National

Stock of excise duty stickers for domestic liquor and tobacco products depleting fast

Tax officials say they have few options—either using stickers meant for other types of products or put a halt to sales of domestic liquor and tobacco product.

Prithvi Man Shrestha

As per Excise Duty Regulations, liquor and tobacco manufacturers and importers must paste excise duty stickers on their products in order to sell them in the market

Even as the stock of stickers is depleting fast, the tax authority does not have any immediate alternative, as the Supreme Court on November 15 had issued an interim order putting a halt to the procurement process for new stickers through an international competitive bid. The department had planned to procure around 8 billion stickers for use over the next two years.

“We are running out of stickers to be placed on some highly saleable liquor products within a month or a month and a half,” said Thaneshwor Gautam, deputy director-general at the Inland Revenue Department. “It has created a situation where we may have to lose a huge amount of revenue.”

Excise duty is one of the major resources of revenue for the government. But the department said the excise duty collection has been disappointing compared to most other types of taxes.

The growth rate of excise duty collection stood at just three percent during the first half of the current fiscal year against the annual growth target of 30 percent, according to the Finance Ministry.

During the first six months of this fiscal year, the government collected excise duty amounting to Rs63.65 billion, according to the Finance Ministry.

Officials at the tax authority said that excise duty stickers for liquors with 40 percent and 70 percent alcohol by volume, beer and cigarettes are high in demand.

“As per our initial estimate, we will run out of all stickers by mid-June,” said another official at the tax authority who did not want to be named because he was not allowed to speak to the media. “Given the decreased production of alcoholic and tobacco products in recent months, we may possibly be able to make the stickers available until mid-July.”

If the tax authority fails to arrange a new supply of stickers before all the remaining stickers are finished, it may either have to allow liquor producers and sellers to sell their products without excise stickers or halt all sales.

The department sells over 40 different stickers for various categories of liquors and cigarettes.

The tax authority has a few options for the time being.

“Once the stickers meant for certain types of products are finished, we may use stickers meant for other types of products by making a manual adjustment,” said another senior official at the department who also requested anonymity.

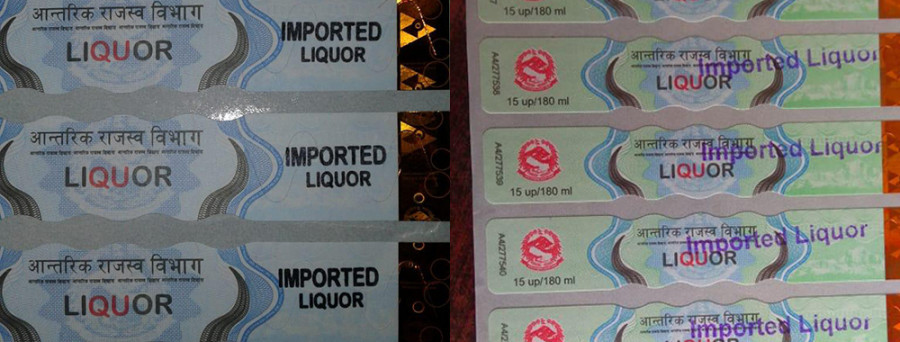

The tax authority has already been using stickers meant for domestic liquor for imported liquors by manually putting a stamp that reads “imported” as it ran out of stickers for imported liquors.

The other option the department has is using around 600 million stickers which are inferior in quality.

Officials said they were supplied by Perum Peruri, an Indonesian security printing firm, in the first instalment.

“We received their replacement later. The first consignment of stickers, which were of inferior quality, is still with us, and we might be forced to use those in the event of a crisis,” said the official.

Tax officials admit that these options are risky as they may lead to tampering of stickers which may mean an increased presence of counterfeit stickers in the market. This will affect the original manufacturers and importers of liquor and tobacco products and cause revenue losses for the government.

“Nepali tobacco companies are already suffering from counterfeit cigarettes in some Tarai districts,” one tax official told the Post.

Last month, in interviews with the Post, liquor manufacturers and producers had expressed concern about the possibility of counterfeit products making into the market due to a lack of excise duty stickers.

As the situation is worsening, tax officials said that they are just waiting for the Supreme Court verdict on the issue. The next hearing has been scheduled for February 24. The court had issued its order in response to a writ claiming that the tender barred domestic printing companies from participating in the bid.

In early November last year, just days before the Supreme Court order, the parliamentary Public Accounts Committee had also ordered the government to immediately suspend the bid for the supply of excise duty stickers immediately, arguing that the tender process barred domestic players from participating.

But, tax officials said that the tender notice didn’t bar domestic players. They said it had only opened the door for foreign players given that there is no security printing registered in Nepal.

“In its instruction, the Public Accounts Committee of Parliament has told us to ensure printing of the stickers in Nepal by taking necessary security measures,” a tax official said. “But we didn’t talk about physical security but security features in the stickers so that the use of counterfeit stickers could be controlled.”

There was also pressure from the Ministry of Communication and Information Technology on the Finance Ministry to stop the tender for stickers on the grounds that it was in negotiations to set up a dedicated security printing press in the country. On the same grounds, the Department of Passports had also cancelled the global tender for e-passports, whose stock is also depleting fast.

Officials, however, said that there’s no certainty over when, or if, the government will procure its own security printing press to print passports and excise stickers.

In the past, excise stickers used to be printed by the government’s Department of Printing. Officials at the department said that in light of several problems due to weak security features, they had started procuring excise duty stickers from abroad.

9.7°C Kathmandu

9.7°C Kathmandu