Culture & Lifestyle

Behind the Madoff Ponzi scheme

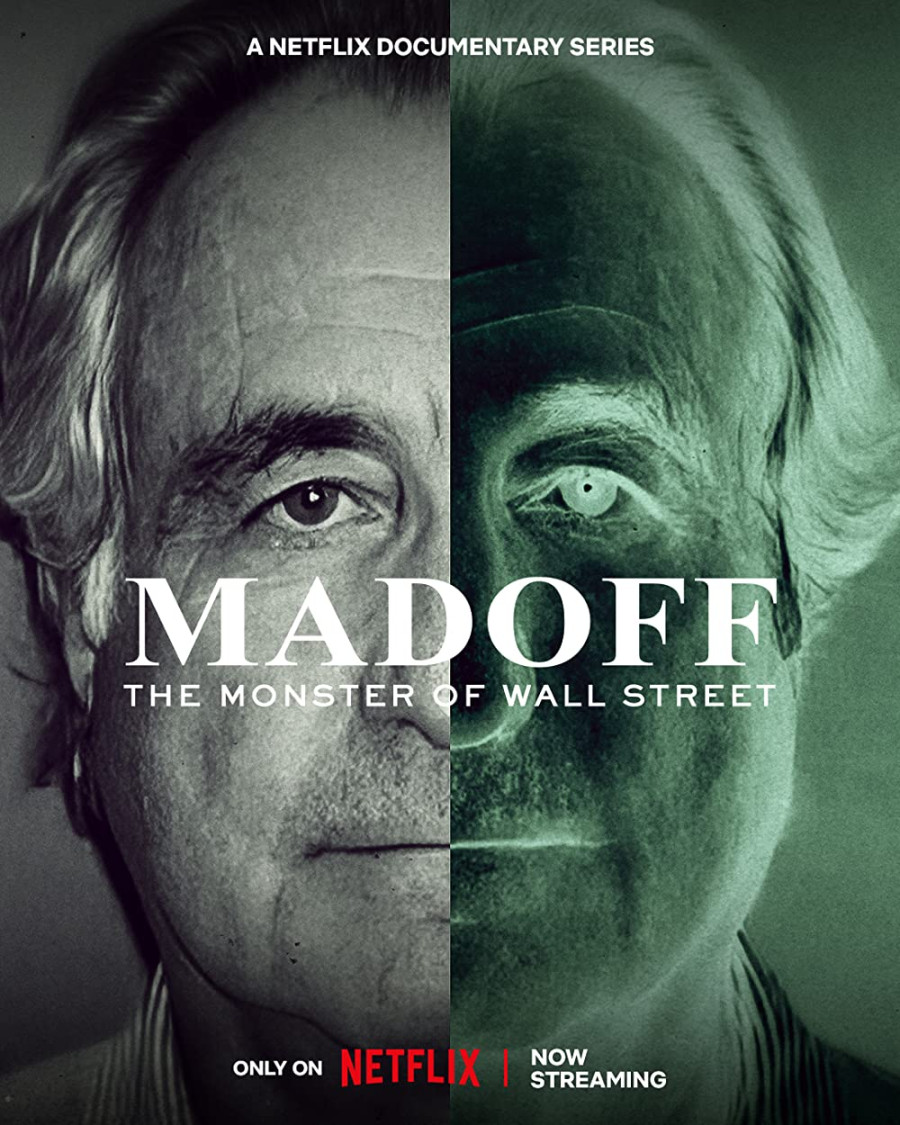

Netflix’s recently released documentary covers the infamous financial serial killer.

Amulya Bashyal

Netflix has recently released a docu-series on Bernie Madoff, Madoff: The Monster of Wall Street. While some of us are not very familiar with this name, for the ones who know about Madoff, the launch of this series has reignited interest in the infamous financial serial killer. As you prepare to delve into the world of Madoff and his Ponzi scheme, allow me to provide a brief overview (or a refresher for people who know his work) of the man responsible for bilking billions from unsuspecting investors. The docu-series is like a financial thriller (judging by the first episode at least), but for me, Madoff's tale is not just one of greed and deception; it is also a cautionary tale of the dangers of blindly trusting those in positions of power and influence. The Madoff Ponzi scheme serves as a reminder to always conduct due diligence and to be vigilant in protecting one's financial interests.

Bernie Madoff is a name that has become synonymous with financial fraud and the Ponzi scheme, a fraudulent investment scheme that involves paying returns to earlier investors with the investments of more recent investors. Madoff masterminded a Ponzi scheme that defrauded thousands of investors out of a total of $65 billions of dollars. The scale of the fraud and the number of people affected by it had a significant impact not only on Madoff's victims but also on the financial markets and public trust in the investment industry.

In this article, we will delve into the background and rise to prominence of Bernie Madoff, the mechanics of the Ponzi scheme he ran, and the events leading up to and following the unravelling of the scheme. Bernie Madoff was born in New York in 1938 and started working in the finance industry in the 1960s at his father-in-law's brokerage firm. He later started his own brokerage firm, called Bernard L. Madoff Investment Securities, in the 1970s, focusing on market-making, which is when you match buyers and sellers of securities to make trades.

Madoff quickly built a reputation as a trusted and successful trader, and his firm became one of the largest market-makers on Wall Street. In addition to his brokerage business, Madoff also managed investments for wealthy individuals and institutions through his investment advisory firm, which he claimed used a proprietary trading strategy to achieve consistent returns for its clients.

As Madoff's reputation grew, so did his client list, which included banks, hedge funds, and individuals with a high net-worth. Madoff was able to gain the trust of these clients through a combination of his personal charm and the aura of exclusivity surrounding his investment advisory business, which was invite-only and required a minimum investment of $10 million. In addition to his professional successes, Madoff was also active in philanthropy and held leadership roles in various industry organizations, further solidifying his image as a respected and successful businessman.

Madoff’s Ponzi scheme was a complex web of fraud that spanned decades and defrauded thousands of investors out of billions of dollars. Madoff was able to convince investors to give him their money by presenting himself as a trusted and successful investor who used a proprietary trading strategy to achieve consistent returns. He also cultivated a sense of exclusivity around his investment advisory business, which was invite-only and required a minimum investment of $10 million. To make it appear as though he was generating returns for his investors, Madoff used a number of fraudulent tactics. He created fake account statements that showed impressive returns and used his position as a market-maker to manipulate the prices of securities. Madoff also engaged in "cherry-picking," selectively choosing the trades that he reported to investors and hiding the losing trades.

His family and associates also aided Madoff significantly. His brother and two sons were all employed at the firm. His brother, Peter Madoff, served as the chief compliance officer at Madoff's firm while his sons, Mark and Andrew, were in investment advisory. Madoff also had a number of employees who aided in the execution of the fraud, including the creation of fake account statements and the maintenance of the illusion of a legitimate investment enterprise.

Essentially, Madoff convinced investors to give him their money, committed various forms of fraud to create the appearance of generating returns, and utilised the assistance of his family and associates to both perpetrate and conceal the scheme.

Little did Bernie Madoff know that the global financial crisis was going to be the end of his Ponzi scheme. In the latter part of 2008, the global financial crisis made it challenging for Madoff to sustain his scheme due to a lack of liquidity, as he was unable to continue paying returns to his investors. In December of that year, Mark and Andrew confronted Madoff about the legitimacy of the investment advisory business, to which Madoff admitted it was a giant Ponzi scheme that had been in operation for years. On December 11, 2008, the FBI arrested Madoff and charged him with securities fraud. The revelation of the scheme caused a stir in the financial industry and left Madoff's victims, many of whom lost their life savings, devastated. In March 2009, Madoff pleaded guilty to 11 federal felonies related to the Ponzi scheme and was sentenced to 150 years in prison.

The aftermath of the scheme saw efforts to reclaim assets for Madoff's victims. The court-appointed trustee managing the bankruptcy proceedings recovered billions through lawsuits against banks, hedge funds, and other institutions that had profited from the Ponzi scheme. However, many of Madoff's victims have not yet recovered their full losses.

The Madoff Ponzi scheme had a lasting impact on the financial industry and on the trust that investors place in financial institutions. The Madoff Ponzi scheme serves as a cautionary tale as well as a reminder of the importance of conducting due diligence and being cautious about blindly trusting financial advisers. It also highlights the need for strong regulatory oversight and the role that individuals can play in preventing financial fraud by reporting suspicious activity.

9.6°C Kathmandu

9.6°C Kathmandu

.jpg&w=200&height=120)