National

Why Nepal's social security scheme has failed to take off

Employers are apprehensive about signing up to the programme, workers are not fully aware of the scheme, and the government has failed to convince contributors..jpg&w=900&height=601)

Chandan Kumar Mandal

The contribution-based Social Security Scheme remains one of the most ambitious programmes of the KP Sharma Oli administration. The programme was rolled out in November last year, aiming to protect and secure private sector employees whose safety and welfare has long been a cause for concern.

The government aimed to serve nearly 3.5 million people in a national campaign to ensure the social security of private-sector workers with a comprehensive welfare package. The launch was praised by both labour rights organisations and the private sector as a much-needed step towards dignifying labour. However, this initial euphoria didn’t sustain and the programme hasn’t done what officials hoped it would.

Here’s why, despite its importance, employers and workers haven't fully embraced the scheme yet.

What are the attractions of the Social Security Scheme?

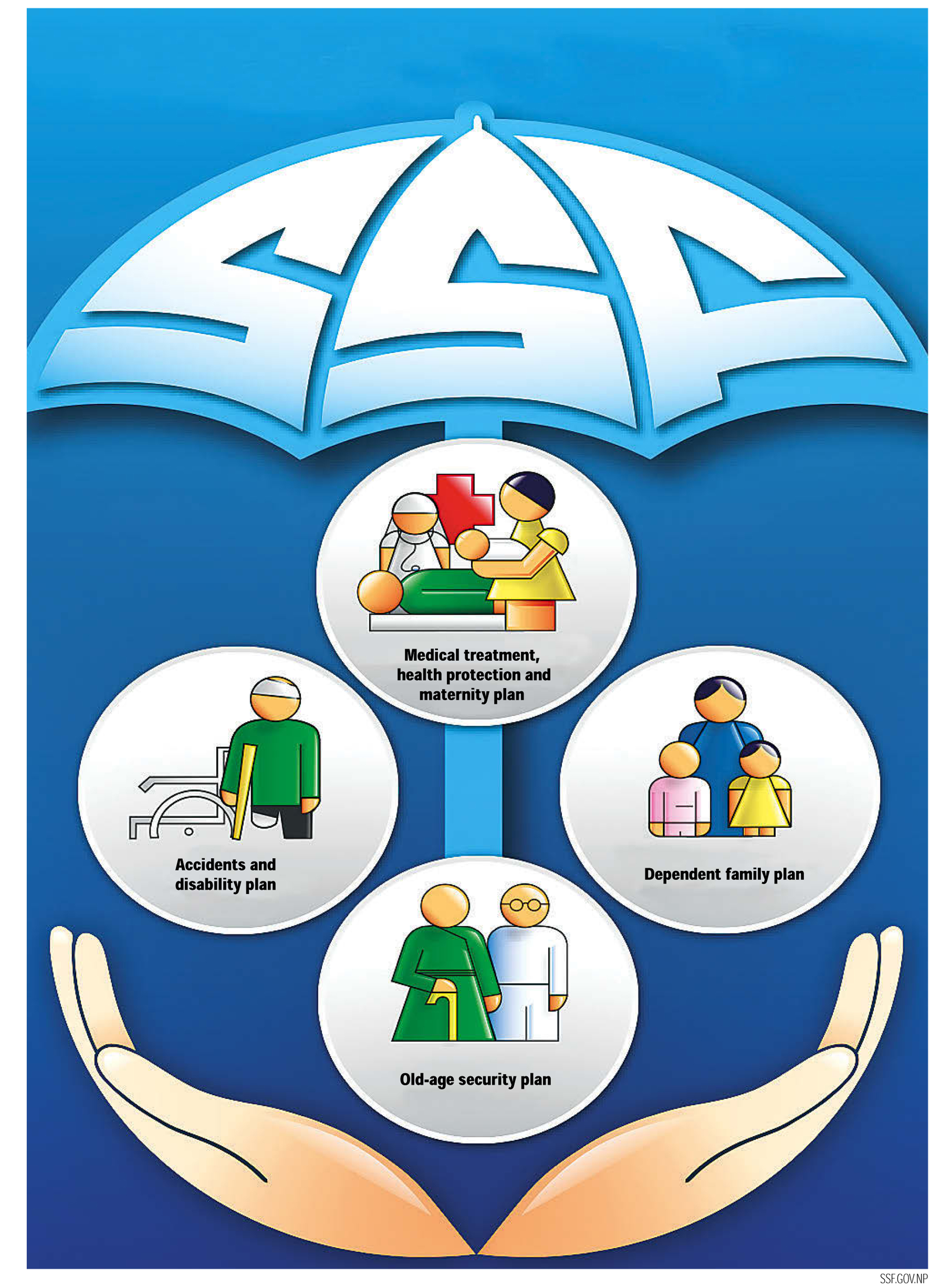

Workers from the private sector are offered financial security under four categories of support—medical treatment, health protection and maternity plan; accidents and disability plan; dependent family plan; and old-age security plan.

Workers are entitled to accident and disability security plan compensation from the first day of enrolment. In the case of workplace accidents and disabilities, financial support is provided to the workers immediately. A worker also gets financial support if s/he dies or is injured en route to the workplace from home, or vice versa.

The fund bears all the expenses of occupational diseases for workers, after they have contributed for two continuous years. In case of accidents outside the workplace, workers will receive a maximum aid of Rs700,000.

The scheme also ensures similar coverage for family members for their lifetime in case of the worker’s death. The worker’s spouse receives a monthly pension equivalent to 60 percent of their basic salary of the last job for a lifetime. A deceased worker’s children receive 40 percent of their parent’s monthly salary as educational support until the age of 18. If the deceased worker does not have any spouse or children, parents of the worker get 60 percent of their monthly salary as pension.

According to Purna Chandra Bhattarai, a labour expert and former government secretary, the social security scheme is one of the measures for protecting workers’ rights and shielding them from any kind of discrimination.

“A programme like social security is not only a good scheme but it is absolutely necessary for protecting workers’ rights and safety. Implementation of such a scheme ensures that a worker does not face any injustice in the long run,” said Bhattarai.

How does a worker sign up and contribute to the scheme?

Enrolment starts with the employer initiating the registration process. Only after the employer has registered and submitted details of their employees can workers sign up and start contributions.

Once a worker is enrolled, they receive a unique social security number and an identity card. The same number and identity card work even if the employee switches jobs.

As the name suggests, both employers and workers are required to contribute to the Social Security Fund, before registered workers are entitled to the schemes.

As per the working procedure, an amount equivalent to 31 percent of a worker’s basic salary—11 percent deducted from the worker’s monthly salary and 20 percent employer’s contribution— is deposited to the fund.

Of the total monthly contribution, 1 percent goes to medical treatment, health protection, and maternity scheme; 1.40 percent to accidents and disability plan; 0.27 percent to the dependent family plan; and 28.33 percent to pension or old-age security scheme.

What are the conditions for accessing the entitlements?

For accessing the scheme’s treatment services and medicine plan—which covers doctor’s fees, hospital charges, test and medicine costs, and travel expenses—a worker must have contributed to the fund for a minimum of six months. By doing so, the worker is ensured for the next six months as well.

In order to receive maternity coverage for herself or a male worker’s wife, workers should have deposited monthly tranche for at least 12 months (in 18 months). Maternity support covers regular pregnancy tests, hospital admission, surgery, and three months of full treatment for the newborn. It also provides one month of basic salary for the care of the mother, financial support in case of miscarriage of 24-week baby or stillbirth.

If the worker has contributed for 15 years and attained 60 years of age, s/he will be entitled to the pension plan. As per the scheme’s operational directives, if the worker turns 60 but has not contributed for 15 years then s/he will get all the money deposited back with interest. However, workers joining the service from this fiscal year must go for the pension plan.

What’s the progress over the year since the scheme’s launch?

Despite offering promising facilities and services, the scheme has been undersubscribed. Since its launch, a total of 10,477 employers and 115,606 workers have registered with the Social Security Fund Secretariat—the body that ensures the protection of social security rights and manages the fund. The board admits that the progress was below the target when the registration deadline expired in mid-October. The body had aimed to bring in at least 45,000 to 50,000 private sector firms under the scheme but the achievement was abysmally low. According to a preliminary report of the National Economic Census-2018, nearly 900,000 private firms, factories, business establishments, and service providers are operating in the country. The Social Security Fund dismisses the data saying that many of them are merely registered but don’t operate.

What’s behind the lukewarm response?

Contrary to the massive promotion from the government and celebration by labour rights organisations and employers, enrolment to the scheme has continued to remain sluggish, forcing the government to extend the registration deadline by a month. The slow registration is largely because employers have not shown much interest in joining the scheme, which adds to their costs. Another reason is that stakeholders remain poorly informed about the scheme, its operation, and the benefits it delivers.

The hitches are said to be normal because of the novelty of the scheme in a country that lacks experience in enforcing a programme of this kind. “Implementation of the scheme will definitely face some hurdles since it has just started. Even European countries required decades for implementing social security schemes,” said Bhattarai, the former secretary. “There might be some complexities in implementing the scheme but in the long-run, this will be much needed and will yield results.”

The confusions and difficulties can be removed in tripartite understanding between the government, workers and employers and through necessary reforms in the schemes, he suggested.

Although government agencies have been conducting orientation programmes in industries and industrial corridors, there is still confusion about the scheme. Labour rights organisations have criticised both the government and employers for failing to effectively implement the scheme to protect private-sector workers. They also accuse employers of running away from prior commitments, as some are laying off workers to avoid the scheme.

What are the employers’ concerns?

All three parties—the government, workers and private sector employers—had called the scheme a landmark and comprehensive programme for workers’ larger welfare and safety. They had expressed their commitment for its implementation from the same stage during its launch. However, their excitement about the scheme seems to have faded of late, evident in the poor registrations.

Private-sector employers nonetheless say that the progress so far is encouraging for a new programme. Some employers want the scheme to be optional and are demanding more time for enrolment citing that workers are still not fully aware of the terms. Concerns about the deposited money being held for long were echoed on the first-anniversary event of the scheme.

Many employers are also pressing for phase-wise implementation of the scheme. Small- and medium-level industries demand more time for enrolment, as they have small workforce and resources. Such firms have also asked the government to chip in the contributions they are expected to make for the workers.

Are workers happy with the provisions?

Workers are in a dilemma over the scheme, which is mostly because of a lack of proper information about the government scheme. Many fear that the money contributed will be stuck for a long time and they will not be able to withdraw it in times of need. This confusion is even bigger among workers whose money is already being deposited in pension and gratuity schemes. Otherwise, workers seem satisfied with the facilities and coverage that the scheme ensures. Many registered workers shared their happiness with the Post on the first anniversary of the scheme.

Will the amendments make the scheme attractive?

Following a sluggish response to the scheme, the government has revised the scheme and is planning to come up with a plan to provide loans to the contributors. With the proposed changes in the scheme, workers can get a loan of up to Rs10 million. The new changes are likely to see a surge in registration, with the scheme attracting both employers and workers. Soon after the loan schemes were out, various private firms and umbrella organisations, which were initially reluctant to join the scheme, have started pledging their support to the scheme. Nepal Federation of Savings and Credit Cooperatives Union Ltd, National Cooperative Bank Ltd and Association of Small Farmers Cooperatives, NGOs and private schools have reaffirmed their commitment to joining the scheme.

Will the scheme improve labour conditions in businesses and industries?

The contribution-based Social Security Scheme has been hailed as a win-win scheme for all the stakeholders—mainly workers and employers. Since the scheme ensures health, safety and security of workers besides taking care of other social security needs of the workers and their family, it is expected to improve labour relations. With workers getting direct support from the fund, employers will not face hassles in case of tragedies.

9.6°C Kathmandu

9.6°C Kathmandu