National

Foreign investment commitment reached nearly Rs400 billion in 10 years, only Rs126 billion realised

The government allows investors to bring in funds in phases, contributing to the gap between commitment and realisation.

Post Report

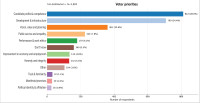

Over the past decade, Nepal received foreign direct investment (FDI) commitments worth Rs395.92 billion, but only Rs126.29 billion, or 37.89% of the pledged amount, has materialised, according to data from Nepal Rastra Bank (NRB).

Between fiscal year 2014/15 and the last fiscal year, although substantial foreign investment commitments were made, a significant portion failed to enter the country. For instance, during the last fiscal year alone, only 13.57% of the committed Rs61.90 billion was realised, with actual foreign investment amounting to Rs8.40 billion.

The trend shows that while foreign investment commitments have been increasing, the inflow of funds remains relatively low. Industry experts point out that there is no regulatory requirement mandating that all committed investments must be realised within the same fiscal period. The government allows investors to bring in funds in phases, contributing to the gap between commitment and realisation.

In fiscal year 2023/24, a net FDI of Rs8.40 billion entered Nepal. While a total of Rs8.47 billion was invested, Rs73.9 million of older investments were withdrawn, reducing the net inflow.

Similarly, in fiscal year 2022/23, the net FDI stood at Rs5.96 billion. Despite a total inflow of Rs7.76 billion, withdrawals of older investments amounting to Rs1.80 billion resulted in a lower net amount.

In fiscal year 2021/22, a commitment of Rs54.15 billion was made for 295 industries, but the net FDI inflow was Rs18.56 billion, after accounting for Rs658.7 million in withdrawals.

To address the declining FDI inflows, the government adopted more flexible policies starting in fiscal year 2022/23. The minimum threshold for FDI was reduced from Rs50 million to Rs20 million in fiscal year 2023/24. Additionally, the government announced plans to review sector-specific minimum investment requirements. The budget also mentions the removal of investment limits for the information technology sector, although the specifics are yet to be finalised.

Investments through the automatic route have seen the removal of limits for the IT sector, further highlighting the government’s efforts to attract foreign capital.

20.9°C Kathmandu

20.9°C Kathmandu