Miscellaneous

Liquor companies, breweries given highest tax exemption

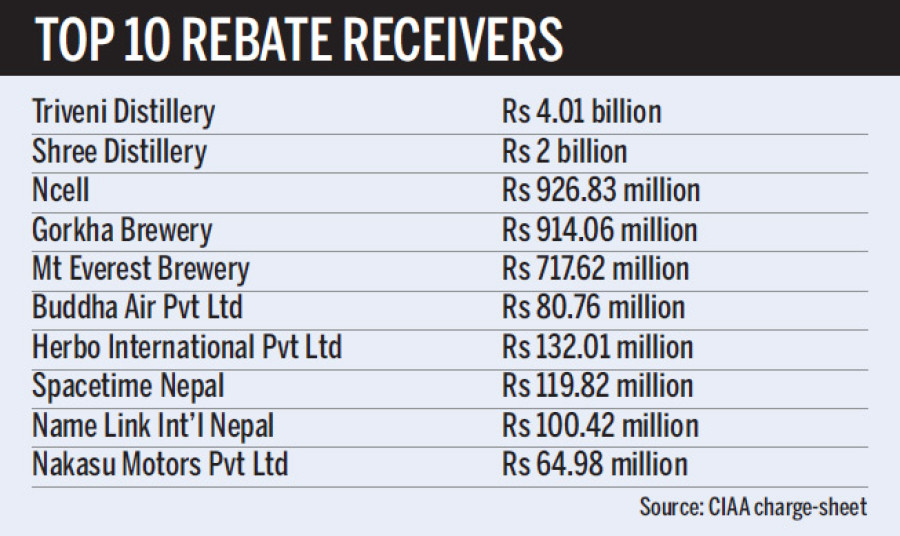

Five alcoholic beverage companies received the largest chunk of tax exemption from the Tax Settlement Commission (TSC), according to the charge-sheet of the Commission for Investigation of Abuse of Authority (CIAA) filed on Sunday at the Special Court against three TSC members.

Prithvi Man Shrestha

Five alcoholic beverage companies received the largest chunk of tax exemption from the Tax Settlement Commission (TSC), according to the charge-sheet of the Commission for Investigation of Abuse of Authority (CIAA) filed on Sunday at the Special Court against three TSC members.

The anti-graft body on Sunday filed a Rs 10.2-billion graft case each against TSC Chairman Lumba Dhwoj Mahat, member Umesh Dhakal and member secretary Chudamani Sharma, also the suspended director general of the Inland Revenue Department.

The trio have been booked for settling taxes of as many as 45 companies in a dubious way, with some of the companies getting up to 99 percent rebate.

Triveni Distillery, Shree Distillery, Gorkha Brewery, Mt Everest Brewery and Himalayan Brewery received tax exemption worth Rs 7.66 billion.

Triveni Distillery was given the highest tax exemption of Rs 4.01 billion, Shree Distillery got tax exemption of Rs 2 billion while Gorkha Brewery and Mt Everest Brewery received tax exemption of Rs 914.06 million and Rs 717.62 million respectively.

CIAA officials said the embezzled amount could go up as it is the anti-graft body is yet to investigate over 1,000 files related to tax exemption.

The chargesheet prepared by the CIAA shows the tax exemption given to various enterprises was higher than what is mentioned in the TSC report.

For example, the tax exemption given to Triveni Distillery stands at Rs 4.01 billion in the chargesheet, while the TSC report shows the company was given Rs 3.29 billion tax exemption.

“Further investigation by the CIAA established higher tax exemption,” said Khagendra Prasad Rijal, assistant spokesperson for the CIAA.

“The TSC did not even follow tax settlement work plan prepared by it for these companies,” states the CIAA chargesheet.

As per TSC Act 1976, the TSC can handle cases only after they are withdrawn from the revenue tribunal. However, the TSC seems to have settled tax cases of 32 enterprises who had not withdrawn their appeals from the revenue tribunal.

“This shows the malicious intent on the part of the TSC members,” said Rijal.

According to the CIAA, a total 16 enterprises including Shree Distillery whose cases were under consideration in revenue tribunal also were given tax exemption.

As many as 20 companies including Herbo International, which had earlier evaded tax through fake VAT bills, have also been given tax exemption.

The CIAA has charged the TSC members with grating tax exemption of millions of rupees based only on the claims of the enterprises, without seeking to asses any evidence on the basis of which they had applied for tax waiver.

The CIAA has sought recovery of a total of Rs 30.06 billion from Mahat, Dhakal and Sharma.

9.7°C Kathmandu

9.7°C Kathmandu