Money

NIBL Ace Capital to launch open-ended mutual fund

Any investor can buy a minimum of 1,000 shares of the open ended fund at the rate of Rs10 per unit

Rajesh Khanal

NIBL Ace Capital is launching an open-ended mutual fund scheme, the first of its kind in the Nepali capital market, by making a public issue worth Rs125 million on June 2. The country’s capital market has seen only closed-ended mutual fund schemes so far.

Last month, the Securities Board of Nepal permitted fund managers to issue new types of market instruments. NIBL Ace Capital will be issuing 12.5 million units of a mutual fund named NIBL Sahabhagita Fund.

According to the board, another six similar mutual fund schemes are in the pipeline. Paristha Nath Poudyal, executive director of the board, said the regulator allowed the new mutual fund scheme as part of the government’s initiative to boost the capital market by introducing new market instruments. “It is expected to offer a new gateway for investors who wish to diversify their investment portfolio,” he said.

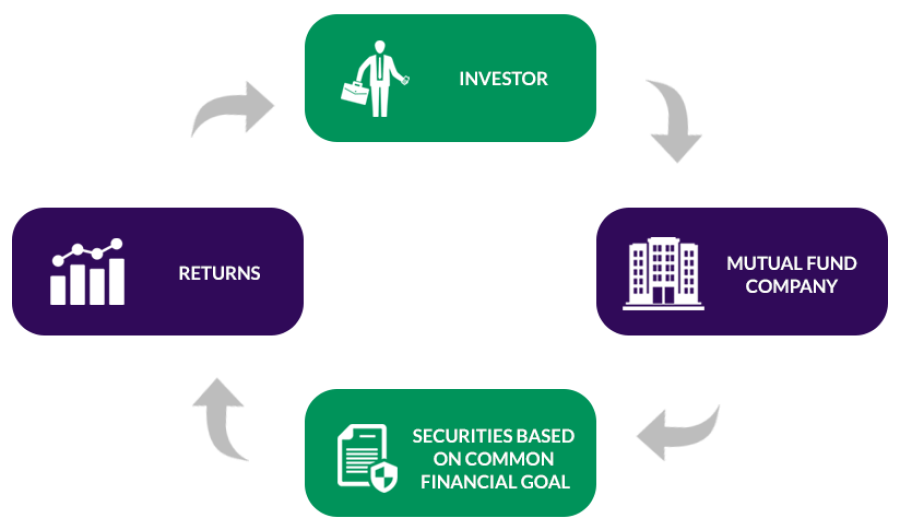

A mutual fund is a portfolio management company which helps investors lacking knowledge about the capital market by collecting money from them and investing it in various instruments of the capital market. These companies can invest in government securities such as debentures, treasury bills and bonds besides securities registered at the board and bank deposits, among others. Till date, 17 closed-ended mutual funds worth Rs16 billion have been launched in the domestic capital market. Unlike the traditional type, the open-ended fund is not listed on the secondary market for trading.

Poudyal said the market value of the new scheme is fixed on the basis of the net asset value of the fund manager. According to him, the fund manager calculates the net asset value by assessing the market value of the fund after deducting its liabilities. “As per the board’s regulation, the concerned mutual fund must calculate its net asset value and make it public on its website on a daily basis,” said Poudyal.

According to the board, any investor can buy a minimum of 1,000 shares of the open ended fund at the rate of Rs10 per unit. Such funds do not have any specified maturity date as in the case of closed-ended funds.

Investors can buy open-end mutual fund shares directly from the fund manager at any time. “Investors do not need to find buyers or sellers through brokering companies to carry out transactions,” said Poudyal. Poudyal said the board had come up with the new provision in line with the Mutual Fund Regulations 2010. According to him, the board is in the process of amending the law to enforce flexible measures to attract a greater number of investors in the future.

14.24°C Kathmandu

14.24°C Kathmandu