Money

Nepse bullish run continues

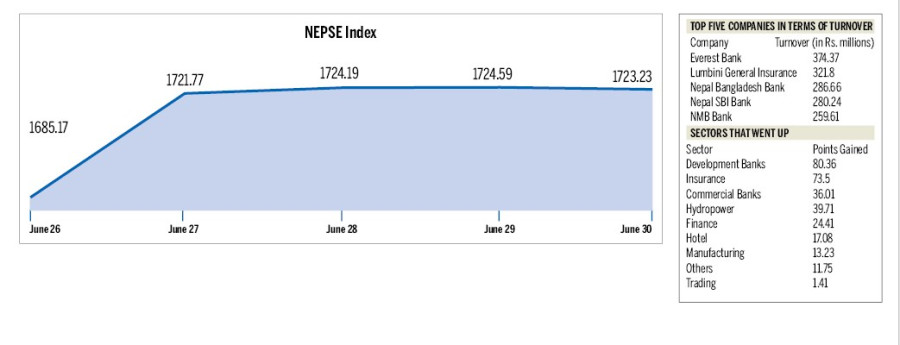

The Nepal Stock Exchange (Nepse)’s bullish run has continued with the index rising by 38.06 points last week.

The Nepal Stock Exchange (Nepse)’s bullish run has continued with the index rising by 38.06 points last week.

The secondary market opened on 1685.17 points and jumped by 38.06 points to close at 1723.23 points.

Last week’s highest gain came on Sunday when the market rose by 36.6 points. After that, the market saw slight gains throughout the week.

All of the nine trading groups posted gains. Development Banks (up 80.36 points) gained the highest followed by the insurance sector, commercial banks, hydropower and others.

The transaction amount increased to Rs8.38 billion from Rs7.82 billion, recording a rise of 7.32 percent. A total of 22.79 million shares were traded during the week through 32,839 transactions.

Stockbrokers attributed the uptrend to growing demand for stocks of commercial banks, micro finance and insurance companies in particular.

According to stockbrokers, a capital increment plan along with good financial health of the institutions as shown in their quarterly reports has also pushed up their indices “The market has seen an increase in the transactions with the shares changing hands frequently,” said Bhuwaneshwor Yadav, managing director of Agrawal Securities.

“The banking and insurance sector have seen a rise in indexes in short period because of capital increment requirements.”

The sensitive index which measures the performance of class “A” companies rose by 8.27 during the week to close at 372.26 points.

Everest Bank topped the charts recording the highest turnover of Rs374.37 million. Likewise, NIBL Sambriddhhi Fund saw the highest number of shares traded with 4.8 million shares being traded. In terms of number of transactions, Century Commercial Bank topped the chart with 1,215 transactions.

The market saw the listing of 100.2 million general shares of Hydroelectricity Investment and Development Company and Mero Microfinance Bittiya Sanstha.

6.12°C Kathmandu

6.12°C Kathmandu

%20(1).jpg&w=300&height=200)