Money

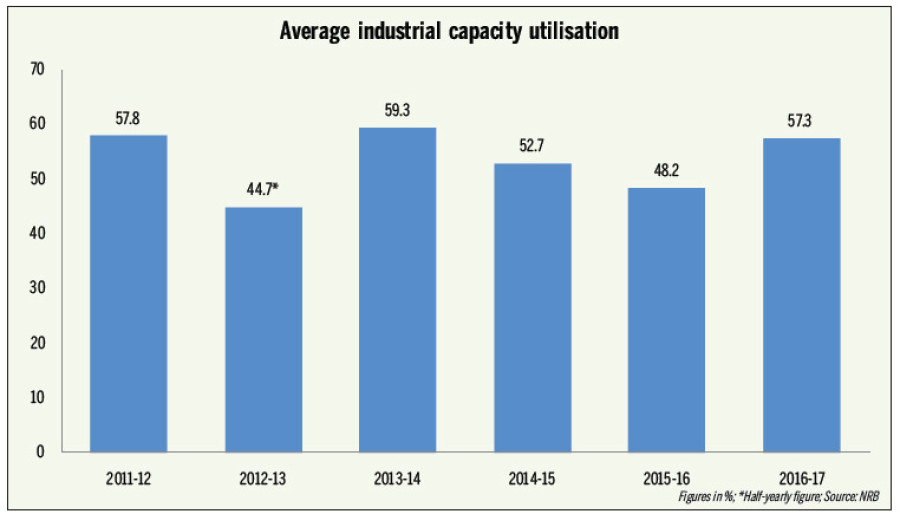

Industrial capacity utilisation hits 3-year high of 57.3pc

Impacts of regular electricity supply and improvement in business climate due to reduction in number of protests are gradually being seen in the economy, as the average industrial capacity utilisation hit a three-year high in the last fiscal year.

Impacts of regular electricity supply and improvement in business climate due to reduction in number of protests are gradually being seen in the economy, as the average industrial capacity utilisation hit a three-year high in the last fiscal year.

Industries in the country, on average, operated at 57.3 percent of their total capacity in the fiscal year 2016-17, as against 48.2 percent in 2015-16, shows the latest Economic Activities Study Report of the Nepal Rastra Bank (NRB), the central bank. The primary reasons for this result are greater availability of grid electricity, normalisation in supply of raw materials, rise in demand for construction materials due to jump in post-earthquake reconstruction works, and improvement in business climate propelled by drastic cut in number of strikes, according to the report, which was prepared based on studies conducted in 57 districts of the country.

The improvement in industrial capacity utilisation witnessed in the last fiscal year was encouraging, but there is nothing to brag about it because the report also suggests industries, on average, are not utilising 42.7 percent of their total capacity.

“This should be a food for thought for policymakers, as it indicates machineries and other resources deployed by industries are not being used efficiently. Efforts should now be made to look into every sector that has performed poorly and introduce policies that can ramp up production,” said Nara Bahadur Thapa, executive director of the Research Department of the NRB.

Some of the units that performed poorly in the last fiscal year were those engaged in processing of rice and production of sugar, bricks, vegetable oil and paper.

Their average industrial capacity utilisation ranged from as low as 28.8 percent for rice processing units to 39.3 percent for paper manufacturing factories.

It is not exactly known why units that process rice, which is a staple in Nepal, operated at such a low capacity. However, capacity utilisation of units that manufacture sugar, another staple, may have been hit by farmers’ reluctance to produce sugarcane because of delay in payments made by sugar mills, according to the report.

Nepal’s average industrial capacity utilisation has historically stood at below 60 percent. The best outcome in past several years is that of 2013-14 when average industrial capacity utilisation hovered around 59.3 percent. But this year’s report shows certain interventions can improve results.

For example, capacity utilisation of factories that produce cement hit 71.8 percent in 2016-17 from 54.9 percent in 2015-16. Capacity utilisation of manufacturing units that produce steel bars also jumped to 46.4 percent in 2016-17 from 19.8 percent in 2015-16. These factories operated at higher capacity because of surge in demand for construction materials in the aftermath of devastating earthquakes of April and May, 2015. “But another major factor for improvement in capacity utilisation was regular supply of electricity, as units that produce these construction materials are energy-intensive,” said Thapa.

Nepal was witnessing power cuts of over 10 hours per day before September 2016. Such a situation is unlikely to repeat again in the future, as Nepal is adding around 2,000 megawatts of electricity to the national grid in the next two to three years.

This is good news for the industrial sector, which was bogged down by power shortage for quite a long time. Also, improvement in business climate following successful completion of all levels of election, which is likely to usher in a period of political stability, is expected to stimulate the industrial sector.

Signs of improvement in performance of the industrial sector are already visible. Pashmina manufacturing units, for example, operated at a capacity of 98.5 percent in the last fiscal year, as against 88 percent in 2015-16. Another star performer was units engaged in production of animal feeds. They operated at 98.4 percent of their total capacity in 2016-17, as against 52.3 percent in 2015-16.

Also, factories that produce beer utilised 82.1 percent of their capacity in 2016-17, up from 62.8 percent in 2015-16, as demand for these products went up in the run up to first and second phases of local elections in May and June.

14.24°C Kathmandu

14.24°C Kathmandu