Opinion

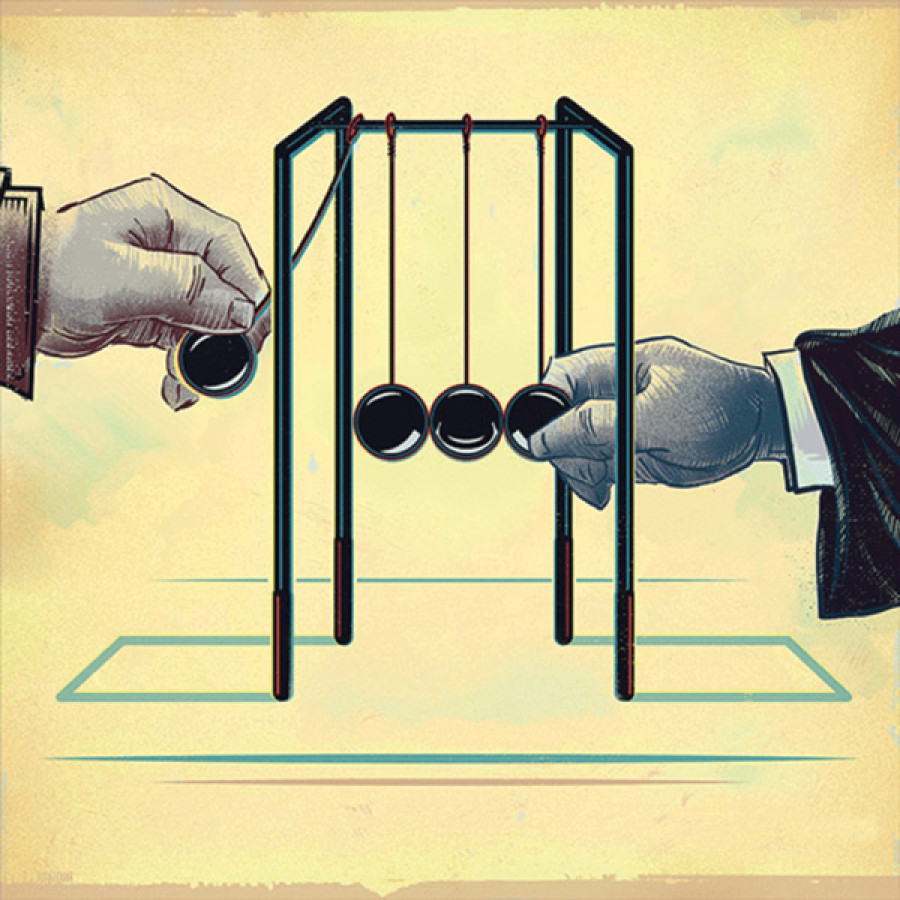

The result of appeasement

In the past couple of months, there have been reports that the demonetisation in India of 500 and 1000 rupee notes has had an adverse impact on Nepali traders, the business community and the industrial sector.

Shyam Kc

In the past couple of months, there have been reports that the demonetisation in India of 500 and 1000 rupee notes has had an adverse impact on Nepali traders, the business community and the industrial sector. These are the sectors that should not have been affected by the demonetisation decision, and yet they are. The ones who should really have been affected are those who go to India in search of work and bring back their savings in the form of Indian currency. Also affected are the Gorkha soldiers who serve in the Indian army.

These are the people who need all possible assistance from the authorities to ensure that the money they have is easily converted into Nepali currency. One can be sure that many Nepalis living in remote parts of the country may not even be aware that the notes have been demonetised. They should not lose their earnings simply because of ignorance or lack of information. These people will really suffer if help does not reach them.

Sticking to legal tender

The Indian government announced the demonetisation of the two notes out of the blue in November last year. It did this, ostensibly, to unearth black money and prevent illegal amassing of fortunes. In India there are both supporters and opponents of this daredevil move. It has affected the Indian people in many ways. What is of interest to this country is how the ordinary people here, who have the old 500 and 1000 rupee notes, will be able to tackle the situation. The

government and the Nepal Rastra Bank have taken up the issue with the Indian authorities and, sooner or later, the problem can be expected to be solved. However, the Indian currency move has also brought some important issues for Nepal to light.

As an independent country, Nepal does not allow any foreign currency as legal tender. The only legal tender is the Nepali rupee. We Nepalis are only allowed to keep Nepali rupees and we are obliged to use them for transactions within the country. But this is far from the reality on the ground. We tend to hoard foreign currencies, especially in recent times, for fear that the Nepali rupee might be devalued. There was a time when the Indian rupee almost replaced the Nepali rupee, but thanks to the foresight of some of our leaders, this did not happen. And even in the Tarai, where the Indian rupee once held sway, the Nepali rupee became the real legal tender and is since being used for transactions. This is no small achievement in a country which was at that time mired in ignorance and illiteracy and which even today has an open border with another country.

It is well known that big and, more importantly, powerful countries try to impose their will on smaller and less powerful ones. It would be good to remember that even the small but militarily better equipped Nepal tried to enforce its will on Tibet, which led to the Nepal-Tibet war of the mid-19th century.

Unseen trade

Without blaming any external forces, it would be wise to think just what the Indian demonetisation might have done to those who hoarded Indian currency in Nepal. This money might have come through legitimate channels such as trade and business deals and such income might even have been subject to taxes in Nepal (though such a possibility looks remote). The point is that apart from those who live near the Nepal-India border and cross over for daily necessities, people and companies that have business deals with their Indian counterparts should have done so in a transparent manner through the use of commercial banks. Nepal’s visible trade with India accounts for 65 percent of the total. But there is also unseen trade where cash is used. Such transactions could also mean bypassing customs and therefore not paying custom duties and other taxes. Such trading usually results in the hoarding of currencies. The ordinary people who cross the border almost every day to get their daily necessities can hardly be suspected of hoarding 500 and 1000 Indian rupee notes; and if they do keep some cash, it will probably be in lower denominations.

Preventing foreign currency hoarding—especially of Indian currency—will require the government to take difficult measures that could be met with resistance from India. Borders may have to be checked more tightly and this may not be agreeable to some people. This will not only prevent unseen trade but also help counter allegations made from time to time that ‘terrorists’ enter India through Nepal. These are some of the hard decisions that will have to be taken sooner or later, for this country cannot always adopt a policy of appeasement towards others at huge costs to itself. These measures will certainly mean some pain to people in the short run, but in the long run, they will prove to be a boon to them and their country.

15.12°C Kathmandu

15.12°C Kathmandu