National

Tax authority’s excise sticker procurement bid faces yet another legal hurdle

The Supreme Court last week issued an interim order against the procurement process at a time when the tax authority is facing a shortage of different types of stickers.

Prithvi Man Shrestha

Officials at the Department of Inland Revenue have once again hit a roadblock in their bid to procure excise duty stickers for liquor and tobacco products being sold in the country. This time, the issue could even halt the production and distribution of liquors and tobacco in Nepal.

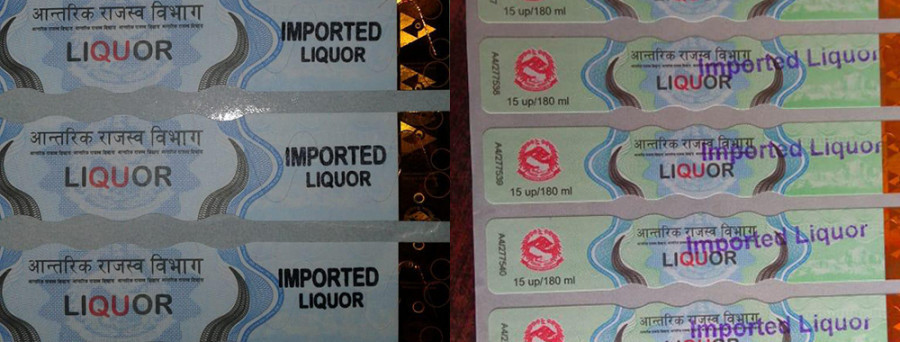

While the department wants to select the supplier of the stickers, which are pasted on liquor and tobacco products to indicate that their excise duties have been cleared, through an international bidding process, domestic suppliers want the department to give them priority in the process.

In the latest turn of events in the dispute, the Supreme Court last week issued an interim order halting the procurement process in response to a writ petition filed by Manohar Raj Ghimire of Mirage Printing Solution and Sishir Nahata of Sprint Printing and Packaging Company.

In the writ petition, they had argued that the department failed to honour the court's previous ruling that had called for prioritising domestic printing presses. “The Supreme Court last week halted the procurement process by issuing interim order,” Gajendra Thakur, deputy director-general at the department. “We have been ordered to submit clarification regarding the procurement process within 15 days.”

The department had issued a fresh tender in October for eight billion pieces of stickers. This was the second time in as many years that officials faced obstructions executing the tender.

In November last year, the court had issued an interim order against the procurement plan after Ghimire had filed a writ petition at the court arguing that the tax authority discriminated against domestic printing firms.

The latest writ petition was filed after the tax authority opened the bids to award the contract.

In February this year, the Supreme Court had cleared the path for the tax authority to move ahead with the tender process even though it had issued interim order in November halting the process. But, the court had told the tax authority to try to accommodate dometic printing presses by adopting a policy of “positive discrimination” while procuring stickers through a fresh bidding process.

The court had also ordered the tax authority to study the prospects of procuring the stickers from domestic printing presses.

“Based on the recommendation of the task force formed to comply with the court’s decision, we had invited a fresh global tender,” said Thakur. “The study had found that as there weren’t any printing presses in the country registered as a security printing press, international bidding was deemed necessary to ensure that the stickers had security features to discourage the counterfeiting of stickers in the market.”

He claimed that despite efforts to accommodate domestic printing presses in the process, it wasn’t possible to do so as printing presses are incapable of delivering the desired quality.

“We have adopted more flexibility in this year’s tender notice. For example, even the printing press without any experience of printing the bank notes or postal stickers can participate. Even presses with ISO 14298 certification have also been deemed eligible this year,” Thakur added.

The Supreme Court’s interim order and yet another legal battle it has ensued regarding the tax authority’s sticker procurement plan has once again created uncertainty over the sticker procurement process.

The department is already out of different types of stickers. It has been using stickers meant for one type of liquor or tobacco for another type of liquor or tobacco products as well. “Without excise duty stickers, the products can’t go to the market. This can hit production and distribution of liquor and tobacco companies and vital revenue for the government,” said Thakur. “The presence of counterfeit stickers will also hurt genuine businesses.”

Even though the Supreme Court in February last year allowed the tax authority to move ahead with its plan to procure stickers, the company selected for printing the stickers didn’t show up to sign the contract with the department.

Indonesian Perusahaan Umum Percetakan Uang Republik Indonesia (Perum Peruri), was selected to print and supply the stickers in March. As per the Public Procurement Act, the tax authority was supposed to award the contract to the second lowest bidder, which was a Lithunian company. But, the department refused to do so, citing technical issues.

The Lithunian company then moved the Supreme Court citing section 27(6) of the Public Procurement Act, which says contracts should be awarded to the second-ranked bidder if the first-ranked bidder refuses to sign the deal. This created further problems for the department to issue a fresh tender. The court later decided in favour of the tax authority.

With last year’s procurement process failing to materialize, the department authorised the Janak Education Material Centre to print nearly 100 million pieces of stickers for cigarettes and chewing tobacco products as a stop-gap measure.

“We have been printing 3-3.5 million stickers daily,” said Chitra Acharya, spokesperson for Janak Education Material Centre. “With security being provided by army personnel, printing work has continued.”

According to the centre, it is printing the sticker with an acceptable level of security features based on whatever equipment and materials it has available. “We cannot ensure all the security features that were there on stickers printed abroad,” said Acharya.

But, liquor and cigarette producers say that they are concerned with the quality of the stickers. “Production of liquor and tobacco has not stopped due to the shortage of stickers so far,” said Ramesh Shrestha, president of Nepal Beverage and Cigarette Industries Association. “But, the tax authority is giving us stickers that don’t match with our products. We are also concerned that the tax authority’s failure to ensure quality stickers could lead to use of counterfeiting of stickers and this could hurt genuine producers of liquor and tobacco.”

9.6°C Kathmandu

9.6°C Kathmandu