Money

Nepse down on selling pressure

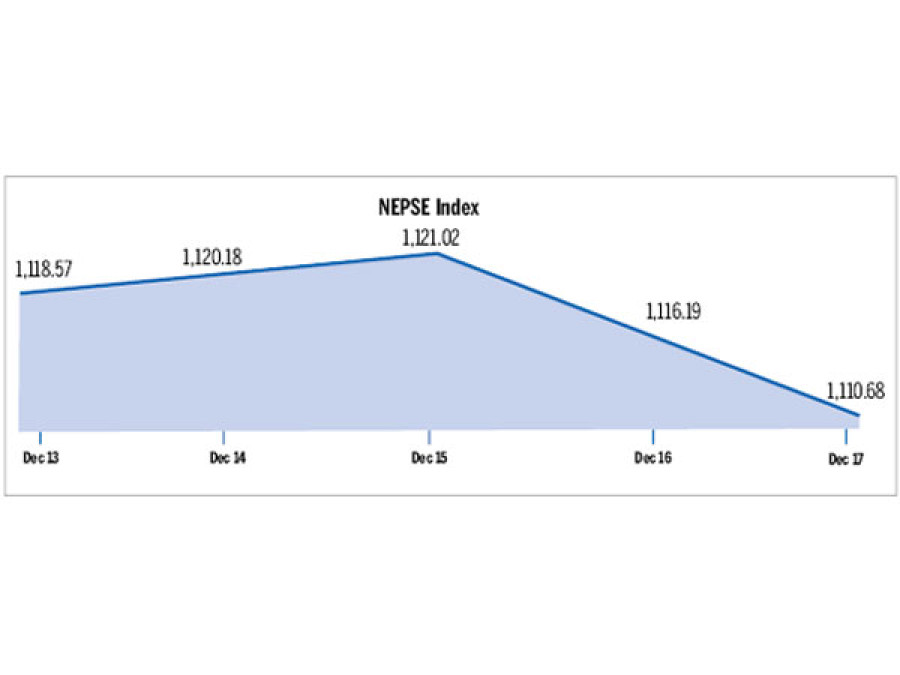

Nepal Stock Exchange (Nepse) last week dropped 7.89 points to close at 1,110.68 points.

Nepal Stock Exchange (Nepse) last week dropped 7.89 points to close at 1,110.68 points.

The market that opened at 1,118.57 points on Sunday rose marginally for the following two days before losing points in the last two days. The week’s biggest fall came on the closing day, Thursday, when the benchmark index shed 5.51 points. Stockbrokers said increased selling pressure contributed to the market fall.

“Many investors sold commercial banks’ shares to pour money in microfinance companies that are offering significant bonus shares,” said Satish Kumar Shrestha, managing director of Siprabi Securities. He said microfinance companies had been offering up to 50 percent rights and bonus shares.

Of the nine trading groups, four witnessed rise in their sub-indices. Insurance Companies, up 190.78 points, was the top gainers. It was followed by Development Banks, Others and Hotels.

Rabindra Prasad Nhuchhe Pradhan, managing director of Premier Securities said rumours about a possible hike in the paid-up capital requirement for insurance companies attracted investors towards the sector in expectation that the companies would issue rights and bonus shares to meet the requirement.

The Hydropower group dropped 30.65 points, while Commercial Banks and Finance Companies shed 24.89 points and 4.76 points, respectively. Indices of Manufacturing and Trading groups remained stable at 1,879.84 points and 207.97 points, respectively.

The sensitive index that measures the performance of “A” class companies was down 3.06 points to close at 237.94 points.

Despite fall in the benchmark index, the market transaction rose 2.98 percent to Rs1.90 billion. The number of traded shares to increased to 3,330,440 units from 2,984,820. Pradhan attributed the rise in the transaction volume to investors selling shares of insurance and banking companies.

National Life Insurance posted the highest individual transaction of Rs124.92 million. Nepal Life Insurance, Prime Life Insurance, Chilime Hydropower and Swabalamban Bikas Bank rounded out the top five. Arun Finance (promoter’s shares) topped in terms of the number of traded shares (279,000 units).

NEPSE LAST WEEK

Number of companies 159

Number of transactions 15,612

Total turnover Rs. 1.90b

Number of shares traded 3,330,440 units

SECTORS THAT WENT UP

Sector Points Gained

Insurance Companies 190.78

Development Banks 13.42

Others 5.87

Hotels 5.27

SECTORS THAT went down

Sector Points Lost

Hydropower Companies 30.65

Commercial Banks 24.89

Finance Companies 4.76

TOP FIVE COMPANIES IN TERMS OF TURNOVER

Company Turnover (in Rs. millions)

National Life Insurance 124.92

Nepal Life Insurance 109.48

Prime Life Insurance 89.81

Chilime Hydropower 83.3

11.12°C Kathmandu

11.12°C Kathmandu