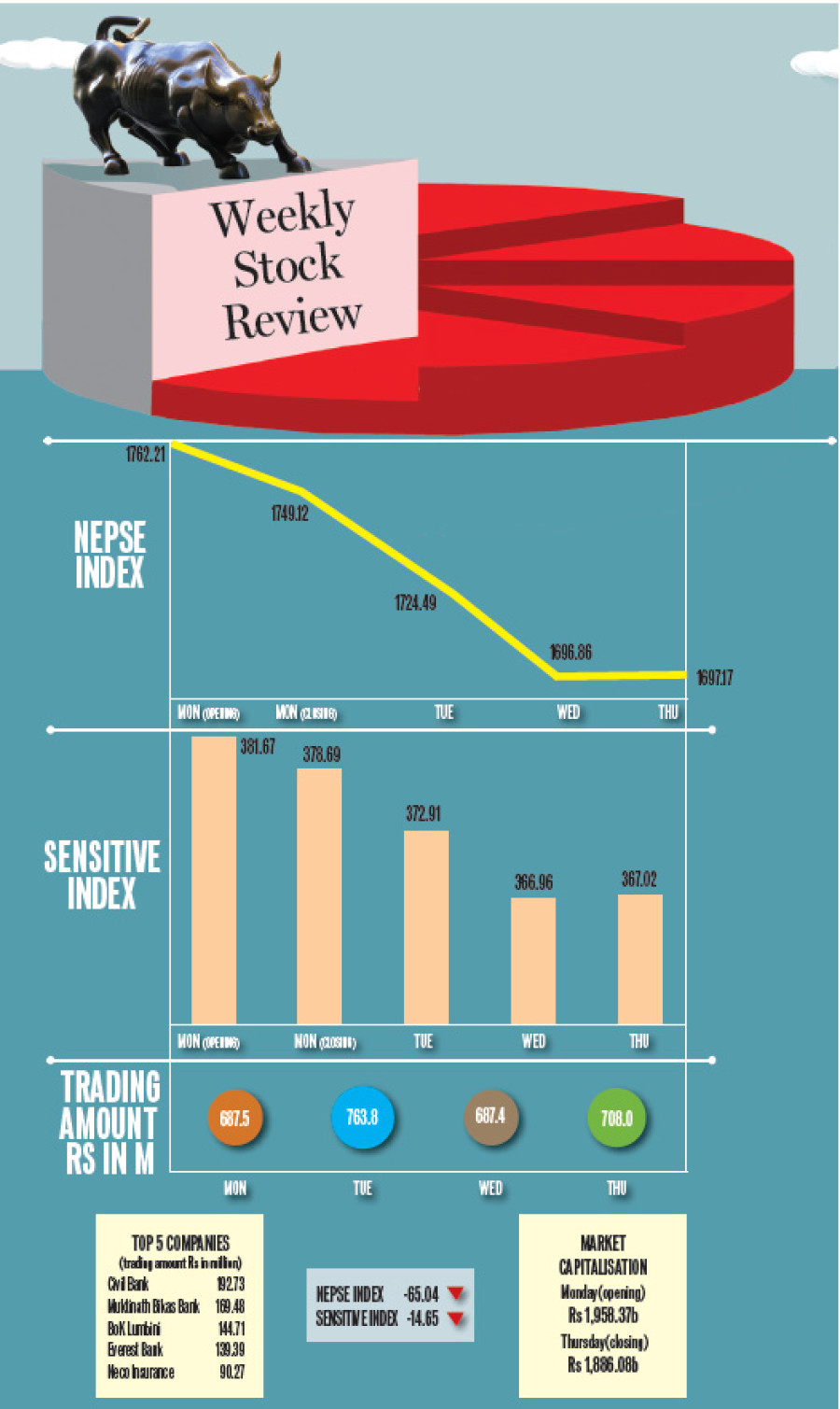

Nepal Stock Exchange (Nepse) shed 65.04 points to close at 1,697.17 points last week on investors’ reluctance to boost investment as a number of companies failed to declare timely dividends.

Nepal Stock Exchange (Nepse) shed 65.04 points to close at 1,697.17 points last week on investors’ reluctance to boost investment as a number of companies failed to declare timely dividends.

The secondary market, which opened at 1,762.21 points on Monday, lost 13.09 points to close at 1,749.12 points. The market extended losses on Tuesday, shedding 24.63 points, to close at 1,724.49 points. The Nepse index lost further 27.63 points to reach 1,696.86 on Wednesday, before gaining a nominal 0.31 points on Thursday, the last trading day. Overall, the index ended the week 3.69 percent lower.

“As some banks, such as Everest Bank, are yet to declare their dividends—against expectation that they would announce dividends immediately after Tihar—the investors were reluctant to increase investment,” said Parmeshwor Bhakta Malla, managing director of Malla & Malla Stock Broking Company. “Standard Chartered Bank’s lower-than-expected dividend declaration and ambiguity over the bank’s further public offering fuelled negative investor sentiment.”

Along with the Nepse index, the sensitive index that measures the performance of Group ‘A’ companies also dipped 14.65 to close at 367.02 points. Last week, the average value of shares listed on the market declined by Rs72.29 billion, with the market capitalisation falling to Rs1,886.08 billion.

Of the nine trading groups, indices of almost all plunged. The insurance sub-index was the biggest lower, down 374.2 points to close at 8,761.49 points.

Malla said investors were disappointed over low returns declared by insurance companies. “Compared to high share prices, most of the insurers announced only 20-30 percent dividends,” he said.

Other losers included hydropower companies, down 106.99 points; commercial banks, down 67.55 points; hotels, down 65.68 points; and development banks, down 64.26 points.

Manufacturing, finance companies and others also shed 31.03 points, 19.27 points and 5.49 points, respectively. The trading sub index was stable at 202.79 points.

Last week, Civil Bank observed the biggest turnover of Rs192.73 million. Malla said low price of the bank shares attracted investors. It was followed by Muktinath Bikas Bank (Rs169.48 million). Bank of Kathmandu Lumbini, Everest Bank and Neco Insurance rounded out the top five.

Civil Bank also topped in terms of the number of shares traded (584,000 units of shares).

Right Shares/Bonus Shares

Company Type Units

Srijana Finance Right 672,000

Nepal Community Development Bank Right 1,000,000

Sanima Bank Right 168,532

Butwal Power Company Right 188,930

Nepal Community Development Bank Bonus 95,000

Karnali Development Bank Bonus 200,000

Hamro Bikas Bank Bonus 159,565

Bhaktapur Finance Company Bonus 110,000

Bagmati Development Bank Bonus 80,500

8.12°C Kathmandu

8.12°C Kathmandu