Money

Nepal requests US to add products to trade preference programme

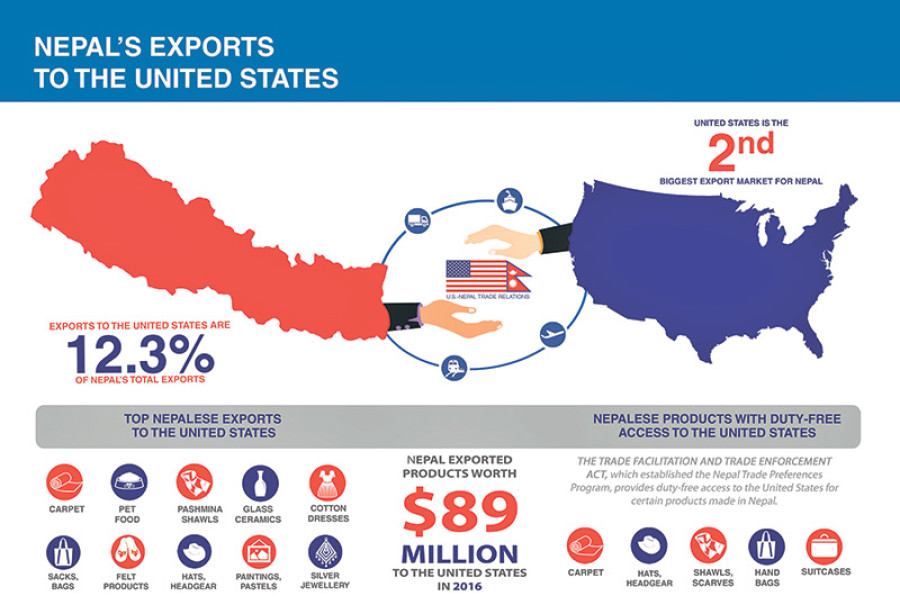

The government has formally requested the US to add more products to the Nepal-specific trade preference programme which provides duty-free access to a range of Nepali goods, such as carpets, bags, headgear, shawls and scarves, to the American market.

The government has formally requested the US to add more products to the Nepal-specific trade preference programme which provides duty-free access to a range of Nepali goods, such as carpets, bags, headgear, shawls and scarves, to the American market.

The request was made during the third meeting of the Nepal-US Trade and Investment Framework Agreement (Tifa) Council held in Kathmandu on Thursday.

“We have taken note of the request. We will convey the message to the US Congress, which is authorised to make amendments to the programme,” Mark Linscott, assistant US Trade Representative, who is in Kathmandu to take part in the Tifa Council talks, told the Post on the sidelines of an event called MaxTradeUSA.

The event was organised on Friday by the US Embassy in Kathmandu, in association with the Ministry of Commerce and the Federation of Nepalese Chambers of Commerce and Industry, to disseminate information on the new duty-free programme.

The duty-free programme, specially designed for Nepal, came into effect on December 15, 2016 following introduction of the US Trade Facilitation and Trade Enforcement Act by former US President Barack Obama. The Act was introduced to support Nepal’s economic recovery in the aftermath of devastating 2015 earthquakes.

Under the programme, Nepali products covered by 77 Harmonised Tariff Schedule are granted duty-free entry into the US till December 31, 2025.

This means goods like carpets and rugs, shawls, scarves, luggage articles, handbags, pocket goods, such as wallets, travel bags and other containers, headbands, blankets, hats, and gloves, which previously used to be subject to tariffs ranging from 5 percent to over 20 percent can now enter the US market at zero tariff.

However, such goods must be grown, produced, or manufactured in Nepal, with the cost of the Nepali materials plus the cost of processing standing at at least 35 percent of the product’s sales price.

“Made in Nepal is considered as an exotic brand in the US.... and holds special allure. We hope the products covered by the programme will carry that [reputation] forward,” US Ambassador to Nepal Alaina Teplitz said.

Although Nepalis have hailed the US government for introducing the Nepal-specific trade preference programme, many have said the list incorporates goods that are rarely exported to the US and has avoided items like readymade garments that make up a big chunk of Nepali exports to the world’s largest economy.

Exports of products covered by the programme, for example, stood at $6.8 million in 2016. In other words, these goods made up only 7.6 percent of the total exports of $89 million in that year.

Nepal has asked the US government to add more products to the list because of this reason.

However, the introduction of the new programme does not mean Nepali exporters will be barred from tapping another duty-free scheme called Generalised System of Preferences, or GSP, designed by the US government for developing countries.

“But the US importer must claim for either the Nepal trade preference programme or GSP duty-free treatment,” Linscott said.

- Enter a product’s name in the search box

- A list of harmonised tariff schedule (HTS) numbers associated with the product appears on the left side of the screen

- Select the item that best matches the description

- Identify the correct HTS subheading and look at the ‘Rates of Duty’ section and find the column for ‘Special’

- If the code ‘NP’ appears, then the product is eligible for duty-free treatment under the Nepal Trade Preference Programme

- The code ‘A’ identifies articles that are eligible for Generalised System of Preferences (GSP) facility; ‘A+’ indicates products eligible for least developed countries

9.68°C Kathmandu

9.68°C Kathmandu