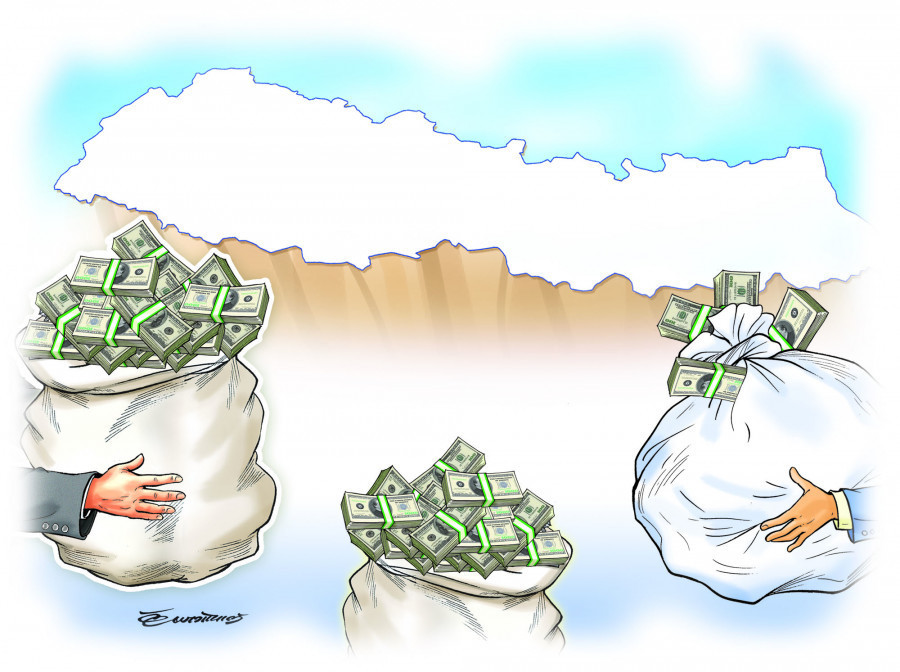

Money

Lowered FDI threshold lures small investors

Nepal received commitment for Rs15.03 billion for 211 small ventures, which is 67.3 percent of the total pledges.

Post Report

The foreign direct investment (FDI) commitment increased by a whopping 69.29 percent in the first half of the current fiscal year, which officials attributed to the revision of the minimum investment threshold for foreign investors.

According to the Department of Industry, the FDI commitment totalled Rs22.33 billion for 226 projects during the review period. The proposed investment has been envisaged to generate employment for 12,167 people.

Most of the proposed FDI has come for the establishment of small-scale business ventures, the department’s data shows.

The country received an Rs15.03 billion commitment for establishing 211 small-scale business ventures in the review period, which is 67.30 percent of the total pledges made by foreign investors.

On May 29, 2022, the annual budget for the fiscal year 2022-23, which begins in mid-July, reduced the minimum threshold for FDI to Rs20 million, down from Rs50 million, to attract additional foreign investment, including in small and medium-sized enterprises.

The statistics show that the FDI commitment of Rs3.63 billion came for 12 medium-scale ventures during the review period.

The FDI commitment for large-scale ventures came only for three projects of Rs3.66 billion.

The department officials say that South Korean companies have proposed setting up investment companies. They, however, did not provide the details.

Sector-wise, Nepal received the highest investment commitment in the service sector amounting to Rs12.76 billion for 83 projects, followed by Rs5.78 billion in the tourism sector for 103 projects.

The FDI commitment in the manufacturing sector was Rs2.83 billion for 23 projects.

Shankar Singh Dhami, director of the Foreign Investment and Technology Transfer Section at the Department of Industry, said that investment pledges by foreigners have increased due to the revision of some policies by the government.

“The budget for the current fiscal year had made a slew of changes to attract FDI,” he said, adding that no charges are levied for registering a company and the FDI approval process has been fast-tracked through an automated route.

The budget statement said that an arrangement would be made to approve foreign investments of up to Rs100 million through an automated system in seven days. The remaining procedures for investment approval and operation take six months.

Similarly, no charges are levied for increasing the capital in such FDI companies, said Dhami.

The most attractive scheme was the revision of the minimum threshold, officials said.

In September 2012, the government increased the minimum amount of FDI to Rs5 million for each investor from Rs1.6 million.

But in June 2019, following protests by the Nepali private sector, the government had again jacked up the minimum limit for FDI from Rs5 million to Rs50 million.

The private sector had complained that the minimum threshold should be increased because a lower ceiling would allow foreigners to invest in small businesses such as restaurants and coffee shops rather than encouraging large investments.

However, FDI started to decline after the threshold was raised to Rs50 million and was further compounded by the Covid pandemic.

Now, officials say that foreign investors are complaining about policy instability.

“Foreign investors are looking for government assurance and policy stability to invest in Nepal. The government seriously needs to work on it,” said Dhami. “The entry of foreign investors has eased to some extent. Now, Nepal needs to ease the process to make foreign investors feel that the exit process too is equally simple,” he said.

The government is organising the 3rd Investment Summit on April 28.

According to the department, the country received the FDI commitment of Rs240 million for four agro and forestry-based ventures, Rs320.67 million for seven communication and information technology-based ventures and Rs300 million for four infrastructure-related ventures.

The mineral sector received the FDI commitment of Rs85.94 million for two projects.

Country-wise, China topped the country for the FDI commitment.

The northern neighbour has committed to invest Rs8.77 billion.

The commitment from the southern neighbour remained at Rs2.21 billion during the review period.

During the review period, the department recommended 1,356 business visas for foreign investors.

The approved repatriation amount of royalty was Rs1.04 billion in the first six months of the current fiscal year, increasing from Rs947.12 million in the same period last fiscal year. Likewise, the government approved repatriation of dividends worth Rs1.53 billion during the review period.

Interestingly, despite the huge pledges, the actual FDI inflows remained disappointing.

According to the Nepal Rastra Bank, the net FDI inflow remained at Rs3.92 billion in the first five months of the current fiscal year, which ended mid-December.

According to the survey report on Foreign Direct Investment in Nepal 2021-22 published by the central bank, there is a significant gap between approved FDI and actual net FDI inflows in Nepal. Between 1995-96 and 2021-22, total actual net FDI inflow stood at around 36.2 percent of total FDI approval.

The cumulative total of FDI in Nepal increased by 16 percent during 2021-22 and stood at Rs264.3 billion as of mid-July 2022, the report said.

The paid-up capital increased by 15.5 percent, reserves by 16.4 percent, and loans by 16.6 percent, respectively. The foreign liability of Nepal in terms of direct investment stands at Rs264.3 billion as of mid-July 2022, the report said.

Electricity, gas, steam, and air conditioning sectors have the highest FDI stock of Rs86.8 billion (32.8 percent of the total) followed by the manufacturing sector Rs77.9 billion and the financial and insurance services sector Rs.67.8 billion.

According to the Nepal Development Update published by the World Bank in October, foreign direct investment remained negligible and was equivalent to a mere 0.1 percent of the GDP.

14.12°C Kathmandu

14.12°C Kathmandu