Money

Rising recurrent spending poses fiscal risk: ADB

The government’s rising recurrent expenditure—almost a third of which is used to cover wages, salaries and retirement benefits of those included in the state’s payroll—has been posing a financial risk for Nepal, says the latest report of the Asian Development Bank (ADB).

The government’s rising recurrent expenditure—almost a third of which is used to cover wages, salaries and retirement benefits of those included in the state’s payroll—has been posing a financial risk for Nepal, says the latest report of the Asian Development Bank (ADB).

The warning comes at a time when the government raised recurrent budget for this fiscal year by 27.4 percent than a year ago.

A significant jump in recurrent spending is not considered good for the financial health of a country as most of the money is put into unproductive use such as consumption.

The government’s decision to raise the salary of civil servants by 25 percent is one of the reasons that led to surge in the country’s recurrent budget in the current fiscal year. This is expected to raise government spending on wages and salaries by 26.9 per cent to Rs 132.3 billion in 2016-17.

Despite this, the ADB report says the “overall wage bill of the public sector has been termed sustainable”. “But there are some risks of unsustainability with the increasing size of the security forces and the integration of Maoist ex-combatants [in the Nepali Army] as part of the peace process. There will also be pressure on medical and other benefits and future pension payments,” says the report ‘Mapping Fragile and Conflict-affected Situations in Asia and the Pacific: The ADB Experience’.

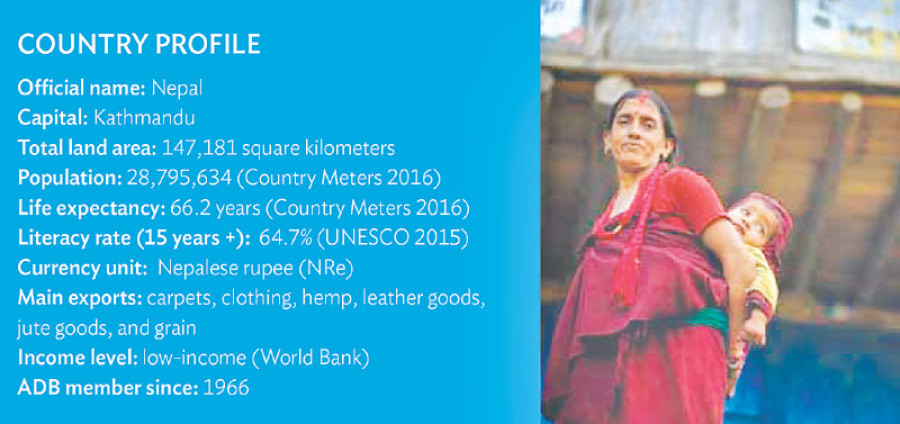

Although the Manila-based multilateral lending institution has already removed Nepal from the list of fragile and conflict-affected nations, the country’s profile has been included in the latest report, as “Nepal, which is in a transitional phase, still exhibits characteristics of fragility and needs special attention”.

While the successive governments in Nepal have stressed on fiscal discipline and the need to limit recurrent spending, the size of recurrent budget keeps inflating every passing year because of increment in wages, salaries, retirement benefits and grants.

In the current fiscal year, for instance, the size of retirement benefits jumped 28 percent to Rs 58 billion.

Funds allocated for retirement benefits and wages cum salaries make up almost 31 percent of the total recurrent budget of Rs617.2 billion allocated for the current fiscal year.

This fiscal, the government also raised grants, under the Constituency Development Programme, for each of around 596 lawmakers to Rs5 million from Rs2 million. Also, each of the 240 electoral constituencies are entitled to Rs30 million under the Constituency Infrastructure Special Programme in the current fiscal year—up from Rs15 million in the previous fiscal year.

These programmes, according to government officials, have had very little developmental impact in the past because lawmakers use most of the funds to build small projects or secure vote banks.

Yet funds have been allocated. It is therefore not surprising that the government’s spending on grants is expected to surge by around 27 per cent to Rs262.7 billion this fiscal year. This amount accounts for 42.6 percent of the recurrent budget allocated for this fiscal year. One of the reasons for the government’s inability to control these activities, according to the ADB report, is “influence of political patronage’ on “the public administration”.

19.12°C Kathmandu

19.12°C Kathmandu