Books

Navigating the new currency landscape

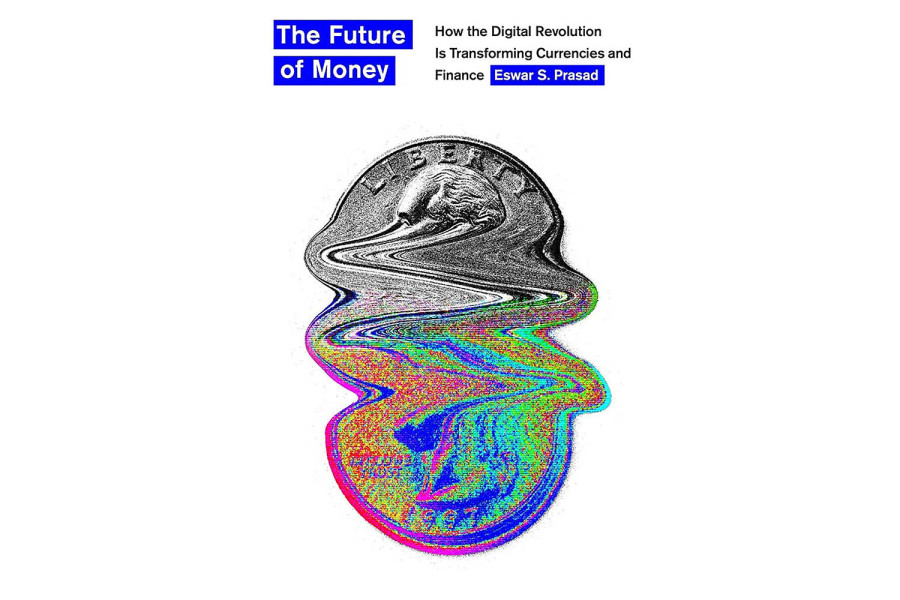

In ‘The Future of Money’, Eswar S Prasad explains how the concept of money is evolving due to technology and the impact it will have on global economics and monetary systems.

Michael Siddhi

The concept of money is evolving. Emerging technologies and digital algorithms are reshaping money's traditional roles, breaking them into new forms. Privately issued currencies compete with government-issued fiat money, impacting central banks, nations, large corporations, and even ordinary people.

If you find virtual private money intriguing and want to explore more without getting inundated with technical jargon, you'll enjoy ‘The Future of Money’ by Eswar S Prasad. In this book, Prasad explains how the concept of money is evolving due to technology and the impact it will have on world economics and the monetary system.

The book explores technological advancements, macroeconomic impacts, and regulatory challenges, highlighting their interconnectedness. It provides a compelling perspective on fintech, Bitcoin, Ethereum, other cryptocurrencies, stablecoins, Central Bank Digital Currency (CBDC), and more complex ideas like consensus mechanisms and initial coin offerings. Prasad is an economist, professor of Economics at Cornell University, and former head of IMF’s financial studies division.

He draws on his teaching and policy-making experiences to unravel the complex world of economic innovation and its impact on ordinary lives. His expertise in economics, policymaking, and the global financial market, along with his deep understanding of fintech and emerging technologies, enables him to clearly explain the technical and non-technical aspects of new forms of money and their regulatory implications.

‘The Future of Money’ is divided into four parts. The first part is the preamble, which discusses how the world of finance is changing due to the development of technology and explains the basics of money & finance, which is very helpful to those with non-finance backgrounds. The second part, ‘Innovation’, talks about the rise of fintech & cryptocurrencies & how it is challenging the traditional domains. Part three is dedicated to Central Banks' money. This is probably the book's most vital part, where the history, evolution, outcome & implications of CBDC are discussed in detail. The fourth and final section, titled ‘Ramifications’, serves as the conclusion, discussing the impact and consequences on the global economy and central banks. The third section, ‘Central Bank Money’, is particularly relevant for Nepal in light of recent developments, as a bill proposing the issuance of a Central Bank Digital Currency (CBDC) has been introduced in Parliament.

A recently issued report by Nepal Rastra Bank (NRB) on the CBDC roadmap cites the issuance of pilot wholesale CBDC by August 2026 and cross-border CBDC and retail CBDC by 2027. In preparation for the issuance of CBDC, NRB published a CBDC white paper in August 2022, which is quite extensive and exhaustive. If you find NRB’s white paper too technical and difficult to understand, reading ‘The Future of Money’ is highly recommended. In this book, Prasad unravels CBDC, its considerations, the arguments for and against it, and its impact on international finance and central bank monetary policy, all illustrated with real-life examples. By the time you finish the book, you'll likely have formed your views on Nepal’s potential CBDC.

Understanding the history and evolution of money is essential in understanding the emergence of virtual currency. So, Prasad traces the evolution of money, starting with cattle, cowrie shells, and amber beads, progressing through metal tokens, and culminating in modern paper currency, backed by tangible assets until the collapse of the Bretton Woods agreement in 1971. The unbacked fiat became the norm until the financial meltdown 2008 caused a massive loss of trust in the government money. It is not a coincidence that Satoshi Nakamoto released the Bitcoin white paper six weeks after the Lehman Brothers crash. In 2019, when Facebook announced the launch of Stablecoin Libra (later Diem), it became a triggering point for the Central Banks worldwide to launch their digital currency. Prasad explains the evolution of money so convincingly that readers are left certain that money is on the brink of another significant transformation.

While CBDC seeks to bring revolutionary change, the digitalisation of fiat money is not a Panacea, argues Prasad. He explains this using real-life examples like the failure of Petro by Venezuela, Ecuador’s Dinero Electronico or The Sovereign by The Marshall Island or even the failed attempt by Russia. Prasad argues strongly that CBDC is only as strong and credible as the institution that issues it. He questions how CBDCs might challenge governments to balance efficiency with individual freedoms and whether they could become political and social control tools, especially under authoritarian regimes. Prasad also outlines the advantages and disadvantages of CBDCs, highlighting how they can enhance the central bank's ability to promote financial inclusion and economic stability. He claims that major reserve currency economies like the USD, Euro, and GBP are not pursuing aggressive digitisation of their fiat currencies.

On the other hand, economies like Singapore, Canada, and the UAE are exploring new possibilities through POCs like Project Jasper-Ubin (Canada & Singapore), Aber (Saudi Arabia and the UAE), and Project Inthanon ( Hongkong & Thailand). He suggests that the advent of trade settlement through bilateral Wholesale CBDC and the emergence of private & government-owned digital currencies could upheaval the international monetary system, possibly leading to the emergence of the world's next reserve currency. Prasad’s rationale is very plausible; one strongly feels he is right. These ideas make the book captivating, opening the reader's mind to future possibilities.

Lately, I have been reading many books on digital currencies, cryptocurrencies, DeFi, and Smart contracts and have gathered much information. To reinstate my understanding & knowledge, I wanted a book by a true expert who had a more holistic approach to the global markets & policy-level implications and not just technology stuff. I am glad I picked Prasad’s ‘The Future of Money’. The book was published in 2021, and in a world where things change overnight, a three-year-old book may seem obsolete. However, as Prasad explains in this book, economic principles and fundamentals don’t change overnight. The benefit of hindsight, though, is that it brings clarity. Despite his vast knowledge, experience, and insight, Prasad did not predict the rapid rise of cryptocurrencies and virtual money, which began with Nakamoto’s Bitcoin. In truth, no one did—perhaps not even Nakamoto himself. That makes the future of money even more intriguing.

Siddhi is the head of the Transaction Bank at SCB Nepal.

The Future of Money

Author: Eswar S Prasad

Publisher: Belknap Press

Year: 2021

8.79°C Kathmandu

8.79°C Kathmandu