National

Social Welfare Council to introduce anti-money laundering directive for non-profit organisations

Government assessment rates the non-profit sector as vulnerable to money laundering and terrorist financing.

Prithvi Man Shrestha

The Social Welfare Council is preparing to introduce a directive that non-governmental organisations must follow to address the risk of money laundering and terrorist financing.

This is the first ever effort made by the council to check money laundering and terrorist financing through non-governmental organisations by keeping tabs on their finances and the sources of their funds.

“We are currently in the drafting phase of the directive that all non-governmental organisations must adhere to once it’s introduced,” said Puskar Khati, member secretary at the council.

“After preparing the draft, we will submit it to a committee that looks after potential terror financing headed by the home secretary.”

The date for the meeting between the council and the committee has not yet been set.

Khati said the directive would ensure that non-governmental organisations are transparent about the source of their funds and how they have invested in the country.

As per the recommendation 8 of Financial Action Task Force (FATF), a global rules setting agency against money laundering and terrorist financing, all countries should review the adequacy of laws and regulations that relate to entities that can be abused for the financing of terrorism.

According to the task force, non-profit organisations are particularly vulnerable to money laundering activities and terror financing, and countries should ensure that they cannot be misused.

It says that terrorist organisations can abuse non-profit organisations by posing as legitimate entities and they can exploit legitimate entities as conduits for terrorist financing, including for the purpose of escaping asset-freezing measures.

A number of regulatory agencies, such as the Nepal Rastra Bank, the Insurance Board, the Department of Cooperatives and the Securities Board of Nepal, already have directives against anti-money laundering and terrorist financing.

The council’s decision to introduce its own directive comes at a time when the government has felt the need for regulating non-profit organisations effectively to address the risk of money laundering and terrorist financing through them.

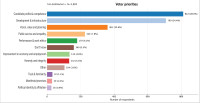

The National Risk Assessment Report on Money Laundering and Terrorist Financing 2020, prepared by the government, has found the vulnerability of the non-profit sector to be ‘medium’, stating that the lack of laws requiring the measures against money laundering and terrorist financing and the absence of national statistics on non-profit organisations were the main problems.

The assessment also found the sector requires specific law enforcing measures against money laundering and combating terrorist financing.

The report also found there were no cases reported so far of non-profit organisations engaged in terror financing activities.

According to the report, the challenges emanating from foreign aid to organisations or individuals associated with them, the limited reach of financial sector regulations and the open border call for vigilance against potential incidents of terrorist financing.

According to the assessment, the Department of Money Laundering Investigation has investigated just two cases linked to terrorist financing involving defendants from foreign jurisdictions.

An official at the council, who spoke on condition of anonymity, told the Post that there has been a series of discussions regarding what types of policies to formulate to curb money laundering and terrorist financing over the past year.

“There is a need for scrutiny on the source of funding, to see if non-governmental organisations spent the resources as approved by the council and whether beneficiaries were the intended people,” the official said.

People who have led international non-governmental organisations say banks scrutinise the source of funds when they come from abroad.

“The banks usually don’t allow withdrawal of funds right after they are transferred to the account of international NGOs here,” said Govinda Neupane, who have led a number of foreign NGOs in the past, including IM Swedish Development Partners most recently. “If there is a new donor, the banks scrutinise more.”

The government, however, is more concerned about international funding to non-profit organisations which have religious objectives, particularly from the perspective of religious conversion and religious extremism.

The Development Cooperation Policy 2019 says that fofreign NGOs, while mobilising their resources directly or through domestic NGOs, should fund development works other than religious and political institutions and the country’s sensitive areas.

A strategy policy prepared by the council regarding the functioning of the international NGOs says that the projects opposed by either India and China will not be implemented.

Cross-border terrorism and criminal activities along the Nepal-India border and madarasas operating in the bordering region have been causes for concerns for India while activities of exiled Tibetans are conerns for China.

According to the council, madrasas in the bordering region are receiving funds from countries like Qatar, Saudi Arabia and Turkey. “There is a need for proper regulation of domestic and foreign NGOs, which are focussed on religious activities for potential misuse of funds for other purposes other than what they mention during project approval,” said an expert who has the experience working with foreign NGOs for years.

22.17°C Kathmandu

22.17°C Kathmandu