Money

Above-normal rains could come as a boon, but fertiliser crisis may dampen farmers’ hopes

As the economy faces a crisis, the situation is unlikely to improve with concerns stemming from high food prices.

Sangam Prasain

Nepal is likely to receive above-normal monsoon rains this year, according to meteorologists from South Asia. Ideally, this raises prospects for growth in the economy battered by the Covid pandemic.

A bountiful rainfall will not only boost farm output but also help replenish groundwater and reservoirs critical for drinking and power generation.

But there are concerns.

Officials say Nepal may not be able to reap the gains this year. The crunch of one crucial item—chemical fertilisers—is set to make the economy suffer and could even lead to a full-blown food crisis.

Time is running out, and it seems that the government may not be able to import enough chemical fertilisers for the key monsoon crop, mainly paddy.

Paddy harvest is a major contributor to the economy and planting season is set to start next month.

As of May 1, fertiliser stock in two state suppliers—Salt Trading Corporation and Agriculture Inputs Company—are almost exhausted. And import prospects are also diminishing, according to multiple sources privy to the matter.

At least three officials from the state-owned fertiliser suppliers the Post spoke to said that shortage in Nepal during the key paddy transplantation period has been a perennial problem and this year, the crisis may deepen further.

If the monsoon is above normal, and fertiliser supply is below normal, there is no gain at all, they said, adding that the farm sector will suffer and farmers will lose income.

While there is an immediate concern about the impact of high food prices on food security, especially in low- and middle-income countries, fertiliser prices spike and concerns about availability cast a shadow on future harvests, and thus risk keeping food prices high for a longer period, according to Washington-based International Food Policy Research Institute.

Rising prices of coal in China, the main feedstock for ammonia production there, along with a phasing out of inefficient production capacities, have also led to reduced production, contributing to rising global fertiliser prices as well.

High energy prices, strong demand, and limited supply also drove up spot prices of potash in 2021 and into 2022. China has restricted urea imports since October 2021.

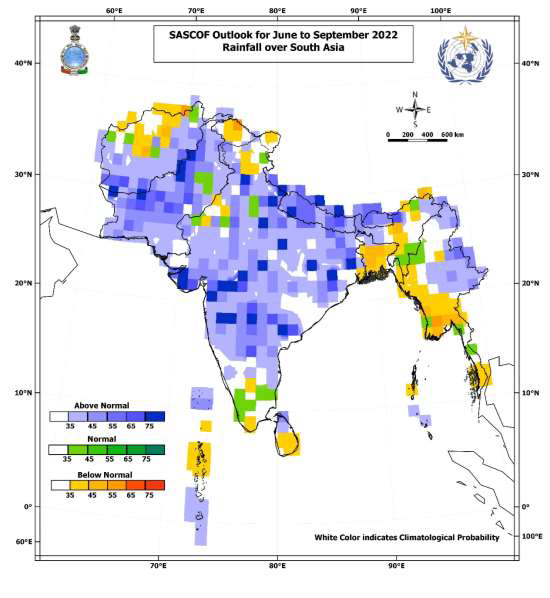

According to a consensus statement released by the 22nd Session of South Asian Climate Outlook Forum last week, normal to above normal rainfall is most likely during the 2022 southwest monsoon season [June–September] over most parts of South Asia.

Geographically, above-normal rainfall is most likely along the foothills of the Himalayas, many areas of northwestern and central parts of the region, and some areas in, east, and southern parts of the region, said the statement.

Nepal plans to unveil the country’s outlook on Friday.

“The encouraging forecast of an above-normal monsoon augurs well for a timely onset of summer crop sowing, particularly paddy," said Indira Kandel, senior divisional meteorologist and chief of the climate analysis section at the Department of Hydrology and Meteorology. “The monsoon obviously benefits the country’s economy, mostly the production of crops. But there should be good preparations to reap the benefits.”

The climate outlook means the region should prepare well.

“There is a good rains forecast and along with that, farmers should be provided with enough fertiliser and seeds on time so that the country can benefit from the above normal monsoon,” said Kandel.

Apart from the agriculture perspective, an above-normal monsoon could prove to be a disaster if the response is not timely, Kandel stressed.

“It’s a sensitive issue. You need proper planning so that risks are minimised,” said Kandel.

The monsoon is crucial for the Rs4.85-trillion economy, as it brings nearly 80 percent of the rain needed by farms, besides replenishing reservoirs and aquifers.

Nearly two thirds of Nepal’s farmlands are rain-fed and are dependent on the annual rains from June to September. Farming accounts for 23.95 percent of the economy but sustains more than 60 percent of the population.

Summer crops, mainly paddy, alone contribute over 11 percent to the national gross domestic product and are the major income sources for more than half of the population.

Paddy, which is transplanted in June and harvested in October, contributes around 7 percent to the gross domestic product.

But paddy needs fertilisers.

Chemical fertiliser in Nepal is a political commodity. Experts say it could stoke unrest among the country’s politically important farmers ahead of the general elections.

The government has gambled.

“We are in a difficult situation,” said Pankaj Joshi, deputy general manager of the Salt Trading Corporation, a public-private supply venture that sells subsidised chemical fertilisers. “The problem started when China restricted exports. Then the Russia-Ukraine war compounded the situation.”

Moscow invaded Ukraine on February 24 and the war has continued, affecting shipments and impacting the world economy.

“Russia is offering a 30 percent discount on fertiliser prices but no one is willing to take the risk to import from the war zone,” said Joshi.

During the paddy planting season, Nepal will require 210,000 tonnes of chemical fertilisers. And the country must secure between 150,000-170,000 tonnes to avoid havoc.

“So far, Salt Trading Corporation has been able to secure 42,000 tonnes over the next four months,” said Joshi. “This consignment will start entering the country after 20 days… if things go as planned.”

In past months, according to state-owned fertiliser suppliers, many tenders were cancelled by global suppliers [who supply to the two state-owned companies] owing to higher international prices.

The Agriculture Inputs Company, the state-owned fertiliser supplier, had planned to import 50,000 tonnes of chemical fertiliser but “a technical error” occurred in the documentation process and it was cancelled, according to an official familiar with the development.

“It has re-tendered and will take at least 30 days to open the letter of credit and another 90 days to bring the consignment, if things go as planned,” said the official. “This means it will take at least four months to import fertiliser meant for June.”

World market prices for both food and fertiliser have increased significantly over the past year and a half and have climbed to even higher levels following Russia’s invasion of Ukraine in February, hitting their highest levels yet in March, according to the International Food Policy Research Institute.

According to Joshi, urea used to cost $390 per tonne in November 2020, but it costs $1,100 per tonne now. In Nepal, urea currently costs Rs134 per kg, while the state-owned suppliers are selling it at Rs15 per kg.

Di-ammonium phosphate (DAP) was priced at $375 per tonne two years ago, and it now costs $1,307 per tonne. The DAP price has gone up to Rs160 per kg but it is priced Rs43 per kg at a subsidised rate.

“The price is extraordinarily high,” said Joshi.

For example, buying 100,000 tonnes of chemical fertiliser, which used to cost Rs3 billion two years ago, now costs Rs12 billion.

Normally, the country plans to supply 500,000 tonnes of chemical fertiliser annually by spending around Rs15 billion. “Importing the same amount of fertiliser will now cost Rs75 billion,” said Joshi.

Officials say that during the time of election, the government cannot take an unpopular decision to increase the prices. On the other hand, it cannot fund fertiliser purchases either giving the high prices.

This puts Nepal’s economy in a quandary.

Even Nepal’s neighbour India, with whom Nepal had recently signed a government-to-government deal to import fertiliser, is one of the worst affected by the worldwide fertiliser crisis. India imports up to a third of its fertilisers and is the world’s biggest buyer of urea and di-ammonium phosphate.

Persistent shortages of chemical fertilisers in Nepal stem from multiple factors—from lean inventories to poor supply mechanisms and from faulty policies to international pricing factors.

This causes chronic distress to tens of thousands of farmers annually who also have to worry about other threats like droughts, floods and crop failure.

A comprehensive audit report of the Office of the Auditor General has pointed out major policy lapses in the supply and distribution mechanism of chemical fertilisers and said the government itself does not know the country’s actual fertiliser requirement.

“Farmers are compelled to make long queues at the depots where fertiliser is distributed every year. This year, the queues will be much longer but only few will get the vital farm input,” according to a government official who wished not to be named. “The situation has slipped out of our hands. The only glimmer of hope is India if it sends some fertiliser.”

Prakash Kumar Sanjel, spokesperson for the Ministry of Agriculture and Livestock Development, said that the government-to-government deal to import 150,000 tonnes of chemical fertilisers from India is a work in progress.

India has appointed its Rashtriya Chemicals and Fertilisers and from Nepal's side, the government has designated Agriculture Inputs Company to sign a commercial agreement to import fertiliser following the initial agreement that was concluded on February 28 between the two neighbours, he said.

The chief of Agriculture Inputs Company left for Delhi last Friday to hold discussion for a commercial agreement with the Rashtriya Chemicals and Fertilisers Ltd.

“The joint steering committee of Nepal and India is close to finalising the rates as per the import parity price,” said Sanjel. The import parity price is the price at the border of a good that is imported, which includes international transport costs and tariffs.

But, if that didn’t happen, the country’s economy as well as food availability situation could unfold differently in the next fiscal year, according to an official of one of the state-owned fertiliser suppliers.

“We are hopeful and expecting that the negotiations will end soon and fertiliser will arrive by the end of May,” said Sanjel.

19.57°C Kathmandu

19.57°C Kathmandu