Money

NRB board on the path ‘to wreck the institution’

The board of directors of the Nepal Rastra Bank (NRB), the central bank, is mulling over taking a decision that is expected to be detrimental not only to the institution but other state-owned commercial banks operating in the country as well.

Rupak D. Sharma

The board of directors of the Nepal Rastra Bank (NRB), the central bank, is mulling over taking a decision that is expected to be detrimental not only to the institution but other state-owned commercial banks operating in the country as well.

Most of the NRB board members are now advocating for removal of a provision in the Employees Guideline that will pave the way for the central bank staff to continue working after 30 years in service.

NRB Governor Chiranjibi Nepal, two deputy governors Chinta Mani Siwakoti and Shiba Raj Shrestha, and board members Ramjee Regmi and Sri Ram Poudyal were long in favour of removal of the provision.

Now, another crucial board member, Finance Secretary Shanta Raj Subedi, has also come on board to lend support to the voice raised by the five, with the expression of the view that NRB’s retirement policy should be same as that of other government agencies.

At present, NRB staff must retire after 30 years of service or after reaching the age of 58, whichever comes first. But most of the government agencies force employees to retire on the basis of their age, which is 58, rather than on the basis of number of years in service.

“At a time when life expectancy has increased and people have started working for longer period, the retirement policy of the central bank has become obsolete. So, we need to rethink on it,” an NRB board member said on condition of anonymity.

If this advice is heeded, all employees at the central bank will be able to work till they reach 58, regardless of when they joined the institution. This implies people, who joined the NRB at the age of, say, 20, can serve the institution till the time they reach 58, taking up the number of years of service to 38, as against the current provision of 30.

This change in retirement policy, many at NRB say, will allow “older and especially unproductive staff” to continue working for the central bank, thereby reducing intake of “younger, smarter and techno-savvy” people. This will also bar competent young employees from climbing the rungs of career ladder at a desired pace, as most of the senior posts would be occupied by older employees.

Worse, the change in policy will encourage state-owned and state-run financial institutions like Rastriya Banijya Bank, Nepal Bank Limited and Agricultural Development Bank, which are already overstaffed, to follow suit. This is because the three institutions follow in the NRB’s footsteps to frame policies for employees.

“Since the NRB is the leader of the financial sector, it should look at the entire financial system before taking any decision. Otherwise, the result could be detrimental,” said former NRB governor Yubaraj Khatiwada, who had opposed the plan to remove the provision on compulsory retirement after 30 years of service while in office.

“But if there are plans to align retirement policies of the government and the NRB, then similar provision should be introduced for others working for the state,” Khatiwada said, referring to army and police who are allowed to retire based on number of years in service. “Such a change, however, could increase the government’s pension and other financial liabilities.”

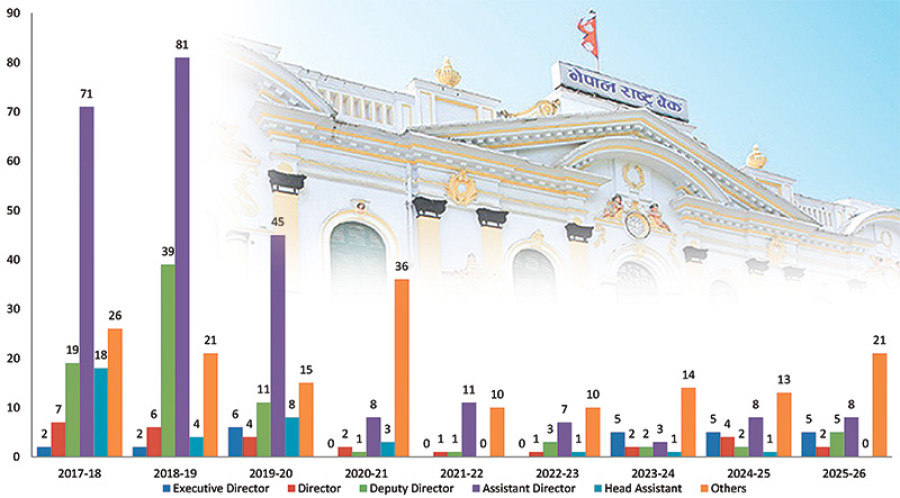

The NRB currently has a workforce of around 1,200 people. Of these people, 385 are retiring in the next three years. Majority of these employees are retiring because they have completed 30 years of service. And many employees retiring on the basis of number of years of service do not have proper educational qualification or have educational qualifications other than those stipulated by the NRB, central bank officials said.

“These people are pushing for removal of the provision on compulsory retirement after 30 years of service, so that they could serve the organisation for a longer period,” NRB officials said, adding, “It is sad the board is planning to serve the interest of small group of people rather than that of the institution.” The NRB had introduced the provision on compulsory retirement after 30 years in service around 12 years ago, as part of the Financial Sector Reform Programme launched in December 2000.

The Programme was introduced after two state-run banks-Rastriya Banijya Bank and Nepal Bank Limited-became technically bankrupt, as they had accumulated losses of around US$450 million, which was equivalent to 46 percent of the government’s annual budget and around 8.6 percent of the gross domestic product of that time.

While these two banks were on the verge of collapse, the NRB, the oversight agency, had failed to regulate their activities properly, as the regulatory body did not have quality human resources or overlooked those problems due to political pressure.

It is therefore not surprising that the Financial Sector Reform Programme had stressed on the need to strengthen the NRB and let it operate as an autonomous body. Currently, the NRB needs young blood more than ever because global financial sector regulations are rapidly changing and boom-and-bust cycles are becoming shorter. Also, the central bank now has to tackle complex issues like money laundering and terror financing, and promote digital finance to make the financial sector effective and efficient.

“So, it is not advisable for the NRB to take a decision in isolation,” Khatiwada said.

9.83°C Kathmandu

9.83°C Kathmandu