Money

Nabil Bank unveils emission report of its projects

Nabil Bank, being the first private sector bank in Nepal, has pioneered financial service innovations and sustainability in the banking industry.

Post Report

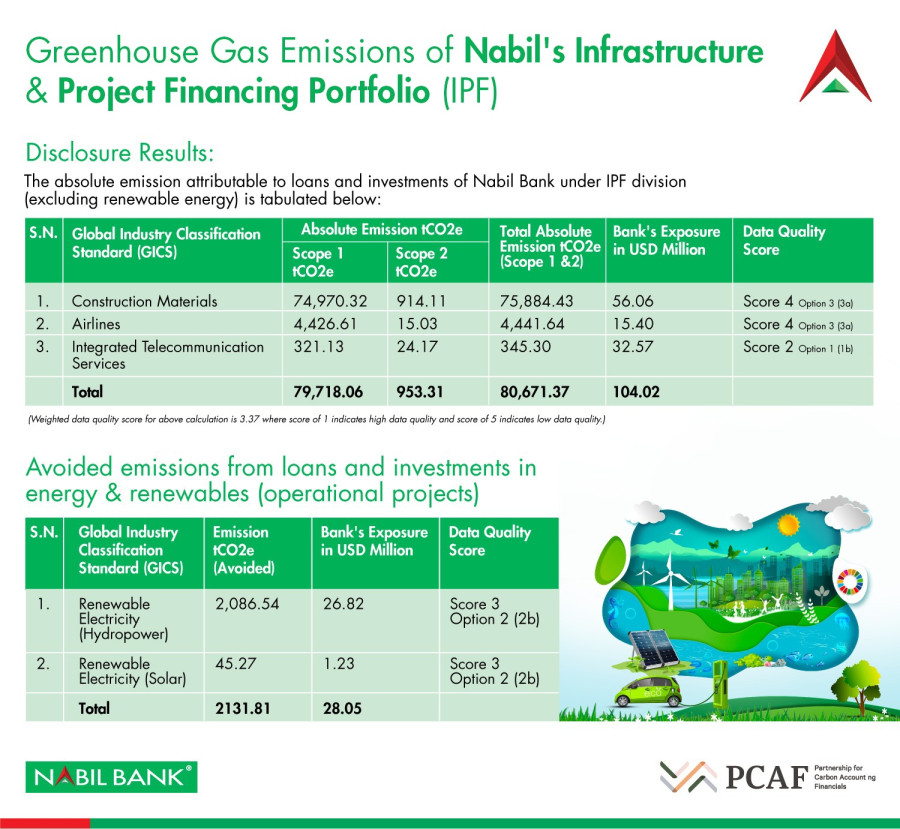

Nabil Bank has unveiled its greenhouse gas emission report for the year 2022 from the bank’s loan and investment portfolios under the infrastructure and project financing division.

The report has been made public as part of a commitment letter signed by Nabil Bank as one of the Partnership for Carbon Accounting Financials signatories in 2021.

The infrastructure and project financing portfolio includes a range of investments and loans to business sectors like energy, cement, airlines, telecommunication services and others.

The sustainable banking vertical of the bank had set out to measure emissions from the bank’s loan and investments portfolio under the infrastructure and project financing division.

The assessment of the portfolio’s carbon emission revealed that the total emissions for the year 2022 amounted to 80,671.37 tonnes of carbon-dioxide equivalent. Simultaneously, investment in hydro and solar comprises carbon-dioxide emissions avoided by 2,131.81 tonnes.

“While this is a significant amount, we are actively working to reduce our carbon footprint and make our portfolio more sustainable,” said Gyanendra Prasad Dhungana, CEO of Nabil Bank.

Nabil Bank is dedicated to building a sustainable future, he added.

“We recognise that this requires collective action. We believe that transparency is essential in achieving our goals, as we are committed to providing regular updates on our progress towards a net-zero carbon footprint.”

Nabil Bank, being the first private sector bank in Nepal, has pioneered financial service innovations and sustainability in the banking industry.

9.83°C Kathmandu

9.83°C Kathmandu