Money

Nepal’s total debt jumps to 32 percent of GDP

Nepal’s total debt soared by 19.1 percent in the first six months of the current fiscal year to 32 percent of the gross domestic product (GDP), as internal borrowing surged and Nepali currency weakened vis-a-vis special drawing rights (SDR), a unit of money created by the International Monetary Fund.

Nepal’s total debt soared by 19.1 percent in the first six months of the current fiscal year to 32 percent of the gross domestic product (GDP), as internal borrowing surged and Nepali currency weakened vis-a-vis special drawing rights (SDR), a unit of money created by the International Monetary Fund.

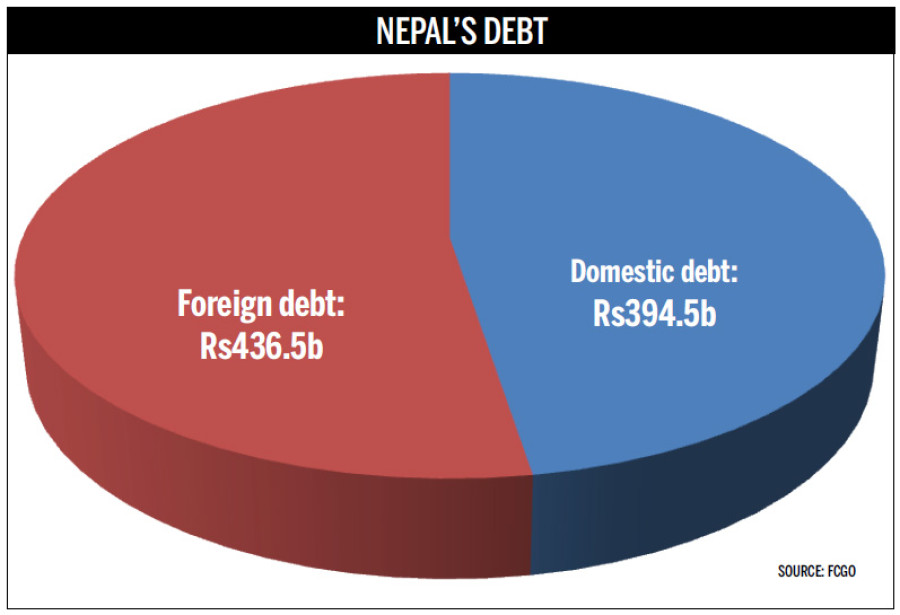

The government’s total debt stood at Rs831 billion in mid-January, which is 32 percent of the GDP, according to the latest report of the Financial Comptroller General Office (FCGO). Nepal’s total debt stood at Rs697.7 billion when the fiscal year began in mid-July.

One of the reasons for sharp hike in total debt is jump in internal borrowing in the first six months of the current fiscal year.

Nepal’s domestic debt soared by 39 percent to Rs394.5 billion in the first half of this fiscal year.

The domestic debt accumulated till the end of first six months of current fiscal year is 15.2 percent of the GDP.

The government has been extensively raising money from the domestic market since the beginning of this fiscal year as it faced shortage of resources to provide grants to newly-established local bodies.

In the past, the domestic debt collection cycle used to begin in the third quarter of the fiscal year.

But for the first time in history the government started raising domestic debt from the first month of the current fiscal year, as it did not have adequate funds to provide the first tranche of grants totalling Rs75 billion to local bodies.

The government generally faces shortage of funds in the initial months of the fiscal year because it collects first instalment of income tax—which makes second biggest contribution to the government’s income—only at the end of first half of fiscal year.

As the government’s reliance on domestic funds rose, the share of domestic debt in total debt rose to 47.5 percent at the end of the first half of the fiscal year from 40.6 percent at the beginning of the current fiscal year, FCGO report says.

With the hike in collection of domestic debt, the share of foreign debt in total debt fell to 52.5 percent at the end of the first half of the fiscal year from 59.3 percent at the beginning of the current fiscal year.

The volume of Nepal’s foreign debt went up by 5.4 percent to Rs436.5 billion in the first half of this fiscal year. The volume of foreign debt accumulated by Nepal till the end of first six months of fiscal year is 16.8 percent of the GDP.

“One of the reasons for hike in external debt is weakening of Nepali currency vis-a-vis SDR,” says the FCGO report.

Of the total foreign debt accumulated by Nepal, Rs395.3 billion was acquired from multilateral lending institutions, such as the Asian Development Bank and the World Bank, and Rs41.2 billion was obtained from bilateral donors, including Japan, China and India.

During the six-month period, Nepal spent Rs19.3 billion on debt servicing. Of this amount, Rs8.8 billion was used to repay principal of foreign loans and Rs1.8 billion was spent to pay the interest. The government also used Rs3.9 billion to repay principal of domestic loans and Rs4.7 billion to pay the interest, the FCGO report shows.

14.24°C Kathmandu

14.24°C Kathmandu