Money

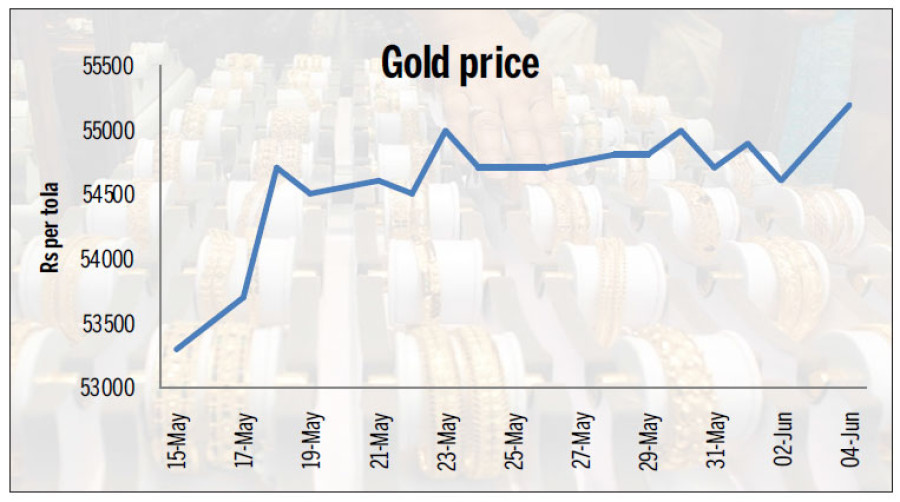

Gold price up 600 per tola to Rs55,200

Price of gold has taken an upward spiral in the domestic market, as price of the precious yellow metal rose to a six-week high in the international market on Friday.

Price of gold has taken an upward spiral in the domestic market, as price of the precious yellow metal rose to a six-week high in the international market on Friday.

Gold price rose by Rs600 per tola (11.66 grams) in the domestic market on Sunday to close at Rs55,200 per tola. Gold was traded at Rs 54,600 per tola on Saturday.

The jump in gold price in the local market, according to traders, has very little to do with domestic factors and was the result of hike in prices in the international market.

According to Reuters, bullion rose in the international market after disappointing US non-farm payrolls data.

This weighed on the dollar and lowered some expectations for more aggressive US interest rate increases this year.

“The US job growth slowed in May and employment gains in the prior two months were not as strong as previously reported, suggesting the labour market was losing momentum,” Reuters reported. “A slow recovery in the world’s biggest economy dents the likelihood for higher interest rates which benefits non-interest yielding and safe-haven gold.”

According to Tej Ratna Shakya, former president of the Federation of Gold and Silver Dealers’ Association (Fenegosida), the volatility in gold price in the international market has made it difficult for local traders to analyse the price trend.

“It is predicted that gold price would remain in between $1,200-$1,300 per ounce in 2017,” Shakya said. “All we can say based on this prediction is that price per tola will not go below Rs53,000 and won’t cross Rs55,000 mark.” On Friday, spot gold was up 1 percent at $1,277.76 per ounce in the international market, after hitting its highest level of $1,279.10 on April 21 and was headed for the fourth week of gains, according to Reuters.

The local market, which is seeing slowdown in bullion sales, meanwhile, is also feeling the heat of higher prices.

“Demand for gold remains subdued in between mid-May and mid-June, as it is a period with almost no auspicious occasion. Against this backdrop, steady rise in price has further discouraged people planning to buy gold,” Shakya said, adding that traders now waiting to see the international trend on Monday, when markets open after the weekend.

Sales of gold had started taking a dip since last month when first phase of local elections diverted people’s attention.

However, traders are upbeat about a bounce back in demand beginning mid-June when wedding season begins.

The Nepal Rastra Bank (NRB) has allowed banks to import 20 kg gold per day. Gold demand in the domestic market is estimated to hover around 30-35 kg per day

during peak season. “Regular imports and recycled gold at present are enough to cater to the market demand,” Shakya said.

9.89°C Kathmandu

9.89°C Kathmandu