Money

Stock market scales fresh peak

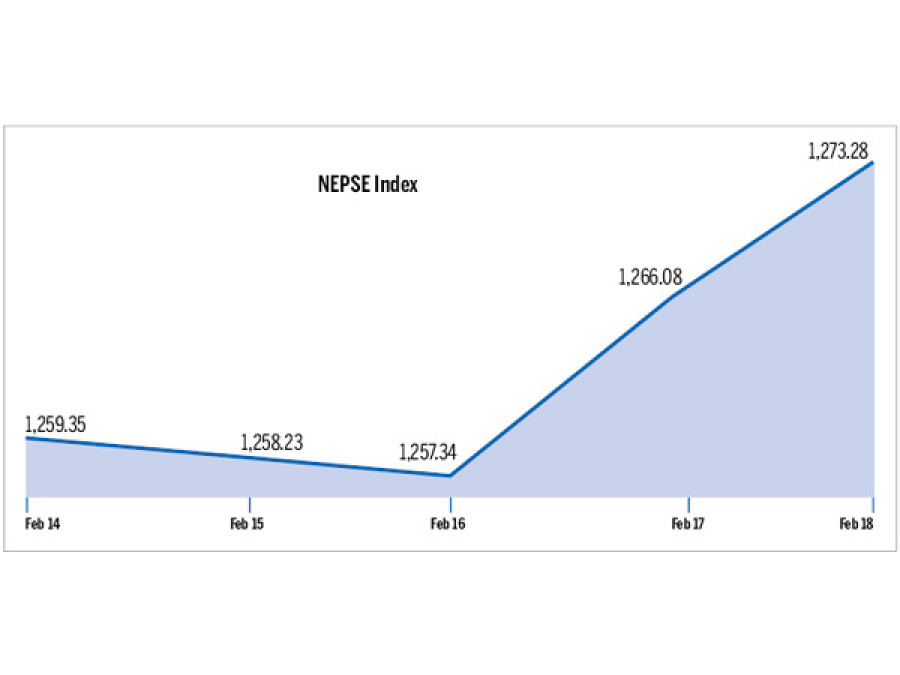

Nepal Stock Exchange (Nepse) last week gained 13.93 points to hit yet another record high of 1,273.28 points.

Nepal Stock Exchange (Nepse) last week gained 13.93 points to hit yet another record high of 1,273.28 points.

The market that opened at 1,259.35 points on Sunday fell for the following two days before surging in the last two days of the week. The week’s biggest gain came on Wednesday, when the benchmark index rose 8.74 points.

Stockbrokers attributed the rise, for over a month now, to factors such as high liquidity in the banking system that has brought down interest rates and better second quarter results of banks and financial institutions.

Ananta Kumar Poudyal, managing director of Online Securities, said despite the Tarai unrest and Indian blockade, good financial results of a number of companies boosted investor confidence. “Besides, most of the listed companies’ announcements of bonus and right’s shares issuance as a part of their plan to boost capital also contributed to the rise,” he said.

Ram Krishna Tiwari, managing director of Oxford Securities, said the regulatory bodies’ works towards ensuring smooth functioning of the market also encouraged people to invest in stocks. “Securities Board of Nepal recently trained 26 stockbrokers by sending them to India,” said Tiwari, adding the regulator has also been issuing circulars to facilitate online trading, besides capacity building.

Of nine trading groups, six posted gains. Hotels (up 61.95 points) was the top gainer, followed by manufacturing, insurance, commercial banks, development banks and finance companies. Hydropower and others were down 8.31and 3.52 points, respectively. The trading group was stable at 201.38 points.

The sensitive index that measures the performance of ‘A’ class companies also rose 3.14 points to close at 274.85 points.

The market transaction volume jumped 33.25 percent to Rs2.53 billion, while the number of traded shares rose to 8,470,750 units from 3,316,760.

Nepal Bank posted the highest individual transaction volume—Rs178.51 million. It was followed by Nepal Investment Bank, NMB Bank, Nepal Investment Bank (promoter’s shares) and Nepal Bangladesh Bank. Siddhartha Equity Oriented Scheme took the pole in terms of the number of shares traded (3,581,000 units).

Stockbrokers expressed hope the market would grow in the future. “High turnover almost every day sheets the market will rise further even if there are a few short-term falls,” said Tiwari.

Meanwhile, Nepse listed 1 million primary shares of Sajha Bikas Bank. It also registered bonus shares of Nabil Bank, Narayani National Finance and Sindhu Bikas Bank, and right’s shares of Machhapuchchhre Bank.

Nepal Bank 178.51

Nepal Investment Bank 161.36

NMB Bank 125.87

Nepal Invest Bank (Pro) 125.78

Nepal Bangladesh Bank 96.58

Hotels 61.95

Manufacturing 28.6

Insurance Companies 26.42

Commercial Banks 19.12

Development Banks 7.56

Finance Companies 6.71

Hydropower Companies 8.31

Others 3.52

10.12°C Kathmandu

10.12°C Kathmandu