National

Forex reserves down to fund imports for just a little over six months raises alarm

Questions arise if import control measures have worked and government is doing much to address economic woes.

Prithvi Man Shrestha

Nepal’s foreign exchange reserves have slid to a level to sustain imports of goods for less than seven months, for the first time in the last six years, setting off alarm bells. Even the import control measures taken by the Nepal Rastra Bank do not seem to be yielding the desired results, and economists say immediate intervention is a must.

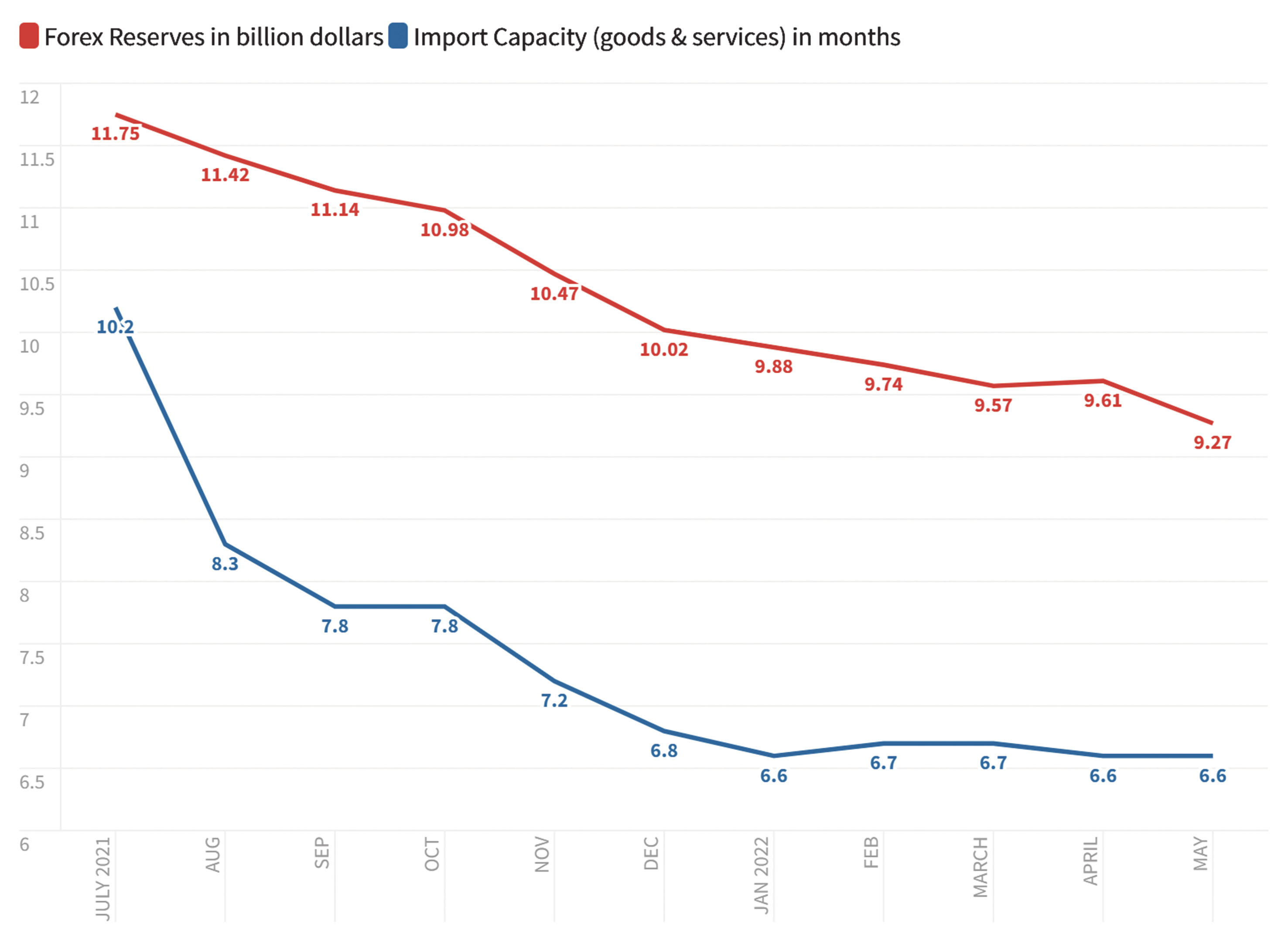

As of the first 10 months of the current fiscal year 2021-22, Nepal’s foreign exchange reserves decreased by 21.1 percent to $9.28 billion in mid-May 2022 from $11.75 billion in mid-July 2021, according to Nepal Rastra Bank (NRB).

The current chest is sufficient to sustain import of goods and services for just 6.6 months against Nepal’s target of maintaining the foreign exchange reserves enough to cover imports of at least seven months.

In mid-July last year, the country had foreign currency reserves adequate to import goods and services for 10.2 months. The reserves slid below the seven-month mark in November, and there has been a gradual decline since.

In late April, the government banned imports of at least 10 goods, which it considers luxury or non-essential, till the end of the current fiscal year in a bid to stop the country’s foreign exchange reserves from depleting further.

Imports of liquor and tobacco products, diamonds, mobile sets priced over $600, colour television sets bigger than 32 inches, jeeps, cars and vans except ambulances, motorcycles of over 250CC, dolls, cards and snacks have been banned.

The government also imposed strict controls on the import of gold jewellery and hiked duty on bullion imports.

Experts say questions remain whether the reported foreign exchange reserves reflect the true picture amid reports of banks and financial institutions approving large amounts of loans without the availability of loanable funds.

According to a report published by the Post’s sister paper Kantipur on June 23, as many as 27 commercial banks approved Rs383 billion in loans as of mid-May amid liquidity shortages.

“Many letters of credit (LC) might have been opened for importing goods whose payment is pending,” said Dipendra Bahadur Kshetry, a former central bank governor. “Foreign exchange reserves might decline further if payments due to all the letters of credit are made.”

Citing the LC trend, experts say there has been no control on imports of the products that the government has barred from importing.

Central bank officials also don’t reject such a possibility.

“We don’t have details about LC related liabilities immediately,” said Prakash Kumar Shrestha, chief of the economic research section at the central bank.

If the LC-related liabilities have been paid, foreign exchange reserves must be much lower than what is shown by the central bank, and officials and experts say that is a major concern.

“We are at a critical juncture, which is evident from the existing level of foreign currency reserves,” said Nara Bahadur Thapa, former executive director of the Nepal Rastra Bank. “As we have become an increasingly import-dependent country, we must have foreign currency enough to sustain imports for seven to ten months, at least.”

Nepal’s ratio of imports of goods and services to gross domestic product (GDP) has been on the rise over the last decade. According to the Central Bureau of Statistics, the country’s estimated import to GDP ratio stood at 41.49 percent in the current fiscal year, compared to 29.17 percent in the fiscal year 2011-12.

“This suggests our increasing dependence on imports for which we need more foreign currency. In fact, we rely on imports for our living and carrying out development activities,” said Thapa.

In mid-August 2020, the country had foreign exchange reserves enough to sustain imports of goods and services for 15.6 months when the country had lifted a nearly four-month-long lockdown imposed to curb the spread of the coronavirus.

Not only due to increased imports of goods and services, foreign exchange reserves are facing pressure also due to rising global prices. Because of rising inflation, Nepal is facing the problem of paying more even for buying fewer goods.

According to Manik Lal Shrestha, former head of the statistics division at the International Monetary Fund (IMF), global rises in commodity prices are responsible for increasing Nepal's import bill by around 20 percent since the beginning of the fiscal year 2021-22.

“Since the beginning of the current fiscal year, rising prices have weighed on import bills by 20 percentage points,” he said at an interaction on the country’s economy organised by the Society of Economic Journalists Nepal in Kathmandu in early May.

Kshetry, the former governor, also said it is necessary to maintain foreign exchange reserves at a comfortable position considering the risk of foreign currency outflow due to rising prices of commodities and rise in import costs.

In order to boost foreign exchange reserves, the country either has to control the outflow of foreign currency by strictly controlling imports of goods and services or boost exports that can earn foreign currency as well as promote other sources such as remittances, foreign aid, foreign direct investment and tourism.

Officials and experts doubt if the government’s effort to control imports has worked as import figures continue to remain high.

In December last year, the central bank made it mandatory for importers to keep a 100 percent margin amount to open a letter of credit to import 10 types of goods.

These goods included alcoholic drinks; tobacco; silver; furniture; sugar and foods that contain sweets; glucose; mineral water; energy drinks; cosmetics; shampoo, hair oils and colours; footwear; umbrellas; and construction materials such as bricks, marble, tiles and ceramics.

Motorcycle and scooter importers had to keep 50 percent margin amount, and importers of diesel-powered private automobiles also needed to keep 50 percent margin amount compulsorily.

And the central bank’s yet another directive issued on February 9 increased the number of import items requiring 100 percent cash margin to 43, while it fixed the cash margin needed for importing four types of goods at 50 percent.

Monthly figures since mid-January show no significant decline in imports.

For example, Nepal’s monthly import in Paush (mid-December to mid-January) stood at Rs 160.9 billion which slightly declined to Rs148.1 billion the following month (mid-January to mid-February) but again rose to Rs161.3 billion in the month of Falgun (mid-February to mid-January), according to the central bank statistics.

In Baishakh (mid-April to mid-May), imports decreased to Rs137.99 billion, according to the central bank.

But imports climbed to Rs158.57 billion in Jestha (mid-May to mid-June), according to the data from the Customs Department.

“Import control measures have not been very effective. There has not been any significant drop in imports,” said Shrestha of the central bank. “Despite reduced credit flow, continued high imports have raised questions if they were real imports or fake and if traders have informal channels such as Hundi to make payments.”

He said that as long as there are aggregate demands in the economy, the traders seek to supply whichever way possible.

Continued high imports have also raised questions about the implementation of the central bank’s import control measures.

“We cannot rule out the possibility of certain importers taking loans from one bank to maintain the cent percent margin in another bank to open a letter of credit to import products discouraged by the government,” said Thapa, the former executive director at the central bank. “The objective of import control measures taken by the central bank is to deny access to bank loans for importing certain goods. The measure might not have been implemented properly.”

With imports continuing to remain high, despite improvement in inflows of remittances and tourism earning, there continues to be pressure on foreign exchange reserves.

Yet another source of foreign currency is foreign aid. But with the government failing to spend the capital budget, there has not been any significant inflow of foreign aid in the first nine months of this fiscal year.

According to the Public Debt Management Office, Nepal borrowed a total of Rs111.68 billion between the start of the current fiscal year and the third quarter.

Of this, only Rs12.21 billion is from external sources and the remaining Rs99.47 billion is from internal sources. Foreign direct investment has continued to remain insignificant in the country.

“The cavalier approach to foreign exchange expenses must be stopped,” said Thapa. “The government also must expedite the projects being developed under foreign aid so as to receive reimbursement in foreign currencies. More efforts should be made to attract foreign direct investment.”

13.2°C Kathmandu

13.2°C Kathmandu