Money

Budget introduces green tax on petroleum products

Excise duties on alcohol, beer and tobacco have been increased. The customs duty on the import of skimmed milk has been reduced to 1 percent.

Krishana Prasain

The government has imposed a green tax on imported petroleum products to fulfil its international commitment to reducing carbon emissions, according to the Financial Act for the fiscal year 2024-25 presented on Tuesday after the budget speech.

Equitable taxes will be imposed based on the economic transaction of the new business model and digital transaction, Finance Minister Barsha Man Pun said.

The objective of the revenue policy is to expand economic activities and promote investment by improving the revenue system, prioritising domestic industries, developing coordinated revenue systems by expanding the boundary of revenue, and controlling revenue leakage through coordination among government bodies, he said.

To encourage domestic industries, import duty on raw materials for medicine, induction stove, thread, helmet, incense stick, sanitary pad, cashew and peanut processing will be reduced, he said.

The import duty and excise duty has been reduced for firms producing these goods.

Likewise, to protect domestic firms, the import duty and excise duty on some finished imported goods have been increased.

To attract foreign direct investment, the government has reduced income tax on interest from loans obtained from foreign banks and financial institutions.

A double tax avoidance agreement will be made with the potential countries to draw foreign direct investment.

“If IT firms capitalise their profits, they will be provided with a waiver on dividend tax,” said Pun. “Tax subsidies will be provided to foreign companies if they reinvest or increase the capacity of business.”

The customs duty on the import of skimmed milk has been reduced to 1 percent from existing 15 percent for dairy firms that produce more than 1,000 litres of milk daily.

The customs duty on the export of plates made from waste leaves have been removed.

Instead of refunding the VAT on scooters imported by differently-abled people, a waiver will be provided at customs points.

Pun said that a provision would be made for all taxpayers associated with VAT to issue invoices electronically. Taxpayers with transactions of more than Rs250 million annually will be associated with a central invoice monitoring system.

The VAT imposed on potatoes, onions, apples and other green vegetables has been removed. “I believe this will protect domestic production,” said Pun.

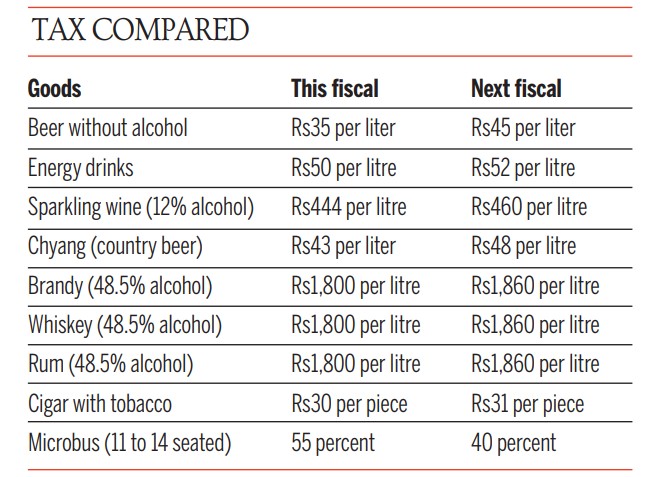

The excise duties on alcohol, beer and tobacco have been increased.

The government has imposed a health risk tax this year.

Imported or domestically manufactured bidi (hand-rolled unfiltered cigarettes) have been subjected to an extra 30 paisa per piece as health risk tax and 60 paisa per cigar. Readymade tobacco, gutkha, and pan masala will face a health risk tax of Rs60 per kg.

The government will impose a 3 percent education service charge on foreign currency exchange on students going for foreign study.

To develop an IT-based customs system, coordination will be done with the United Nations Conference on Trade and Development, Pun said.

A single person earning Rs500,000 annually from employment will have to pay 1 percent income tax, while a married couple earning up to Rs600,000 will also be subjected to the 1 percent tax.

The digital services provided by Non-Resident Nepali to Nepali consumers will be imposed with a 2 percent digital service tax on the transaction of digital services.

12.28°C Kathmandu

12.28°C Kathmandu