Money

Foreign direct investors rush back following Covid slump

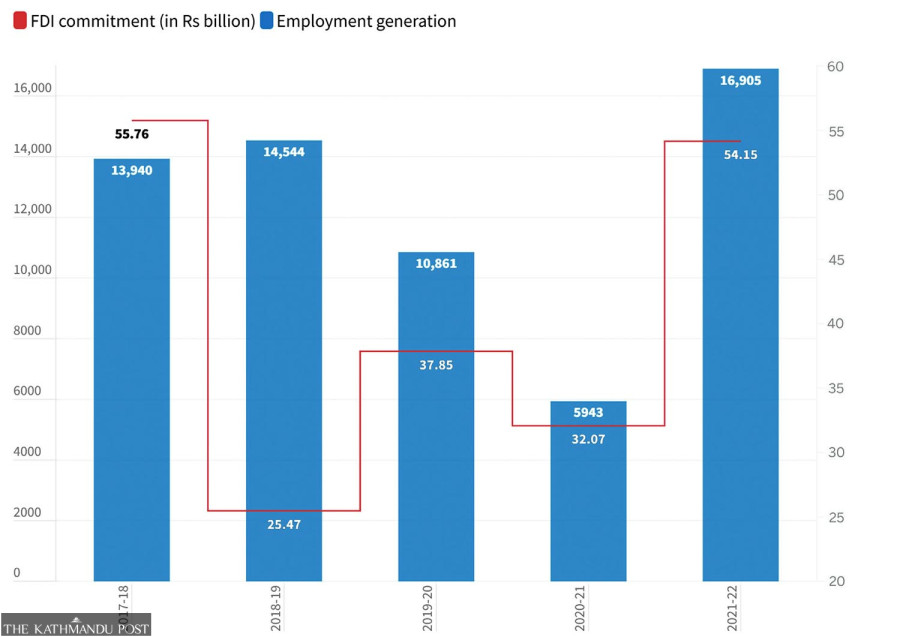

Investment commitments in the last fiscal year soared 68 percent to Rs54.15 billion, the Department of Industry said.

Krishana Prasain

Investment pledges shot up sharply in the last fiscal year ended July 16 as investors rushed back following the Covid slump.

Foreign direct investment commitments, with China in the lead, soared 68 percent year-on-year to Rs54.15 billion, the Department of Industry said.

The investment pledges in 295 projects will create 16,905 jobs. But officials say that investment pledges and actual money spent rarely match.

In the previous fiscal year 2020-21, Nepal received investment pledges worth Rs32.20 billion for 183 projects and services.

Suresh Shrestha, director of the Foreign Investment and Technology Transfer Section at the Department of Industry, says foreign direct investment commitments show an increasing trend.

“Investment pledges are coming mostly for small and medium-sized industries.” He added that investments had slowed after the minimum was ramped up to Rs50 million.

In May 2019, the government revised the minimum threshold for foreign direct investment from Rs5 million to Rs50 million.

Prompted by shrinking foreign currency reserves, the budget statement for this fiscal year brought down the minimum to Rs20 million.

“We have done very little in terms of promoting Nepal as a potential investment destination. We need to publicise our products that have a comparative advantage for investment,” Shrestha said.

Shrestha said that credit rating is necessary for a country like Nepal to attract foreign capital. "Credit rating will build trust as political instability spreads concern among potential investors," Shrestha said.

The government has proactively made policy reforms to attract foreign investors, and the budget for the current fiscal year has brought different provisions under foreign direct investment.

"There is still a problem with the difference in foreign direct investment commitments and actual investments," Shrestha said.

China tops the list of foreign investors in Nepal with investment pledges worth Rs42.72 billion in the last fiscal year, nearly double the previous fiscal year’s figure.

In the fiscal year 2020-21, investment pledges from the northern neighbour stood at Rs22.50 billion.

Investment pledges from India jumped to Rs2.48 billion in the last fiscal year from Rs906 million in the previous fiscal year. The financing commitments are for 12 projects.

According to the department's statistics, 125 investment commitments worth Rs19.40 billion have come for tourism projects, almost all of them from China.

The manufacturing sector received 51 foreign investment pledges valued at Rs7.91 billion, and the service sector received 98 pledges amounting to Rs23.74 billion.

The budget has made a few revisions in a bid to attract foreign investment.

Arrangements will be made to approve foreign investments of up to Rs100 million through an automated system.

If large investors request foreign investment approvals electronically, an arrangement will be made to provide preliminary approvals within seven days so that pre-preparation work can be done, according to the budget statement.

“The growth in investment commitments is good; but it is still not sufficient, especially in the manufacturing sector,” said Dinesh Shrestha, vice-president of the Federation of Nepalese Chambers of Commerce and Industry.

"Foreign direct investment is still lacking in the manufacturing sector which could help Nepal become less import-dependent. It has become important to bring foreign direct investment in the manufacturing sector,” Shrestha said.

“Most foreign direct investors say they are having a hard time getting the facilities offered by the government. Besides, in Nepal, repatriating profits is also difficult,” Shrestha said.

“This kind of message will keep away investors. So, it is important for the government to hold discussions with foreign investors once a year and listen to their grievances.”

According to the Auditor General's report published last week, Nepal is not receiving foreign direct investment as expected due to policy instability, problems in tax administration, land conflicts, industrial security and raw material issues.

The government opened the One Stop Service Centre in May 2019 to make it easy for investors to receive services relating to waiver, facility and subsidies and essential infrastructure.

"But the centre has not been able to function effectively due to lack of digitisation and full automatisation," the report said.

Nepal lacks strong and effective implementation of intellectual property laws due to which foreign investors hesitate to make investments here, local investors say.

Of the 724 complaints filed under the Patent, Design and Trade Mark Act, only 57 cases were resolved while the rest remained pending in the last fiscal year, the report showed.

The current fiscal year’s budget has also announced that intellectual property and copyright of the creators will be protected. The process of taking action against intellectual property theft and copyright infringement will be made effective, the budget statement said.

According to the fourth edition of the Industry Status Report published by the Confederation of Nepalese Industries on Monday, no international investor will invest in Nepal if there is currency risk and the reward is less. Hedging is even more critical when it comes to bringing investments into Nepal.

The Hedging Rule didn’t attract even a single project because of five major issues: The structure and institutional framework were not clear, the hedging fund was not guaranteed, there was no clarity on which currencies could be hedged, and the tenure of the hedged investments was not stipulated, the report said.

13.2°C Kathmandu

13.2°C Kathmandu